The FED raised rates as expected but also upgraded the dot-plot to reflect three rate increases in 2017. in a surprising move. Despite some downplaying by Yellen, the greenback continues higher.

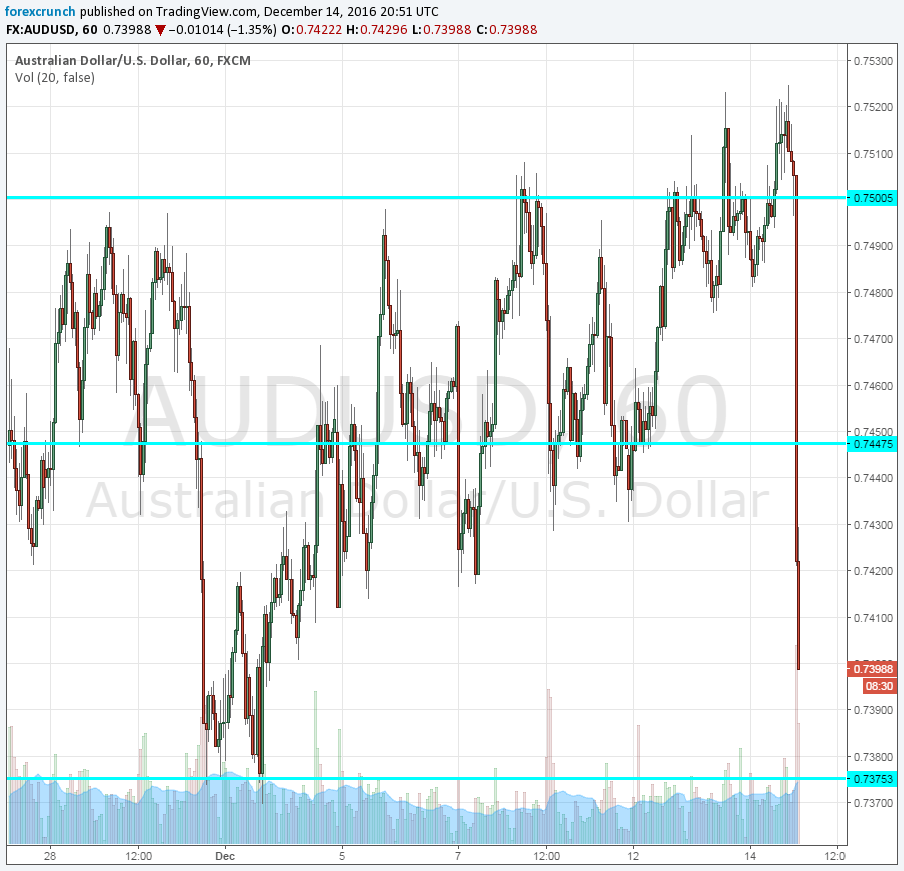

For the Australian dollar, this resulted in a slide within the range, towards the bottom end of this trading range, to just under 0.74. The next level of support is at 0.7375, and the next level to watch is 0.73, a round number.

Are we finally seeing the Australian dollar break out of range? Trading in A$ has been quite frustrating during 2016, with relatively narrow ranges. If we do see a break lower, 0.7240 and 0.71 are the next levels to watch.

If we do see a move to the upside, 0.7440 is weak resistance and 0.75 is an area the pair really loves. Aussie/USD hugged this level in recent sessions. Further above, 0.7660 and 0.7740 are at the top end of the range.

The Australian dollar soon faces a test of its own. See how to trade the Australian jobs report with AUD/USD.

Here is how it looks on the chart: