- The US inflation data could really shake the markets on Thursday.

- A new higher high activates further growth.

- DXY’s sell-off forced the greenback to lose significant ground versus its rivals.

The AUD/USD price rallied in the last hour as the US dollar lost ground. It was trading at 0.6451 at the time of writing.

–Are you interested in learning more about CFD brokers? Check our detailed guide-

The greenback has depreciated versus its rivals since Friday. The USD took a hit from the US Unemployment Rate. The indicator jumped from 3.5% to 3.7%, above the 3.6% expected. The Non-Farm Payrolls came in at 261K, above 197K expected but below 315K in the previous reporting period, while Average Hourly Earnings rose by 0.4%, exceeding the 0.3% growth expected.

On the other hand, Australian Retail Sales surged by 0.6%, matching expectations. Today, the Chinese economic data had an impact on the AUD/USD pair as well. The Unemployment Rate remained steady at 2.1%, as expected.

Trade Balance came in at 587B, below the 702B estimated, while USD-Denominated Trade Balance was reported at 85.2B versus 96.0B forecasted. Tonight, the Australian AIG Index could move the price a little. The US Consumer Credit and the Loan Officer Survey data will also be released.

Fundamentally, the price could also react after FOMC Member Mester and FOMC Collins’s speeches. Tomorrow, the US Congressional Elections could greatly impact the USD. Still, US inflation represents the most important event of the week.

The US CPI and Core CPI could really shake the markets. Higher inflation could lift the USD as the FED should take action in the next monetary policy meetings.

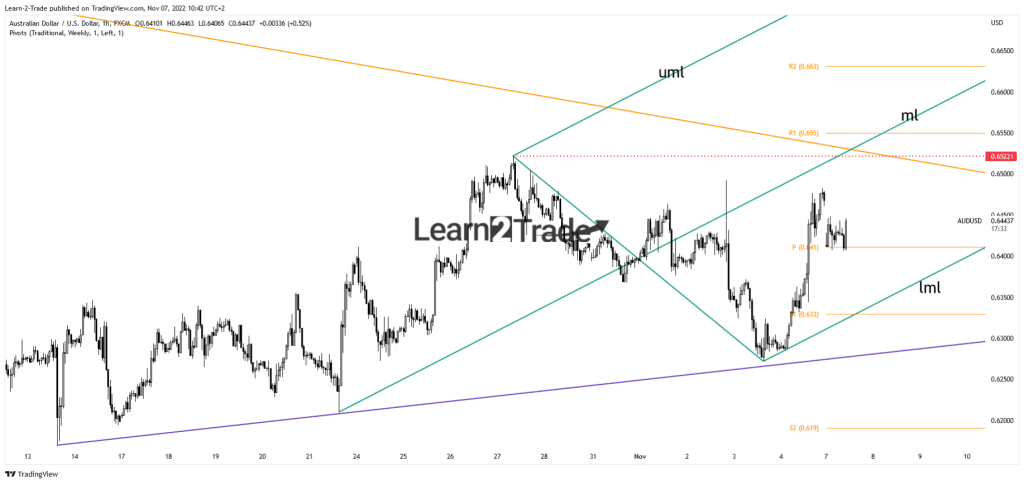

AUD/USD price technical analysis: Bullish momentum

Technically, the currency pair found support on the weekly pivot point of 0.6410, and now it has rallied. Closing the gap down may signal strong upside pressure. The descending trendline, 0.6522, and the ascending pitchfork’s median line (ml) represent upside obstacles. After retesting the lower median line (LML), the currency pair signaled a potential leg higher toward the median line.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

A larger growth could be activated only after a valid breakout through the resistance levels. Friday’s high of 0.6482 represents an upside obstacle as well. Only a valid breakout, a new higher high, validates further growth. On the contrary, staying under this obstacle and making a new lower low could announce a potential sell-off, at least towards the lower median line (LML).

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.