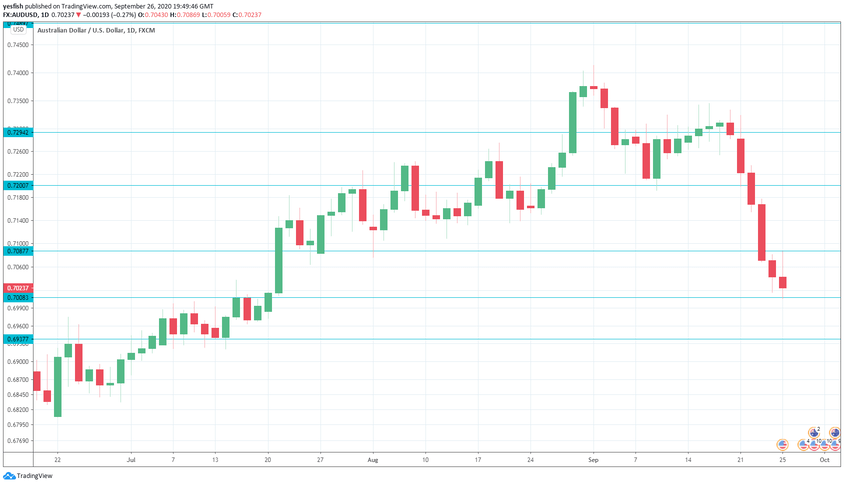

AUD/USD collapsed last week, falling 3.6%. This was the pair’s worst week since March, when Covid-19 sent the Aussie tumbling. The upcoming week has four events, including retail sales. Here is an outlook at the highlights and an updated technical analysis for AUD/USD.

Australian PMIs accelerated in August. The Manufacturing PMI improved for a fourth successive month, rising from 53.9 to 55.5. points. The Services PMI climbed from 48.1 to 50.0, the neutral level separating contraction from expansion. An interim retail sales report was a disappointment, with a decline of 4.2 percent.

In the US, Federal Reserve Chair Powell had a busy week testifying on Capitol Hill. Powell reiterated that the Fed was using all available tools to support the budding economic recovery. He also called on Congress to provide additional fiscal stimulus.

The US Flash Manufacturing PMI for September came in at 53.5, almost unchanged from 53.4 a month earlier. Importantly, the reading beat the estimate of 52.5 points. The index has been in expansion territory for four straight months, with readings above the 50-level, which separates expansion from contraction. On the services front, Flash Services PMI came in at 54.6, just shy of the previous release of 54.8 points. The respectable reading points to a solid rise in business activity, another sign that the economic recovery is strengthening.

The week ended on a sour note, as durable goods orders disappointed. The headline and core readings both slowed to 0.4%, in August. In July, the headline reading was 11.2%, while the core figure was and 2.4%.

- Chinese Manufacturing PMI: Wednesday, 1:00. The PMI continues to show expansion in the manufacturing sector, but barely. The August release was almost unchanged at 51.0, just above the 50.0 level which separates expansion from contraction. Little change is expected in September, with a forecast of 51.3 points.

- Building Approvals: Wednesday, 1:30. Building Approvals tends to show sharp fluctuations. In July, the indicator climbed 12.0%, after four straight declines. The reading easily beat the forecast of -0.9%. A small gain of 0.1% is projected in August.

- AIG Manufacturing Index: Wednesday, 22:30. The index slowed to 49.3 in August, down from 53.5 beforehand. The 50-level separates contraction from expansion. Will we see an improvement in September?

- Retail Sales: Friday, 1:30. Retail sales are the primary gauge of consumer spending, a major growth engine. The indicator fell by 4.2% in August, but is expected to rebound in September with a gain of 3.2%.

.

AUD/USD Technical Analysis

Technical lines from top to bottom:

With AUD/USD declining sharply, we start at low levels:

0.7294 (mentioned last week) remains an immediate resistance line.

The round number of 0.7200 is next.

0.7087 has switched to a resistance role after sharp losses by AUD/USD last week.

0.7008 is protecting the symbolic 0.7000 line.

0.6937 has provided support since mid-July.

0.6732 is the final support line for now.

I am bearish on AUD/USD

The US dollar is showing some new-found strength, and has been making strong inroads against the major currencies. Sentiment towards the US dollar remains strong, so it could be another winning week for the greenback.

Follow us on Sticher or iTunes

Further reading:

Safe trading!