The Australian dollar is feeling heavy, following the Canadian cut as the last in a series of blows to commodity currencies.

Is the RBA set to cut? Can it tackle the 0.80 line? The team at Danske examine the aspects:

Here is their view, courtesy of eFXnews:

Flows. Non-commercial AUD positioning has moved into stretched short-territory. This suggests a high sensitivity to the upside but positioning has historically not been a barrier for more AUD/USD downside.

Valuation. Fundamentally, the AUD remains overvalued with a Danske Bank PPP model estimate for AUD/USD of 0.75. Our short-term financial model also suggests that the pair is currently overvalued with a fair value of 0.79.

Risks. The AUD remains exposed to global risk sentiment. Short term, portfolio inflows from Japanese funds might provide some temporary resistance to AUD weakness.

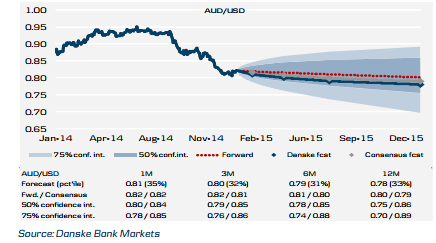

Forecast: 0.80 (3M), 0.79 (6M) and 0.78 (12M).

Conclusion. We have called for the RBA to cut the cash rate target in March and for governor Stevens to communicate an explicit easing bias at the next meeting in February. We still expect this scenario to play out and notably financial markets have also shifted the pricing of the RBA towards an implicit market expectation of a 40% 25 bps cut in Q1. We believe the change in pricing is justified and for five main reasons we believe that the RBA indeed will make a single 25 bps rate cut in Q1 15. These are 1) disappointing economic growth, 2) inflation at the bottom of RBA’s inflation target, 3) the highest unemployment level since 2002, 4) a macro-prudential policy alert from the Australian Prudential Regulation Authority (APRA) limiting the risk of an overheated housing market and 5) more dovish comments from RBA officials. In addition, we still expect US growth outperformance, relative monetary policy, too high expectations of the People’s Bank of China easing further and the USD’s role as an asset currency to pull AUD/USD lower.

&For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.