- President Joe Biden and House Speaker Kevin McCarthy did not reach an agreement on Monday.

- There are just ten days remaining before a potential default.

- Fed policymakers believe the Fed should do more to tame inflation.

Today’s AUD/USD price analysis is bearish as the dollar strengthened on uncertainty regarding the US debt ceiling and hawkish Fed remarks. On Tuesday, the markets exercised caution as the latest US debt ceiling discussions presented mixed prospects for optimists and pessimists.

–Are you interested to learn more about forex bonuses? Check our detailed guide-

President Joe Biden and House Speaker Kevin McCarthy did not reach an agreement on Monday regarding raising the US government’s debt ceiling.

With just ten days remaining before a potential default, both sides emphasized the importance of avoiding such an outcome through a bipartisan deal. They stated their intention to continue negotiations. Consequently, investors adopted a cautious stance, refraining from making significant bets in either direction.

On Monday, Minneapolis Federal Reserve President Neel Kashkari expressed that he was undecided on whether to vote for another interest rate hike or to pause at the upcoming meeting.

Meanwhile, St. Louis Fed President James Bullard suggested that additional rate increases of 50 basis points might be necessary.

“Inflation poses a risk as it may not easily revert to a lower level,” stated Bullard during his address to the American Gas Association. He emphasized the need to address this issue promptly, particularly given the current strength of the labor market. He said the Fed needed to avoid a recurrence of the inflationary challenges witnessed in the 1970s.

These comments prompted traders to revise their expectations for US rate cuts, pushing them from July to November or December. As a result, ten-year and two-year US yields reached their highest levels since March.

AUD/USD key events today

Investors are awaiting several US economic releases, including the building permits, services PMI and new home sales reports.

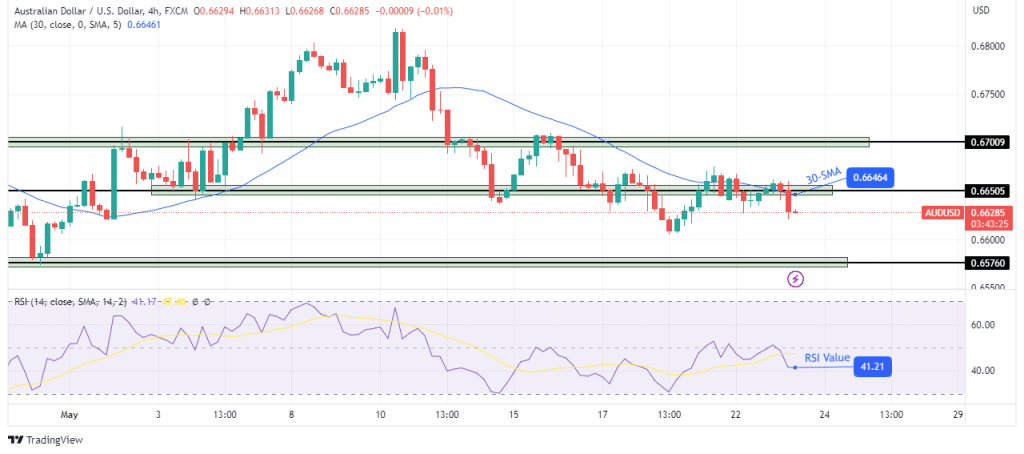

AUD/USD technical price analysis: Bears eye 0.6576 support

The technical bias for AUD/USD is bearish, as the price trades under the 30-SMA with the RSI below 50. It had been consolidating near the 0.6650 key level but is now pushing lower. Bulls had attempted to break above the SMA but failed.

–Are you interested to learn more about forex trading apps? Check our detailed guide-

This allowed bears to take back control, and they might soon retest the 0.6576 support level. This would be a continuation of the downtrend and would further strengthen the bearish bias.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.