One Asian bank has cut credit lines for French banks. 5 more banks in Asia are considering the same: no more credit for French banks.

EUR/USD is lower, at 1.4135, below the support line of 1.4160. Further support is at 1.41 and 1.4070.

The fear in Asia is that French banks are exposed to too much problematic debt, especially from Greece. This is a new credit crunch – the first since 2008.

This follows the yesterday’s rumors of a bankruptcy in Societe Generale – a rumor that was denied, but that can happen if credit is frozen.

Here is quote from Reuters’s report on it:

The banks in Asia and the sources — a mix of risk officers, senior traders and loan bankers — could not be identified because of the sensitive nature of the information.

“We’ve cut. The limits have been removed from the system. They have to seek approval on a case-by-case basis,” the treasury risk official said. The bank official declined to name the French banks.

The weekly report on US jobless claims, released at the same time, showed a drop to 395K, the lowest since April and slightly better than 400K that was expected.

US trade balance disappointed: the deficit rose to 53 billion, significantly more than 47 billion that was expected.

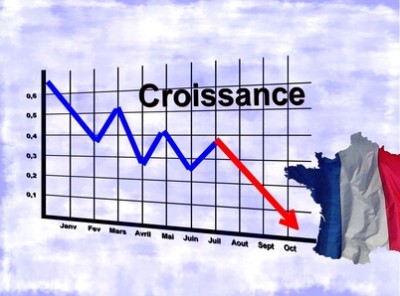

EUR/USD moves these days on the European debt crisis that is now focusing on French banks, after Trichet managed to stabilize the Italian and Spanish bond markets.

Update: EUR/USD is now recovering thanks to moves in the Swiss franc – the SNB is fighting the strength of the franc, especially against the euro, and this indirectly leads to strength in euro/dollar.

For more on EUR/USD, see the euro dollar forecast.