- AUD/USD price suggests a bullish price action.

- China’s Evergrande and NBK headlines may weigh on the Aussie.

- FOMC tapering jitters may also affect the pair.

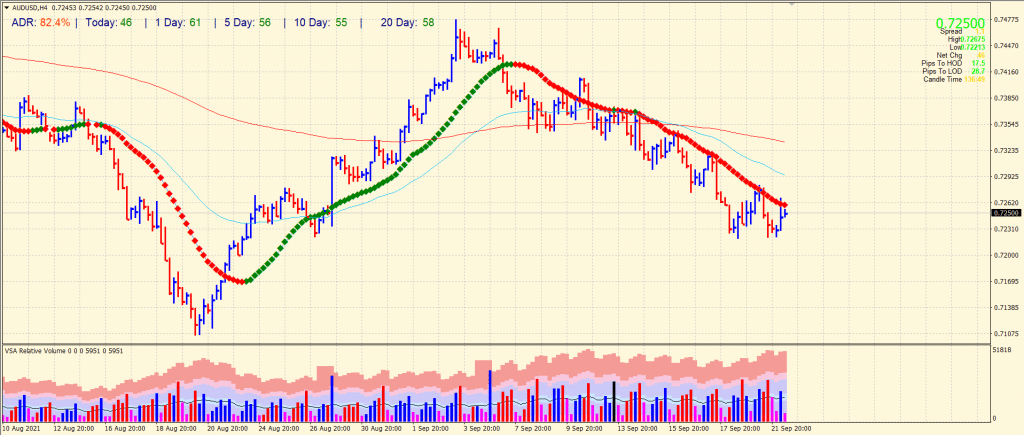

The AUD/USD price analysis suggests a mildly bullish picture. However, the bulls remain capped by the key technical hurdles.

The AUD/USD pair is trading at 0.7250 at writing, up 0.33% on the day.

-Are you looking for the best CFD broker? Check our detailed guide-

After Wall Street struggled in the early hours of Tuesday, the European markets could be in for a volatile session today. Despite modest gains in tech stocks, the S&P 500 and Dow Jones Industrial Average (DJIA) closed down 0.08% and 0.15%, respectively. As stocks fell, so did the AUD/USD pair.

China’s Evergrande situation remains a significant source of market anxiety, with contagion risk concerns at the forefront. This concern was heightened by S&P 500 Global Ratings on Tuesday when the credit agency said the Chinese group was likely to default. However, it said Beijing wouldn’t intervene unless serious economic problems threatened the country.

Following the long weekend, mainland stocks and bonds are expected to resume trading today. The opening of the European session will be closely followed by traders to gauge how the event is received in the domestic markets. In addition, members are closely monitoring the People’s Bank of China (PBOC). The NBK added 100 billion yuan in cash to the banking system on Friday, the highest since February.

Chinese authorities may be concerned about another big injection, but it may also help calm credit markets in China. Commercial banks also plan to announce the rates for one-year and five-year loans today, which will affect the cost of borrowing. Analysts do not anticipate the indicators to decline shortly, but it cannot be ruled out given the current market conditions. A rate reduction was last made in April 2020.

A major risk event will also be today’s Fed rate announcement. The situation in China is being monitored closely by Jerome Powell and his colleagues. In light of the threat of contagion, the FOMC may adopt a more relaxed tone than usual. The language likely used to phase out asset purchases, and the comments about Evergrande will draw the most attention.

AUD/USD price technical analysis: 20-SMA to limit rallies

The AUD/USD price attempted to rally but paused by the 20-period SMA on the 4-hour chart. This is the second consecutive failed attempt in the last two trading days. However, the average daily range is 82% so far. Furthermore, the price has formed two double bottoms that may keep lending support to the Aussie. The volume is discouraging for the bulls. However, if the 20-period SMA is broken, the price may rally to 0.7300 handle.

-Are you looking for forex robots? Check our detailed guide-

On the flip side, the price may test the old double bottom at 0.7220 ahead of the 0.7200 level. Thus, the path of least resistance lies on the upside despite the failed attempts.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.