- AUD/USD gains slightly on the day despite RBA’s meeting minutes.

- The risk sentiment may hurt the Aussie bulls.

- The Fed meeting tomorrow is the key event that market participants eagerly wait for.

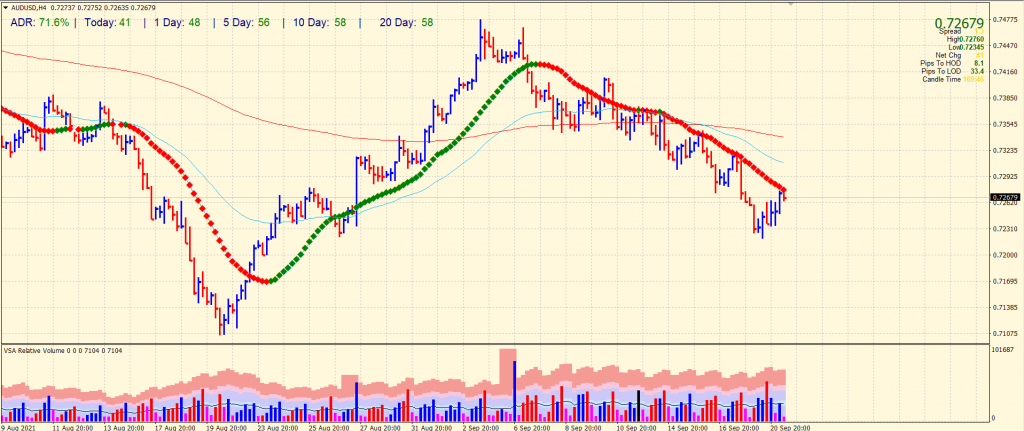

The AUD/USD forecast is conditionally bullish. The main technical hurdle is 0.7300 that may cap the bulls. But bears are barred by the support at 0.7220.

-Are you looking for the best CFD broker? Check our detailed guide-

In response to the minutes of the Reserve Bank of Australia (RBA) policy meeting, the AUD/USD traded at 0.7255-60 early Tuesday, up 0.08% on the day. However, the risk barometer suggests that the recent losses are consolidated around the monthly low by the moderately offered S&P 500 futures.

RBA members acknowledged the impact of the delta variant outbreak on the recovery process. As a result, they contributed to uncertainty about the future,” but they were hopeful that the economy would recover as vaccines became more widespread and restrictions were eased. Thus, mixed comments lead to confusion among the AUD/USD traders in sluggish markets and China.

Australia’s risk-sensitive currency fell against the dollar overnight as Wall Street stocks declined. The Nasdaq 100 lost more than 2% by the close of trading, led by tech and small-cap stocks. In response to the recent default warnings of real estate giant Evergrande Group, investors weigh the danger of a credit crunch in China that could disrupt hot coal sentiment.

On Monday, Evergrande’s share price fell more than 10% in Hong Kong, taking its YTD loss to more than 86%. Price declines were compared to Bear Sterns at the start of the financial crisis in 2007/2008. Then, the US did the same with the big banks during the US housing crisis, so at the time, there was speculation about Beijing taking action to save the company.

The return of China and a key Fed meeting could keep the AUD/USD traders occupied ahead of Wednesday’s key Fed meeting. Also important are the headlines about Evergrande.

-Are you looking for forex robots? Check our detailed guide-

AUD/USD technical forecast: Double bottom to respite

The AUD/USD price attempts to rally but remains capped by the 20-period SMA on the 4-hour chart. The minor upside wave came with a declining volume. Hence, the price is still considered bearish as long as it stays below the 0.7300 area. The pair formed a double bottom at 0.7220. If the pair sustains above the double bottom, the pair may hit the 0.7300 mark ahead of 200-period SMA at 0.7340. Alternatively, if the price breaks the double bottom, it may lead to 0.7200 ahead of YTD lows around 0.7100.

Looking to trade forex now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.