The Australian dollar finally ended the 7-week long rally with quite a downfall. The RBA is left, right, and center in the upcoming week. Was it just a correction or a change of course? Here are the highlights of the week and an updated technical analysis for AUD/USD.

Australia’s inflation report came out below expectations with 0.6% on the headline and 0.4% on the core. Building approvals also weighed with a fall of 20% while PPI surprised to the upside. The biggest blow came on Friday: the excellent US jobs report and the accompanying “risk off” sentiment on fears of an accelerated path of rate hikes in the US sent the Aussie, a risk currency, lower.

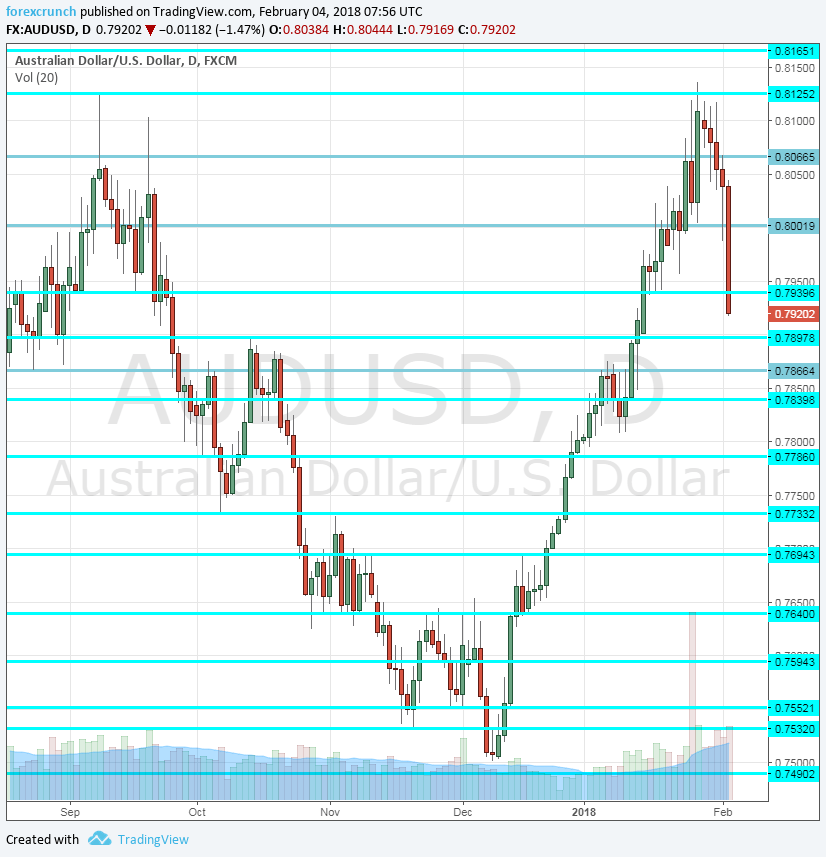

[do action=”autoupdate” tag=”AUDUSDUpdate”/]AUD/USD daily graph with support and resistance lines on it. Click to enlarge:

- AIG Services Index: Sunday, 22:30. This forward-looking survey by the Australian Industry Group has shown moderate growth in the services sector, with a score of 52 points. A similar figure is likely. 50 points is the threshold between expansion and contraction and a score of 52 is OK, but not exciting.

- MI Inflation Gauge: Monday, 00:00. This gauge by the Melbourne Institute provides additional information about inflation, as the government publishes the official numbers only once per quarter. This time, we are close to the official release, so it will likely have less impact. The indicator rose by0.1% last time.

- ANZ Job Advertisements: Monday, 00:30. ANZ’s scan of job advertisements provides another look at the jobs market and comes before the official jobs report. A big drop of 2.3% was recorded in December. We could see a rise in January.

- Retail Sales: Tuesday, 00:30. Australian consumers have been out shopping in November: a surprisingly strong rise of 1.2% was recorded. A correction is now on the cards: -0.2% for January. The publication usually rocks the Aussie, but it could be somewhat more muted ahead of the rate decision.

- Trade Balance: Tuesday, 00:30. Australia had two months of deficits, with 0.63 billion in November. A surprlus of 0.25 billion is on the cards for December. Also here, the wait for the RBA could take the sting out of the release.

- Rate decision: Tuesday, 3:30. The Reserve Bank of Australia makes its first rate decision for the year after taking a break in January. Since its last meeting in December, the world continued growing at a robust pace and this helped the economy. Job growth was solid as well. On the other hand, the recent inflation report fell short of expectations and the high exchange rate does not make the RBA happy. Given the most recent slide, will the RBA try to hit the Aussie when it’s down?

- AIG Construction Index: Tuesday, 22:30. The construction sector can also expect moderate growth according to AIG: a score of 52.8 points was seen in December, not too much above the 50-point threshold.

- NAB Business Confidence: Thursday, 00:30. The quarterly measure by NAB carries more weight than the monthly one. A score of 7 points in Q3 2017 was a tad lower than 8 in Q2, but the trend remains to the upside. The survey of around 1,000 businesses could rise once again given the optimism about the global economy.

- Chinese trade balance: Thursday, 3:00. China is Australia’s No. 1 trading partner and Chinese imports consist of Australian commodities. China had a surplus of 54.7 billion USD in December. The figure for January is expected to be very similar: 54.9 billion.

- Phillip Lowe talks: Thursday, 21:00. The RBA continues moving markets. Governor Lowe will speak in Sydney and will also face questions from the audience. In case the RBA does not the desired market reaction to the rate decision, Lowe will have a chance to clarify.

- RBA Monetary Policy Statement: Friday, 00:30. The last RBA related event is the quarterly report. It provides a wider view than the very short rate statement. Any significant concerns about the exchange rate will have the greatest impact, followed by inflaiton and growth outlooks.

- Home Loans: Friday, 00:30. Somewhat overshadowed by the RBA’s report, this monthly measure of the housing market is expected to show a drop of 0.9% after a rise in 2.1% in mortgages and related home loans.

AUD/USD Technical Analysis

Aussie/USD was unable to challenge the 0.8130 level mentioned last week. It then turned south and even closed below 0.7940 in the last minutes of trade.

Technical lines from top to bottom:

0.8290 was the peak in May 2015 and may come into play. It is followed by the round number of 0.82.

0.8130 was the 2017 high and remains a top line. It is followed by 0.8065, which capped the pair’s rise beforehand.

The psychological round level of 0.80. Below, we find 0.7940, which capped the pair in August.

Quite close by, we find 0.79, a round number that capped the pair in October and also in January. 0.7860 served as support during September and is another line to watch.

0.7810 worked as a cushion for the pair in January. Below, we find 0.7730, that was a high point in June 2017 and also beforehand, working as resistance in November.

The round number of 0.77 capped the pair in mid-December. 0.7640 worked as resistance in November. 0.7595 was a swing high in early December and capped the pair.

I am bearish on AUD/USD

The RBA could hit the Aussie when its down, pushing the pair lower. In addition, the excellent US jobs report is not fully priced in.

Our latest podcast is titled When everything sells off, where is the money going to?

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – projections for dollar/yen

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!