The Australian dollar ended a mixed week slightly lower as the USD gained ground. Australian capex and Chinese PMIs are in the limelight. Here are the highlights of the week and an updated technical analysis for AUD/USD.

The Meeting Minutes by the Reserve Bank of Australia showed caution about the economy. The central bank seems somewhat worried about wages and also about household debt. In the US, the meeting minutes were slightly more hawkish, pushing the US dollar slightly higher.

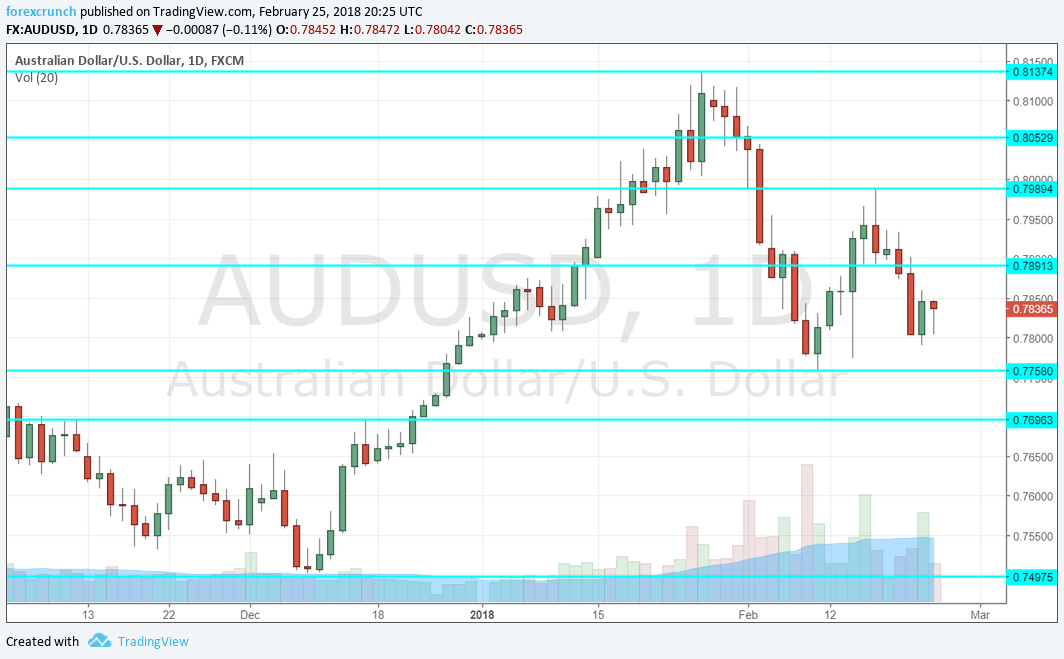

[do action=”autoupdate” tag=”AUDUSDUpdate”/]AUD/USD daily graph with support and resistance lines on it. Click to enlarge:

- Private Sector Credit : Wednesday, 00:30. Credit to the private sector has risen by 0.3% in January and it is now expected to accelerate to 0.4%. A rise in credit implies accelerate economic activity.

- Chinese Manufacturing PMI: Wednesday, 1:00. The official purchasing managers’ index for the manufacturing sector is expected to tick up from 51.3 to 51.4 points. Government statistics are sometimes taken with a grain of salt, but they still move the Aussie. China is Australia’s No. 1 trading partner.

- AIG Manufacturing Index: Wednesday, 22:30. The Australian Industry Group’s manufacturing index stood at a strong 58.7 points score in January, reflecting robust growth. A slide may be seen now.

- Private Capital Expenditure: Thursday, 00:30. This quarterly report provides an overview of investment in the land down under, a forward-looking figure for the RBA. After rising by 1% in Q3, another increase of 1.1% is on the cards now.

- Chines Caixin Manufacturing PMI: Thursday, 1:45. This independent survey of economic activity in China’s manufacturing sector has increased to 51.5 points in January and is now expected to slide to 51.3 points. Chinese manufacturing uses lots of Australian metals.

- Commodity Prices: Thursday, 5:30. This measure of commodity prices is of interest to the Aussie, even though the daily changes in iron ore and copper play a greater role. An annual drop of 0.6% was seen last time.

- HIA New Home Sales: Friday, 00:00. The Housing Industry Association showed an increase of 0.7% in sales of new homes in December. We may see a slide now.

AUD/USD Technical Analysis

Aussie/USD drifted lower, but held above the 0.7760 support line mentioned last week.

Technical lines from top to bottom:

0.8290 was the peak in May 2015 and may come into play. It is followed by the round number of 0.82.

0.8130 was the high point in 2017 and was challenged early in the year. 0.8050 capped the pair in August and also temporarily in January, on its way up.

0.7990 was the high point in February and protects the 0.80 level. 0.7890 worked as support in February and resistance in October.

0.7760 was the low point in mid-February and works as support. The round level of 0.77 was resistance in December.

Lower, 0.7650 worked as resistance in several occasions in late 2017. The last line to watch is the round 0.75 level.

I turn from bearish to neutral on AUD/USD

The Australian dollar continued consolidating, and may have reached a balanced point. Chinese data may keep it stable and prevent it from further falling in the short term.

Our latest podcast is titled Volatility is back with a vengeance and the perky pound

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – projections for dollar/yen

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!