- AUD/USD gained traction this week amid Powell’s speech.

- Despite the dismal Australian PMI data, the Aussie managed to climb higher.

- Positive sentiment in equities helped the pair despite the Fed’s hawkish tone.

- US NFP report is due next which is the key event to keep an eye on.

The weekly forecast for the AUD/USD pair is bullish. Other than technical readings, fundamentals support the gains as USD sees a decline.

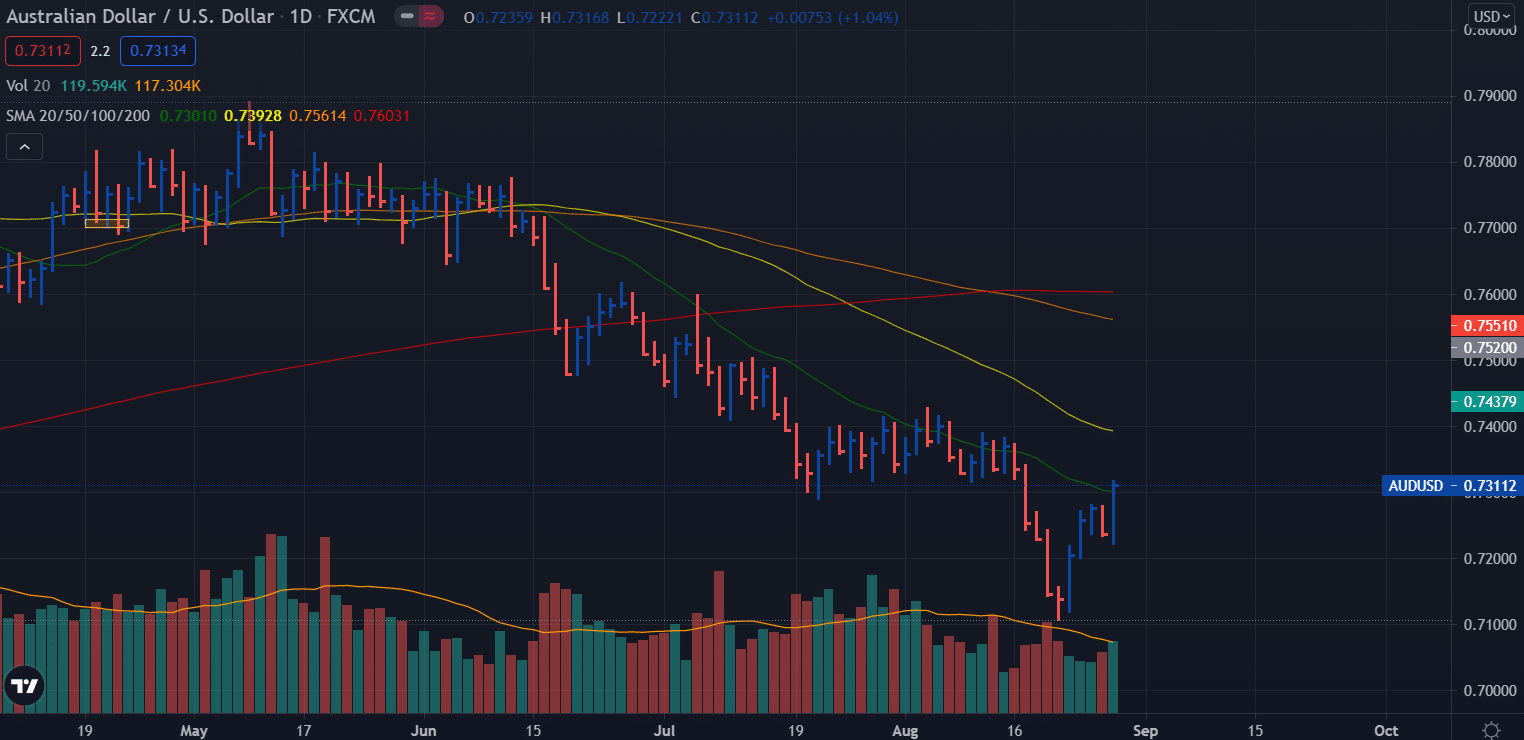

The AUD/USD pair ended the week with a gain near 0.7300, cutting most of the previous week’s losses. In the wake of rumors that the US Federal Reserve would maintain financial support, Wall Street resumed its gains from record highs, spurring an increase in the Australian dollar. However, several Fed officials began to shift sentiment on Thursday when they made restrictive remarks about the tightening.

–Are you interested to learn more about ECN brokers? Check our detailed guide-

Several Federal Reserve officials again predicted a tapering shortly, which weighed on the dollar. Additionally, Chairman Powell said it would be wise to extend the tapering this year, even though there has been improvement in employment since July and more expansion of Delta. Overall, Powell went beyond most market participants’ expectations as most market participants assumed that the event would not occur.

Despite the hawkish remarks, Wall Street continued to support the AUD/USD pair for the rest of the week, despite the pair’s long-term bearish outlook.

There was little interest in the Australian currency. Preliminary PMI data for manufacturing declined from 56.9 to 51.7, which was less than expectations. Service industries were hit the hardest by the current constraints, and the index declined to 43.3. In addition, retail sales in July were revised down from -1.8% to -2.7%.

In August, the US economy posted its slowest growth in eight months, according to Markit. Furthermore, orders for durable goods fell 0.1% in July, while the second-quarter GDP rose 6.6% versus expectations. Furthermore, inflation in July was in line with market expectations at 3.6%.

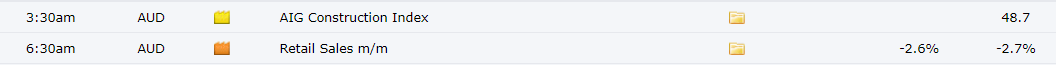

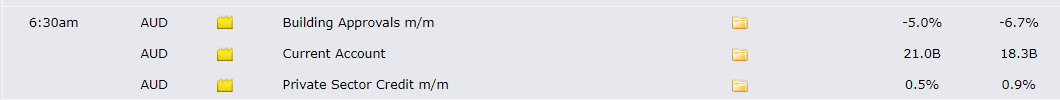

Key data from Australia during Aug 30 – Sep 03

The economic calendar has few low impact events from Australia. However, only retail sales figures are important to watch. The market expects a slight improvement, but a big surprise may trigger volatility.

–Are you interested to learn more about making money in forex? Check our detailed guide-

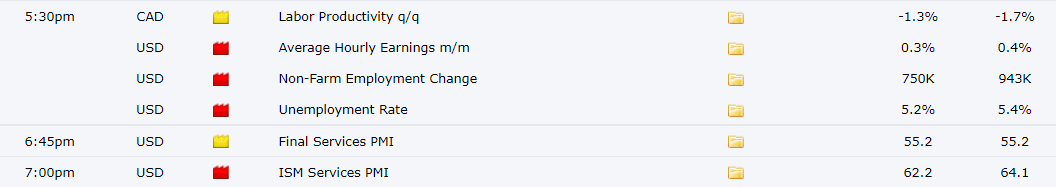

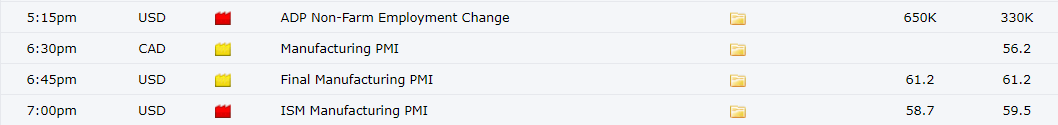

Key data from the US during August 30 – September 03

The most important event next week in US NFP which is expected to decline to 750k as expected to 943k jobs created in July. The ADP nonfarm employment numbers are expected to rise to 650k against 330k reading of July. ISM PMIs for manufacturing and services are also expected next week that may provide some impetus to the market.

AUD/USD weekly technical analysis: Poised to gain further

The AUD/USD pair closed the week above the 20-day moving averages. The pair found the bottom at 0.7100 and now aims at a 50-day moving average and a horizontal level at 0.7400.

The volume is slowly rising with the price rise. However, the pair may consolidate after gaining for an entire week. Therefore, any downside retracement to 0.7250 or 0.7200 can be taken as buying opportunities.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.