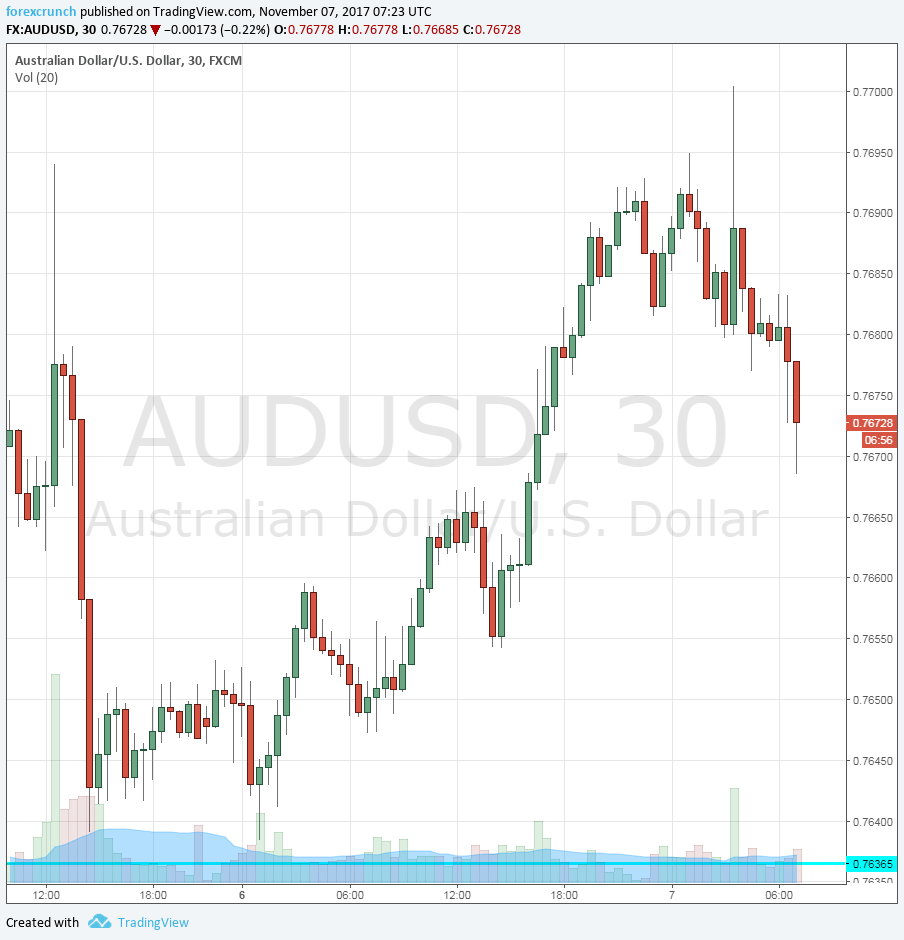

The Australian dollar was moving higher, bouncing off the support line of 0.7640. It had already advanced to nearly 0.77. Well, the initial reaction to the RBA decision sent it to that round number of 0.77, but it was only momentary. From there, the pair slipped back down under 0.7670 and remained entrenched in the range.

They left the interest rate at 1.50%, which was no surprise. It has stuck to that rate since August 2016. As usual, the team led by Phillip Lowe said that a higher A$ is restraining price pressures and would slow the economy. They also acknowledge that the level of inflation remains low but they do see it as picking up gradually.

Some had expected them to go a step further. The recent inflation report was quite weak and we had already learned that one RBA member sees a higher chance of going lower on rates than higher.

They did stress that the slow growth in wages as well as household debt, could weigh on spending. So, while the RBA remains quite neutral, they are certainly in no rush to raise rates either.

Like the RBA, AUD/USD has more room to the downside than to the upside. But will this materialize to big falls? At the moment, markets are very sleepy, to say the least.

More: Elliott Wave Analysis: AUDUSD and NZDUSD