- Covid-19 continues to weaken the Australian Dollar

- The US Dollar lost ground against other currencies after the Federal Reserve press conference. Even so, the Australian Dollar could not recover significantly.

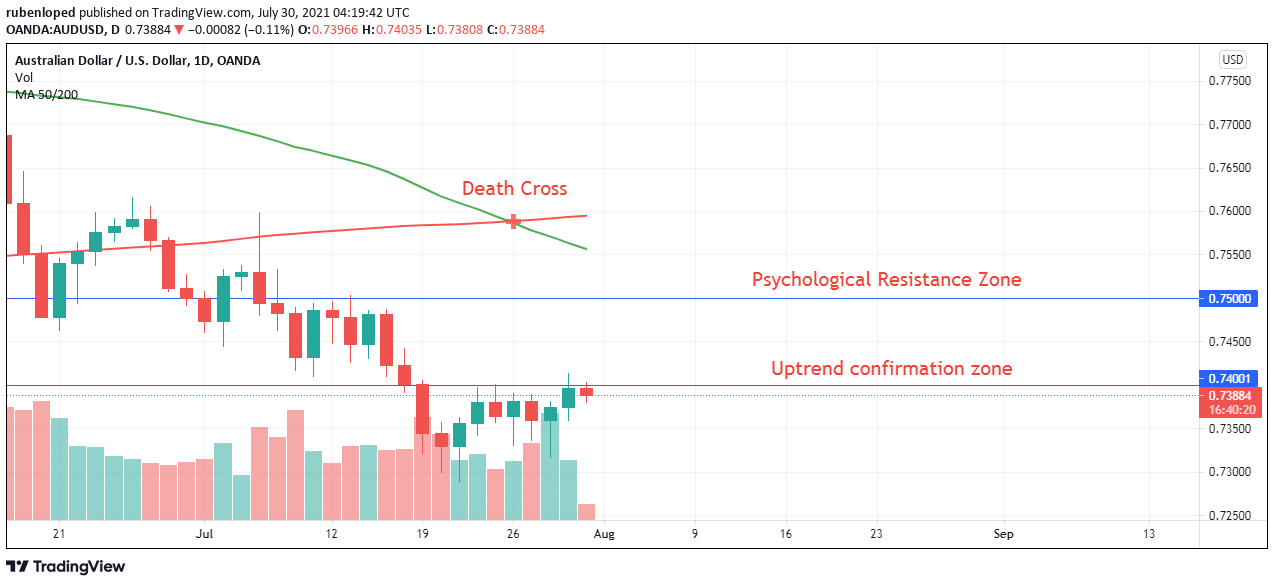

- A short-term uptrend is expected for the AUD/USD pair.

- The long-term trend will be bearish, and the short-term bullish trend will have resistance at 0.75 level

The AUD/USD daily analysis suggests a short-term gain as the US Dollar weakens on Friday. Technical factors support a smaller gain but the trend is still down.

The growth in the rate of Covid-19 infections continues to negatively affect the Australian Dollar, which still can’t recover from last week’s fall. Despite showing bullish signals, these appear to be short-term holdings with a resistance zone at the 0.75 level.

–Are you interested to learn more about buying cryptocurrencies? Check our detailed guide-

After weeks of confinement, states such as Victoria and South Australia ended the lockdowns. However, the investors ignored this optimism and had little influence on the pair price due to the worrying situation of other states such as New South Wales, where the cases of Covid-19 infections continue to increase alarmingly.

Even with the US dollar’s losses, caused by the refusal of the Chairman of the US Federal Reserve to provide details on a future tapering. The recovery of the AUD was weak due to the precarious situation of the country against Covid-19.

On the other hand, Australia reported that the inflation figures for the second quarter met what the market expected with an annualized consumer price index of 3.8% quarter-on-quarter.

The Dollar’s weakening against other currencies, including the Australian Dollar, does not reverse the trend of recent months, and the latter will complete its path to 2 consecutive months of losses against the US dollar.

AUD / USD traders’ hopes are focused on the preliminary US Q2 GDP reading. Until then, the bad news related to Covid-19 will continue to set the pair’s downward trend.

AUD/USD technical analysis: Death cross to cap gains

The technical indicators became higher for the AUD/USD but remained around their mid-lines, so they cannot confirm the upward trend.

It seems that the Australian Dollar has started a small uptrend. However, this only seems to be a short-term trend due to different indicators that suggest the growth of the next few days will be limited.

–Are you interested to learn more about forex robots? Check our detailed guide-

The “death cross” between the SMA 200 and the SMA 50, which has not happened since 2018, is a long-term negative factor that indicates a lower price. If the upward trend is confirmed by exceeding the 0.74 level, the new resistance for the next few days could be close to the 0.75 level, a round number and a psychological level.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.