The Australian dollar stuck to its low range as the RBA did not provide any new direction. What’s next? The jobs report stands out and also watch out for some Chinese data. Here are the highlights of the week and an updated technical analysis for AUD/USD.

The RBA left its interest rate unchanged at 1.50% as widely expected and made few changes to its accompanying statement. The Aussie slipped on the announcement. When will they change their policy? The additional release from the central bank on Friday, its quarterly monetary policy statement, also failed to make waves. In the US, worries about a delay in the tax reform put some pressure on the greenback.

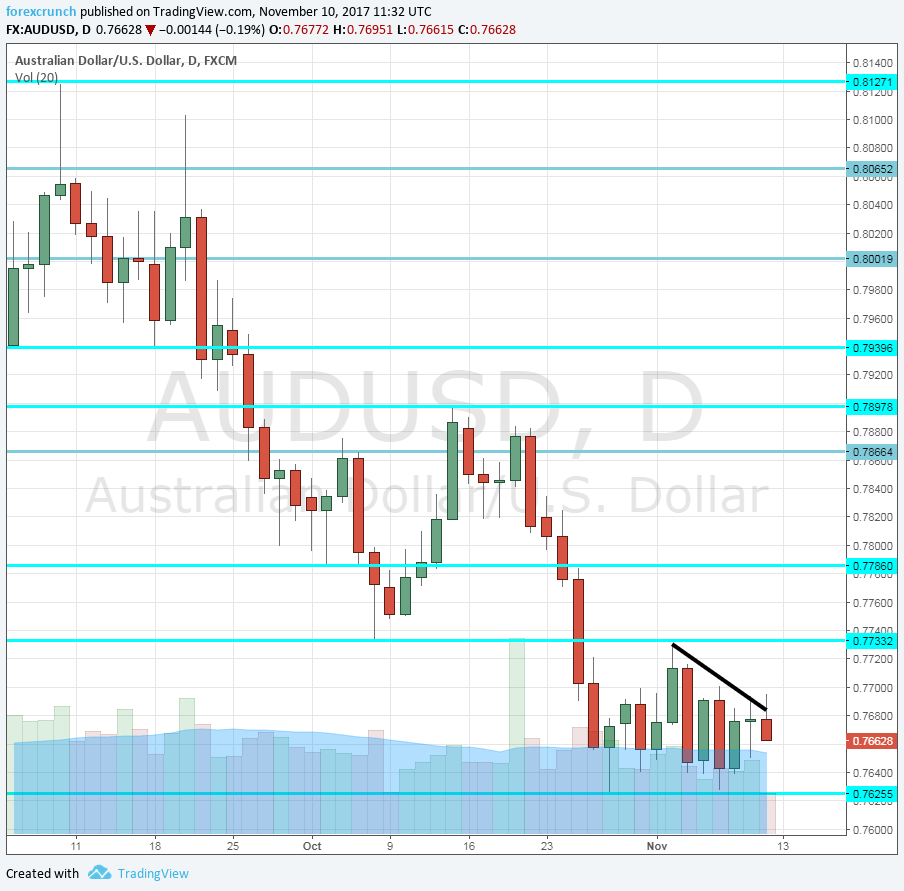

[do action=”autoupdate” tag=”AUDUSDUpdate”/]AUD/USD daily graph with support and resistance lines on it. Click to enlarge:

- Guy Debelle talks: Sunday, 22:00. Just as markets open for the week in Australia and New Zealand, the RBA assistant governor will give a speech about investment in Australia. He has moved markets in the past.

- NAB Business Confidence: Tuesday, 00:30. The monthly indicator from the National Australia Bank has shown a small uptick in confidence back in September, with 7 points. The survey of around 350 businesses has been quite volatile of late.

- Chinese Industrial Production: Tuesday, 2:00. Australia’s No. 1 trade partner imports raw materials from Australia. In September, China saw an annual growth rate of 6.6% in its industrial output. A similar level if likely now: 6.3%.

- Westpac Consumer Sentiment: Tuesday, 23:30. Westpac showed a nice rise in its consumer sentiment indicator: 3.6% in October. We could see a slide after two positive months in this 1200-strong indicator.

- Wage Price Index: Wednesday, 00:30. Salaries are not going anywhere fast in Australia, as in many developed economies. Back in Q2, a rise of 0.5% was recorded, as widely expected. Wages were mentioned in the recent RBA report. A rise of 0.7% is on the cards.

- New Motor Vehicle Sales: Wednesday, 00:30. Sales of cars and trucks serve as another gauge of the economy in Australia, with its vast distances. A drop of 0.5% was printed in September.

- Luci Ellis speaks Wednesday, 7:00. This RBA assistant governor will be on the podium in Melbourne. The topic is economic growth, so quite related to monetary policy.

- MI Inflation Expectations: Thursday, 00:00. The Melbourne Institute fills in a gap for the government, that releases CPI data only once per quarter. Inflation expectations for the next 12 months rose to 4.3% in September. October could see lower levels.

- Australian jobs report: Thursday, 00:30. Australia enjoyed yet another month of growth in jobs in September: 19.8K. The jobless rate slipped to 5.5%. The positive trend will likely continue in this all-important measure. A very similar gain of 18.9K jobs is on the cards. The unemployment rate is predicted to remain unchanged at 5.5%.

- CB Leading Index: Friday, 3:30. This composite indicator is comprised out of seven economic indicators and provides a wide view of the economy. A rise of 0.1% was seen in August.

AUD/USD Technical Analysis

Early in the week, the Australian dollar found challenged the support line at 0.7635 (mentioned last week).

Technical lines from top to bottom:

The psychological round level of 0.80. Below, we find 0.7940, which capped the pair in August.

0.7860 served as support during September and is another line to watch. 0.7785 was a stepping stone on the way up.

Below, we find 0.7730, that was a high point in June 2017 and also beforehand, working as resistance in November. 0.7625 was the low end of the range.

Even lower, we find 0.7565 was a low point before the pair shot higher in July. The last line, for now, is 0.7515.

I remain bearish on AUD/USD

With relatively low inflation and with no desire to raise rates by the RBA, the Aussie could continue slipping. In addition, China is past its big event, and it could squeeze the economy now.

Our latest podcast is titled Yield curve blues and sparks in oil

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – projections for dollar/yen

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!