The Australian and New Zealand dollars look stable and steady. The team at SEB sees them as overvalued.

Here is their view, courtesy of eFXnews:

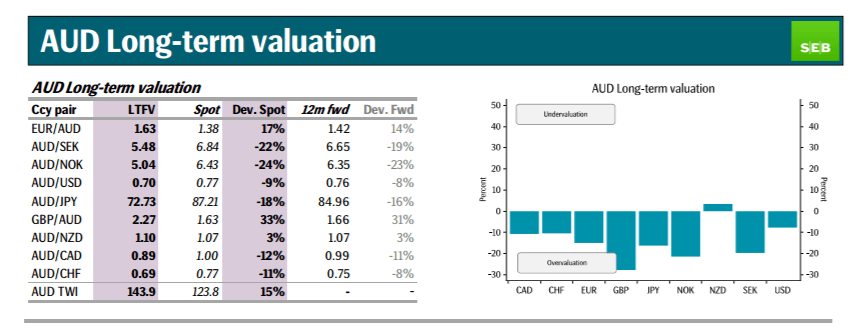

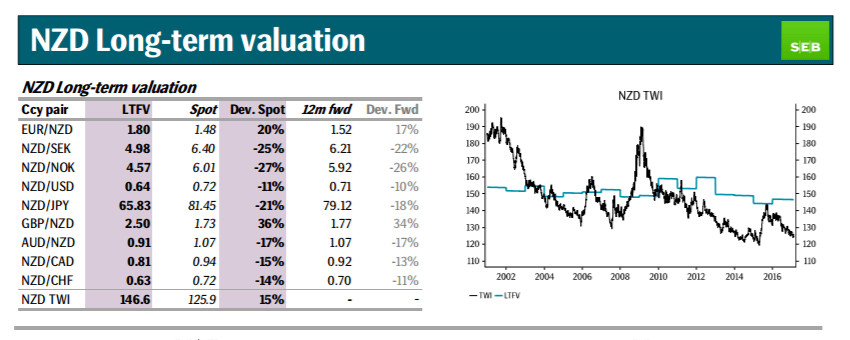

At present, the commodity currencies are more overvalued than any of their G10 counterparts at 15% in trade weighted terms, almost as much as they were a couple of years ago before they corrected substantially lower due to weaker commodity prices and rate cuts from the central banks. Partly, their past year’s recovery probably reflects such fundamentals as above average growth and rising commodity prices, but also the attractive yield offered by the AUD and NZD compared to most other currencies has contributed. Although both are still substantially overvalued, they are less so than a few years ago.

Eventually they will correct lower against virtually all other G10 counterparts, but probably not just yet.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.