The Australian dollar struggled to recover amid mixed data. The highlight of the upcoming week is undoubtedly the rate decision by the RBA. Will they hint about a rate cut?. Here are the highlights of the week and an updated technical analysis for AUD/USD.

Australian trade balance and building approvals beat expectations, but the party did not last for too long. Weak retail sales sent it back down. The independent Chinese Caixin manufacturing PMI met expectations at 51. All in all, it was a mixed week in anticipation of the RBA. In the US, the nomination of Powell as the new Fed Chair was shrugged off and so was the current Fed Chair Yellen’s decision to hold interest rates unchanged. The NFP was somewhat weak but other data shined.

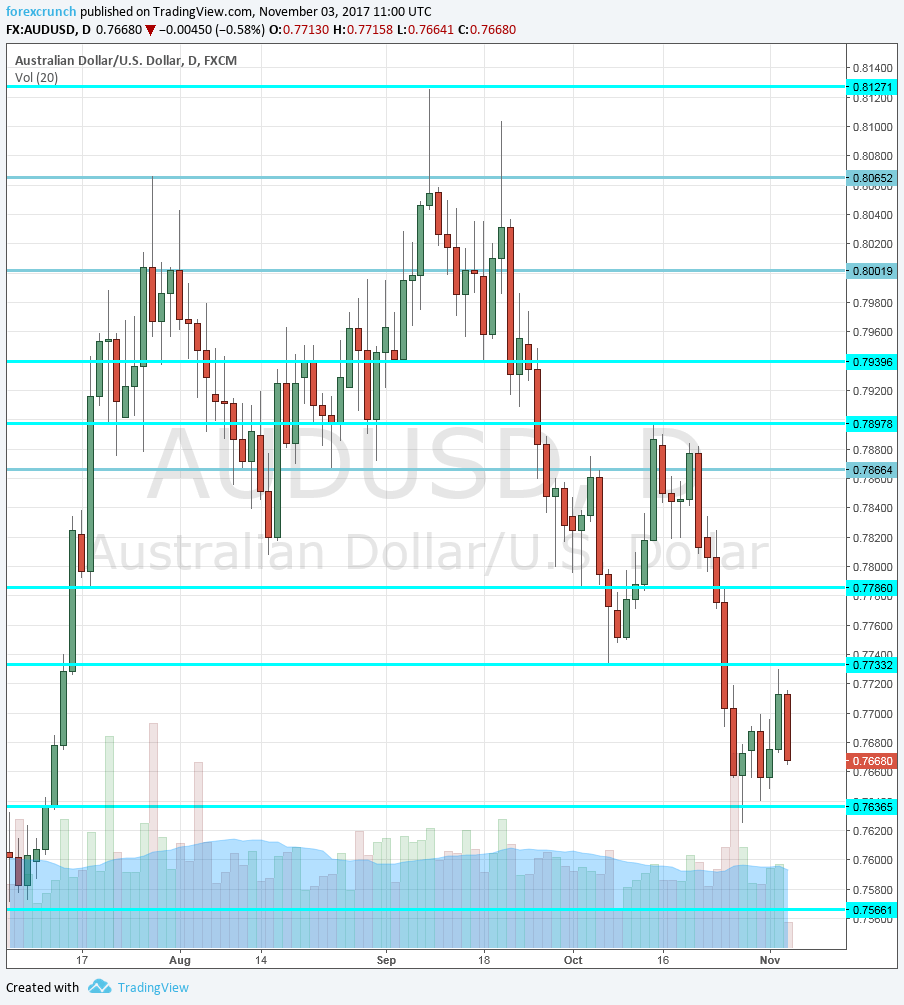

[do action=”autoupdate” tag=”AUDUSDUpdate”/]AUD/USD daily graph with support and resistance lines on it. Click to enlarge:

- MI Inflation Gauge: Monday, 00:00. The Melbourne Institute fills a gap as the Australian authorities publish official CPI numbers only once per quarter. In September, MI showed an acceleration in price rises: 0.3%. A return to the previous level of around 0.1% could be seen now.

- ANZ Job Advertisements: Monday, 00:30. The Australia and New Zealand Banking Group monitors the number of job ads as another gauge of the labor market. Ads remained unchanged back in September. We now get data for October.

- AIG Construction Index: Monday, 22:30. The Australian Industry Group publishes a series of PMI-like indicators. The index for the construction sector for September had a score of 54.7 points, above the 50 point threshold separating expansion and contraction.

- Rate decision: Tuesday, 3:30. The Reserve Bank of Australia has a neutral stance regarding rates. However, in a recent speech, we learned that at least one member leans to a rate cut. Since then, inflation figures came out and they were quite poor. Will the RBA open the door to a rate cut? That could be interesting. On the other hand, the recent drop int he value of the Aussie makes life easier for policymakers.

- Chinese Trade Balance: Wednesday, 2:00. China is Australia’s No. 1 trade partner. The publication of the trade balance also provides a view into the changes in imports. Chinese imports consist of Australian metal exports. In September, China reported a surplus of 28.5 billion USD.A 39.5 billion surplus is on the cards now.

- Home Loans: Thursday, 00:30. The number of new loans has been on the rise in the past four months, including a surprisingly strong advance of 2.8% in July and 1% in August. The figure for September is expected to be +2.1%.

- RBA Monetary Policy Statement: Friday, 00:30. The RBA has another chance to influence the currency late in the week. The quarterly statement may provide insights about inflation and hints towards further moves. In the past, this document certainly had its impact on the A$.

AUD/USD Technical Analysis

The Australian dollar continued falling, dipping under 0.7740 (mentioned last week). It found support at 0.7640 and never went too far.

Technical lines from top to bottom:

The high of 2017 at 0.8125 is the top level. 0.8065 is the previous 2017 high.

It is followed by the psychological round level of 0.80. Below, we find 0.7940, which capped the pair in August.

0.7860 served as support during September and is another line to watch. 0.7785 was a stepping stone on the way up.

Below, we find 0.7740, that was a high point in June 2017 and also beforehand. 0.7635 was a stepping-stone on the way up, also in June.

Even lower, we find 0.7565 was a low point before the pair shot higher in July. The last line, for now, is 0.7515.

I remain bearish on AUD/USD

The RBA could hit the Aussie when it is down and has two opportunities to do so. And while Trump is mired in scandals, the US economy is looking good and so is the dollar.

Our latest podcast is titled New normal NFP, reluctant rate rise

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – projections for dollar/yen

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!