Despite signs that the Trump Rally is showing signs of exhaustion, the U.S. economy continued to post a positive set of economic indicators last week which has only strengthened the view of the markets that the December rate hike is almost a done deal.

The current pace of economic activity has also pushed the markets into pricing in at least two rate hikes in 2017, running ahead of the Fed’s expectations. If the current pace of economic growth continues to pick up, the Federal Reserve is seen leaving many other central banks way behind as far as interest rates are concerned.

Fed’s Beige Book signals U.S. economy continues to expand

Last Wednesday, the Federal Reserve’s Beige Book showed that the U.S. economy continued to expand between the periods of early October through mid-November. While retail sales, real estate markets, and business service firms logged rising activity, inflation showed little signs of increase.

The economic report based on regional data collected on or before November 18 said that “outlooks were mainly positive” with half of the 12 districts “expecting moderate growth.”

On the jobs front, the report shows that regionally, Chicago region saw the highest competition. “It is getting more and more difficult to fill positions at any skill level,” the report showed and noted delays in construction work due to difficulty in finding workers. The Atlanta Fed reported labor shortages in nursing and construction sectors.

Vehicle sales were seen to be soft during the reported period, but it was attributed to the election jitters.

There was also a considerable increase in many businesses seeking to refinance ahead of future rate increases. The continued pace of growth comes after last week’s revised GDP numbers for the third quarter showed a 3.2% increase, up from 2.9% from the initial estimates.

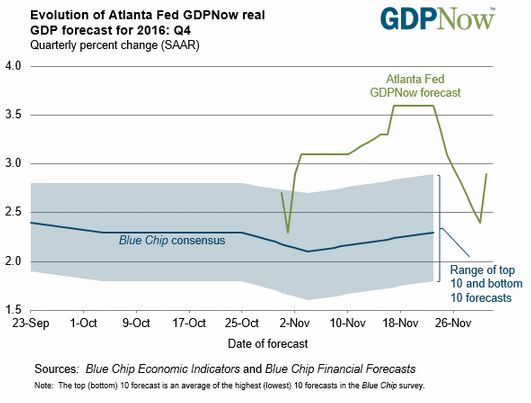

Meanwhile, by Friday’s close, the Atlanta Fed’s GDPNow model is forecasting the fourth quarter GDP growth at 2.9%. The forecast was revised higher after the construction spending report was released.

U.S. unemployment rate a 9-year low

Last week, the US economy continued to outperform, with the main highlights being the U.S jobs report.

On Wednesday, the ADP payrolls report showed a solid print with the private sector jobs seen rising 216k. This was significantly higher than the median estimates of 161k, but October’s print was revised lower from 147k to 119k.

Small businesses added 37k jobs while mid-sized businesses added 89k jobs. The large business sector with 500 or more employees added 90k during the reported period.

Services sector continued to drive hiring, adding 228k jobs while the goods producing sector shed 11k jobs during the period. Natural resources and mining alongside manufacturing lost combined 14k jobs with construction adding 2k jobs.

On Friday, official employment figures released by the Bureau of Labor Statistics showed that the jobless rate fell to a seasonally adjusted 4.6% in November, from 4.9% in October. It was the lowest unemployment rate since 2007 of August. However, the participation rate edged higher to 62.5% from a year ago bit still remains near historically low levels. U.S. employers were seen adding 178k jobs in November which matched the average pace of gains of 180k so far this year. The data showed that the pace of hiring had slowed from 2015 but was consistent with a steadily expanding economy.

Wage growth shows signs of decline, falling 0.1% below estimates of 0.2% increase. The average pay in the nonfarm jobs was on average $25.89 an hour in September, which was down 3 cents from October. On a year over year basis, this brought the average hourly earnings to 2.5% higher than a year ago. In October, average hourly earnings jumped to 2.8%, marking the highest level since June of 2009.

The week ahead is quiet with only the ISM’s non-manufacturing PMI in focus, which could see the markets shift their focus from the U.S to Europe where the ECB will be meeting this week.