- The AUD/USD pair could activate a larger correction if it makes a valid breakdown below the 50% retracement level.

- Staying above the median line (ML) signals that the sell-off is over.

- The US inflation data could be decisive tomorrow.

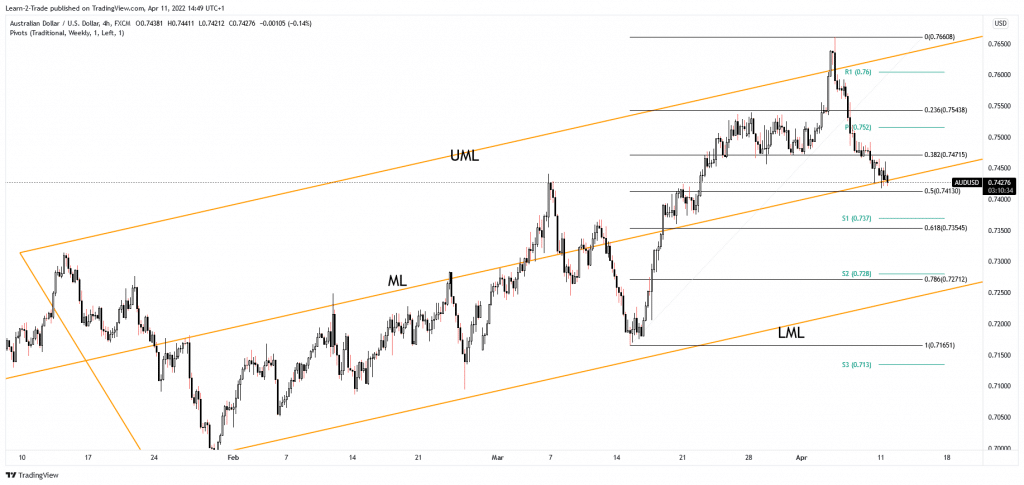

The AUD/USD price dropped at the time of writing as the Dollar Index erased today’s losses. The pair is trading at the 0.7422 level, and it looks soft in the short term. Technically, the pair is in a corrective phase. It remains to see if this will be a larger correction or if the rate could end the retreat here around 0.7441 former high, representing a key level. Also, it has reached dynamic support, so we’ll have to wait for confirmation.

–Are you interested in learning more about CFD brokers? Check our detailed guide-

The Aussie maintained a bearish bias versus the greenback even though the Chinese economic data was better than expected today. Australia and China are economic partners, so the Chinese data could influence the AUD. The Consumer Price Index rose by 1.5% in March versus 1.3% expected compared to 0.9% in February, while the PPI surged by 8.3% exceeding the 8.1% estimates.

Furthermore, the New Loans indicator was reported at 3,130B above 2,750B forecasts versus 1230B in the previous reporting period, while M2 Money Supply registered a 9.7% growth, beating the 9.2% expected.

Fundamentally, the US inflation data could be decisive tomorrow. The CPI could report a 1.2% growth in the last month, while the Core CPI is expected to report a 0.5% growth.

AUD/USD price technical analysis: Downside correction

As you can see on the 4-hour chart, the AUD/USD pair challenges the 0.7441 key level and the ascending pitchfork’s median line (ML). It’s almost reached the 50% (0.7413) retracement level. Taking out the support levels represented by the median line (ML) and by the 50% retracement level could announce a larger corrective phase.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

On the contrary, staying above the median line and above the 0.7441 could signal that the downside movement is over and that the pair could develop a new leg higher. From the technical point of view, a temporary correction was expected after registering only false breakouts above the upper median line (UML).

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money