The RBA giveth, the RBA taketh away. At first, the statement by the Reserve Bank of Australia lacked any hawkish tones and weighed on the A$. Then came the meeting minutes that discussed a potential interest rate of 3.5% in the future and AUD/USD made a big breakout.

And now come two officials at the Australian central bank and they put their pressure on the currency. Guy Debelle played down the discussion about the “neutral rate”. He says that talk about 3.5% has “no significance.

He emphasized that the neutral rate dropped from after the Global Financial Crisis due to uncertainty and risk aversion.

The current interest rate is appropriate and they “do not have to rise in line with global peers”. The message is clear: no rate hikes anytime soon.

The Deputy Governor also said that with a stronger Australian dollar, the benefits of faster global growth do not reach the shores of Australia. He also provides a more direct message: a rising AUD is not welcome. The rise of the A$ is causing complications for the economy’s adjustment.

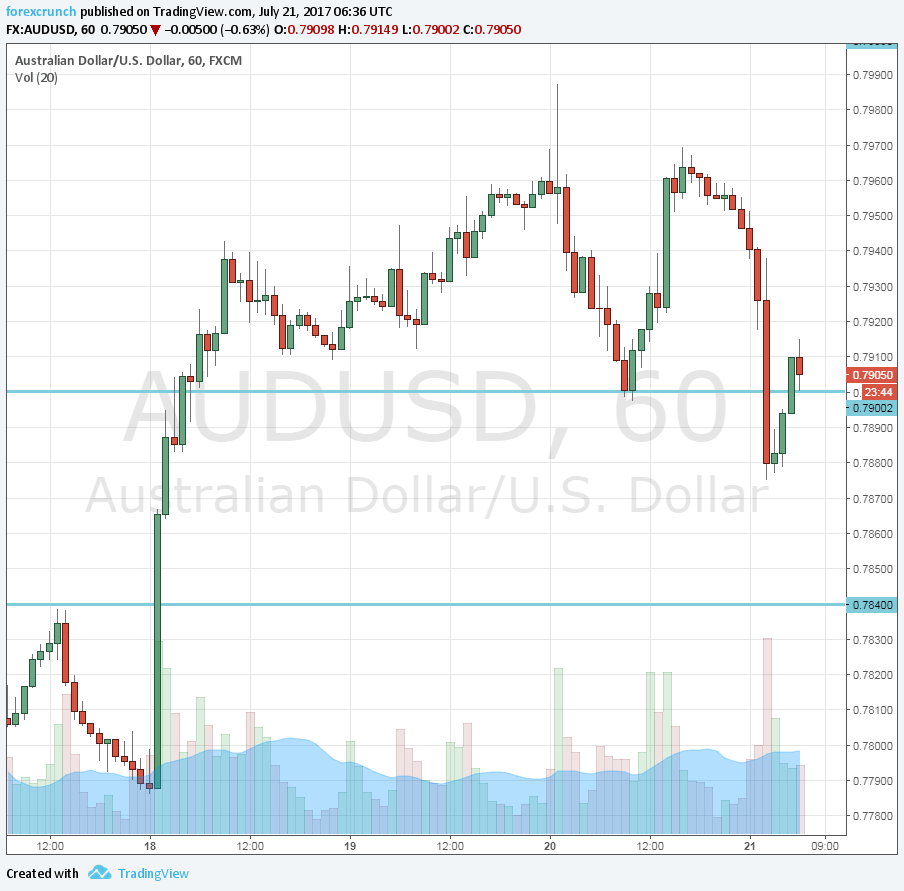

AUD/USD lost ground and hit a low of 0.7875. This is still above support at 0.7835, which was the previous cycle high. At the time of writing, the pair trades just above 0.79, and this is still at the highest levels since 2015.

More: AUD: Valuation Getting Stretched; What’s Next? – NAB

Here is how it looks on the hourly chart. The high point was 0.7987, just under the magic level of 0.80.