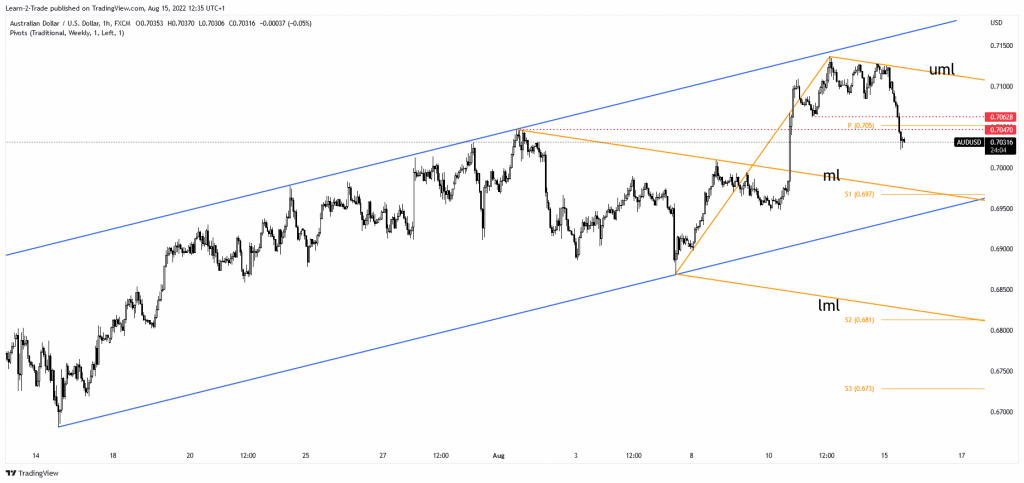

- The AUD/USD pair could extend its sell-off after a minor rebound or distribution.

- The price action signaled exhausted buyers.

- The median line (ml) could attract the price.

The AUD/USD price was trading at 0.7026 at the time of writing. It seems to be under strong selling pressure in the short term. DXY’s strong rebound boosted the greenback, which took the lead versus most of the major currencies.

-Are you looking for automated trading? Check our detailed guide-

As you already know, the Dollar Index was in a corrective phase but the price action signaled that the sell-off could be over and the index could develop a new leg higher. Still, after its strong rally, the DXY could come back to retest the near-term downside obstacles before really printing a broader swing higher.

Fundamentally, the US data came in mixed in the last week. Today, the Chinese economic data had a significant impact on this market. As you already know, Australia and China are economic partners.

The Chinese Retail Sales rose by only 2.7% less versus 5.0% expected, Fixed Asset Investment surged by 5.7% compared to 6.3% estimated, Industrial Production registered a 3.8% growth compared to 4.5% growth forecasted, while the Unemployment Rate came in at 5.4% versus 5.5% expected.

On the other hand, the US Empire State Manufacturing Index is expected at 5.1 points versus 11.1 in the previous reporting period.

AUD/USD price technical analysis: Strong bearish dominance

Technically, the AUD/USD pair failed to make a new higher high signaling exhausted buyers. Now, it has dropped below 0.7062 and 0.7047 downside obstacles indicating more declines. Still, after its amazing sell-off, the price could come back to test the broken support before resuming its downside.

-Are you looking for forex robots? Check our detailed guide-

The 0.7022 is seen as a downside obstacle as well. A new lower low may activate a potential drop towards the descending pitchfork’s median line (ml) which is seen as a downside target. After testing the upper median line (UML), the price could be attracted by the median line (ml). A minor rebound could bring new selling opportunities. Failing to reach the uptrend channel’s upper boundary revealed that the leg higher could be over and that the sellers could take the lead.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.