Summer is over and it’s back to school, also for central banks. Two major events take place in Canberra and in Frankfurt.

Here is what to look out for from the team at BMO:

Here is their view, courtesy of eFXnews:

The RBA has a policy meeting on Tuesday. The Bloomberg analysts’ survey shows all 26 participants expecting no change. One-month OIS suggests that traders put a 5-10% probability on a rate cut.

With AUDUSD approaching levels that the RBA was hoping for, we expect the RBA to hold back this time around in order to preserve the ability to cut rates when AUD is rising.

Weak data, however, could force the RBA’s hand. Q2 GDP is on the docket for Wednesday, the day after the RBA rate decision.

With that in mind, we would be inclined to sell any rally in AUDUSD above 0.7250.

The balance of risks for the outcome of the ECB’s rate decision next week looks to be roughly neutral. Recent financial market tensions, weaker commodity prices, EUR appreciation and sluggish Q2 growth should prevent the overall tone from evolving in a hawkish direction. In addition, the 2016 headline CPI outlook may be marked down. But equally, a number of forward looking Eurozone indicators have continued to display signs of strength. This suggests that there are upside risks the ECB’s new GDP growth forecasts.

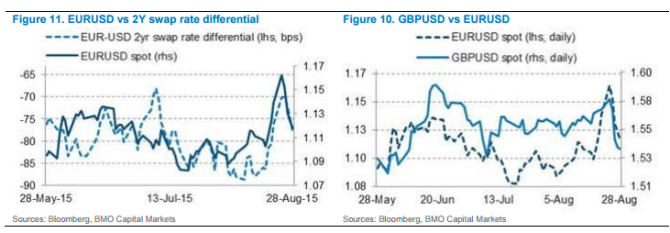

Given the shift lower in swap rate differentials (Figure 11), near-term support at 1.1075/1.1100 is likely to be challenged ahead of the ECB policy decision on Thursday. In addition to the ECB, the US Employment report and the G20 meetings will also be watched closely, given the renewed volatility in currency markets.

A neutral outcome from the ECB on Thursday and a moderately strong US employment report on Friday would prevent the 1.0930/50 support area from breaking. However, a surprisingly dovish ECB press conference and a very strong US employment report on Friday could push EURUSD below 1.0900.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.