The Aussie managed to rise thanks to positive employment figures, even if doubts were cast.

However, this may not last too long. The team at Barclays entered a short with an ambitious target:

Here is their view, courtesy of eFXnews:

A moderation of the RBA’s easing bias has limited the degree of AUD depreciation recently as the central bank assesses macroprudential measures to address financial stability risks from rapidly rising Sydney house prices, notes Barclays Capital.

Yet, Barclays sees three factors that suggest the AUD will remain under pressure, and thus they initiated a fresh short AUD/USD spot position. The following are a list of these 3 factors along with the details of its new short position.

“First, the previously resilient non-mining sector has begun to show signs of weakness, removing one of the hopeful signs that supported the AUD last year,” Barclays notes.

“Second, perceived risks around Australia’s economy and assets have worsened the outlook for Australia’s risk-adjusted relative returns, especially in an environment of impending US rate rises. These forward-looking assessments suggest that AUD’s already low weightings in a risk-averse portfolio may fall further,” Barclays argues.

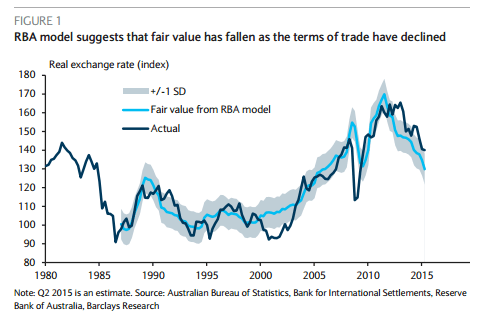

“Third, the AUD faces these challenges from a starting point of a 10% overvaluation due to weakening terms of trade and faces still-slowing Chinese demand for Australia’s commodity exports,” Barclays adds.

In line with this view, Barclays entered a short AUD/USD position from 0.7779, targeting 0.70 with a stop-loss at 0.8180, above recent highs and ensuring a 2:1 reward-to-risk ratio.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.