- Australian retail spending experienced a rebound in May

- Resilient consumption in Australia may strengthen the argument for another interest rate hike.

- Australia’s headline consumer price inflation decreased significantly to 5.6% in May.

Today’s AUD/USD outlook is bullish. In May, Australian retail spending experienced a rebound, with consumers enticed by online sales events and promotional discounts. Consequently, this resilient consumption trend may strengthen the argument for another interest rate hike.

–Are you interested in learning more about Canada forex brokers? Check our detailed guide-

According to data released by the Australian Bureau of Statistics on Thursday, nominal retail sales increased by 0.7% in May. This is in comparison to a flat performance in April and surpassing the predicted growth of 0.1%.

This positive outcome presents a challenge for the Reserve Bank of Australia. The RBA has implemented a substantial 400 basis point rate hike over the past year to temper demand and address high inflation levels.

As the RBA’s July policy meeting approaches, the market remains uncertain whether there will be another interest rate increase or a pause. A pause would allow policymakers to assess the impact of previous tightening measures.

Notably, futures markets indicate a 36% probability of a quarter-point rise, up from 27% before the release of the retail data. Additionally, three of the four major domestic banks anticipate a rate hike.

However, recent figures released on Wednesday suggest the case for a pause. Headline consumer price inflation decreased significantly to 5.6% in May, down from 6.8% in April and below the forecasted 6.1%.

Nevertheless, elevated inflation in the service sector provides a potential justification for further tightening if the RBA board deems it necessary.

AUD/USD key events today

Traders will be keeping an eye on data from the US including GDP, housing data, and pending home sales data. These reports will indicate the current state of the economy, influencing the outlook for interest rates in the US.

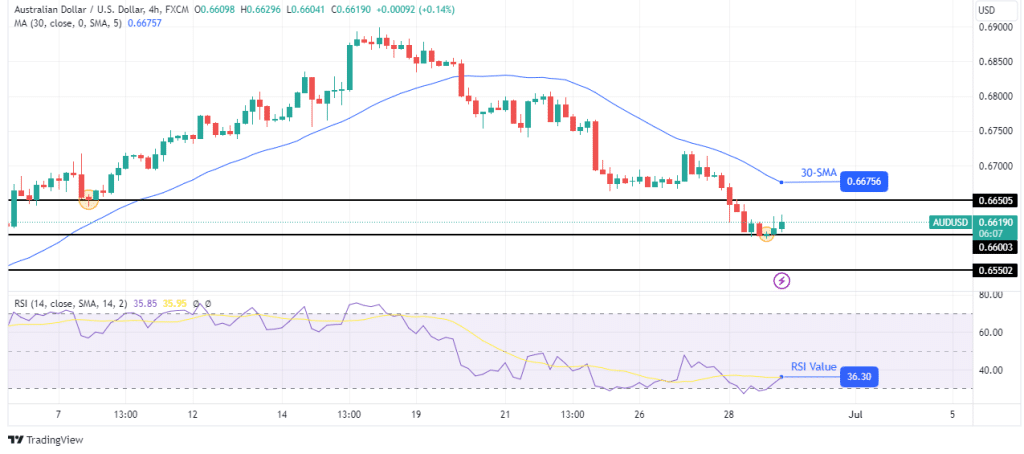

AUD/USD technical outlook: Bears await downtrend resumption.

On the charts, AUD/USD has paused at the 0.6600 support level and has risen slightly. However, the bias is bearish as the price is below the 30-SMA with the RSI near the oversold level.

–Are you interested in learning more about social trading platforms? Check our detailed guide-

Therefore, the current pullback might be short-lived, likely stopping at 0.6650 resistance. At the moment, bears are on the sidelines waiting to resume the downtrend after the pullback. The next target for this bearish trend is at 0.6550 support.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money