The Australian dollar seems to have stabilized after a turbulent period. What’s next?

The team at NAB weighs in:

Here is their view, courtesy of eFXnews:

In the past fortnight, AUD/USD has traded within a 0.7017 to 0.7250 range. The surprise to many has been that the Aussie has not broken back down through 70 cents at a time when: 1. Rising confidence in December Fed rates ‘lift-off’ has generally been supporting the big dollar; 2. Key Australian commodity prices have come under fresh downward pressure, including iron ore revisiting its early July cycle (9 year) lows; 3. Market volatility has been rising (e.g. VIX from below 15 to above 20 in the aftermath of the Paris terrorist attacks).

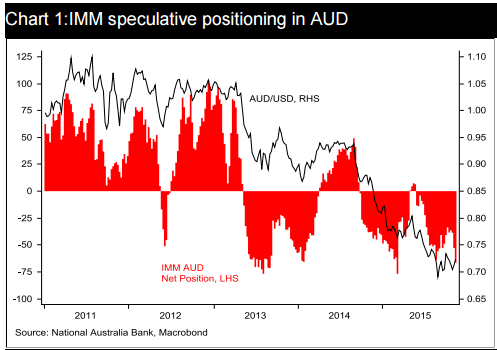

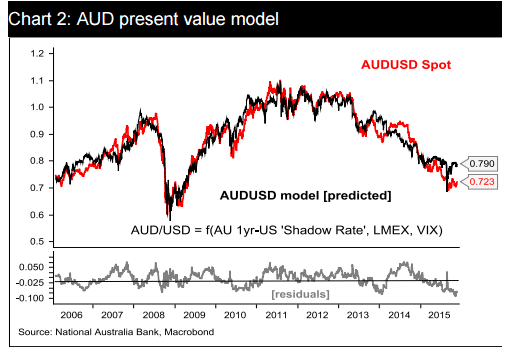

Our main observation here is that since the speculative market is already very short AUD judging from IMM positioning data (Chart 1) a lot of bad news for the currency already looks to be in the price. One way we can judge this is with reference to our short term valuation models and which are currently indicating fair or present value in the 0.77-0.79 area (Chart 2). Back in August, when the VIX spiked above 50 (after China’s currency move and amidst the global equity market rout that ensued) the same models were indicating around 0.68.This highlight the key role volatility plays in driving (big) changes in valuations.

Still forecasting 0.70 for year-end. We’ve held a year-end forecast for AUD at 0.70 since midAugust (when we lowered it from 0.72) and don’t feel compelled to change it at present. We’d assess there to be about as much chance of ending the year above 0.70 as below. The downside risk comes from either the aforementioned volatility spike or a still-stronger US dollar out of the December FOMC; upside risks come from volatility levels falling not rising out of upcoming Fed (and ECB) meeting outcomes and the US dollar potentially falling following the FOMC, having been bid in front of it. Any further reduction in RBA easing expectations would also support higher AUD level, though with only some 15bps of easing now over the coming year, upside for the currency on this factor alone is very limited.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.