The Australian dollar suffered from weak employment daa in Australia as well as other negative influences.

The team at Credit Agricole sees a “sell the rally” approach as the best one at the moment, especially against its neighbor:

Here is their view, courtesy of eFXnews:

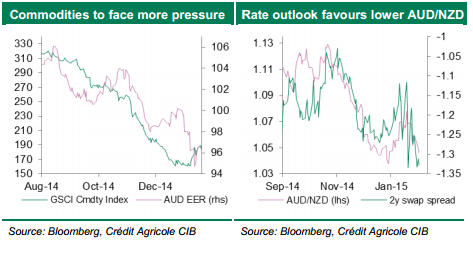

The AUD has been under pressure this week, mainly on the back of muted commodity price developments and further rising RBA easing expectations.

In an environment of weak Asian business activity commodity prices should remain subject to downside risk. Elsewhere, it cannot be excluded that the RBA will ease monetary policy further. This is especially true as weak labour market conditions, as confirmed by this week’s employment report and muted external demand prospects, keep inflation subject to downside risk.

Going forwards, investor focus turns to next week’s RBA minutes release. We expect them to confirm the possibility of additional easing should incoming data make a case for it.

Accordingly we remain in favour of selling the AUD, for instance against the NZD, which should outperform on the back of more supported RBNZ rate expectations. We remain short the cross.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.