- AUD/USD price turns positive above 0.7400 despite weak risk sentiment.

- Investors expect a further aggressive tone from the FOMC.

- Traders await US PPI and Powell’s speech in the New York session.

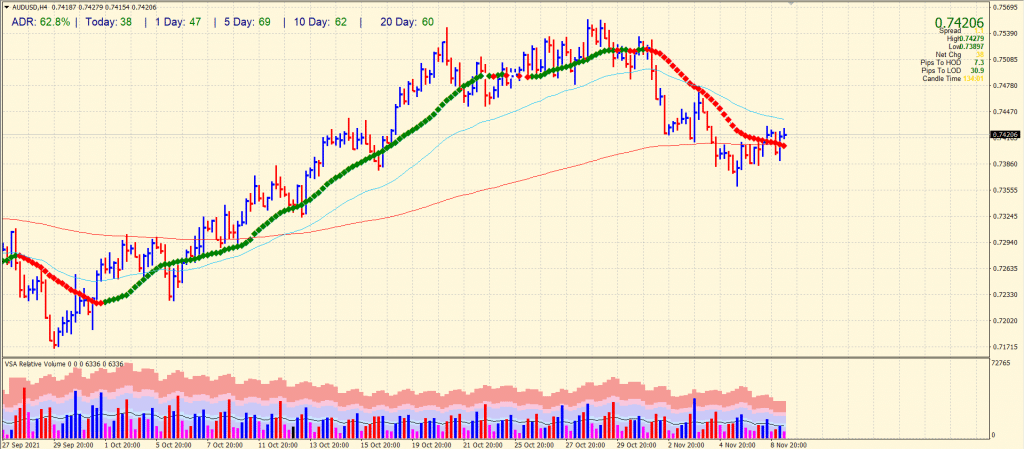

The AUD/USD price reversed an intraday decline below 0.7400 and renewed daily highs in the last hour, despite no continuation. The pair last moved around 0.7420, almost unchanged over the day.

-If you are interested in knowing about ETF brokers, then read our guidelines to get started-

At the start of trading on Tuesday, the riskier Aussie was put under pressure by weaker sentiment in Asian equities. However, the AUD/USD pair rebounded 30-35 pips from its session lows around 0.7390 thanks to the continued appreciation of the US dollar.

In addition to the dollar’s retreat from the swing high after NFP, the Fed’s dovish forecasts suggest that policymakers are not in a hurry to raise borrowing costs. The combination of this and the incentives for risk aversion in the markets further weakened the US dollar and further reduced US Treasury yields.

Despite this, investors remain convinced that the Fed will be forced to take more aggressive measures to control persistently high inflation. Numerous FOMC members have made aggressive remarks suggesting that the central bank will raise rates by 2022 based on speculation.

The market is, as a result, tethered to the latest consumer inflation report released on Wednesday. The Fed rate hike expectations and the short-term direction of the dollar will be influenced by this data. As a result, traders were unable to move up the AUD/USD pair aggressively.

During Tuesday’s North American session, traders will be guided by the release of the US Producer Price Index (PPI) and comments from Fed Chairman Jerome Powell during an online conference. Additionally, US bond yields and broader market risk exposure may add momentum to the AUD/USD pair.

-Are you looking for high leveraged forex brokers? Take a look at our detailed guideline to get started-

AUD/USD price technical analysis: Bulls emerging above 0.7400

The AUD/USD price managed to climb above the 20-period and 200-period SMAs. The price remains supported by the psychological mark of 0.7400. The immediate hurdle for the bulls lies at 50-period SMA (0.7440) ahead of the horizontal level at 0.7480. On the flip side, 0.7400 will be the key for bears to break and test the previous day’s lows around 0.7385 ahead o Friday lows at 0.7360.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.