AUD/USD reversed directions last week and posted modest losses. The pair closed the week at 0.7528. This week’s key event is CPI. Here is an outlook on the major market-movers and an updated technical analysis for AUD/USD.

In the US, construction figures were mixed and manufacturing and employment numbers missed their estimates. The Aussie softened after the RBA minutes expressed concern about the domestic employment and housing sectors.

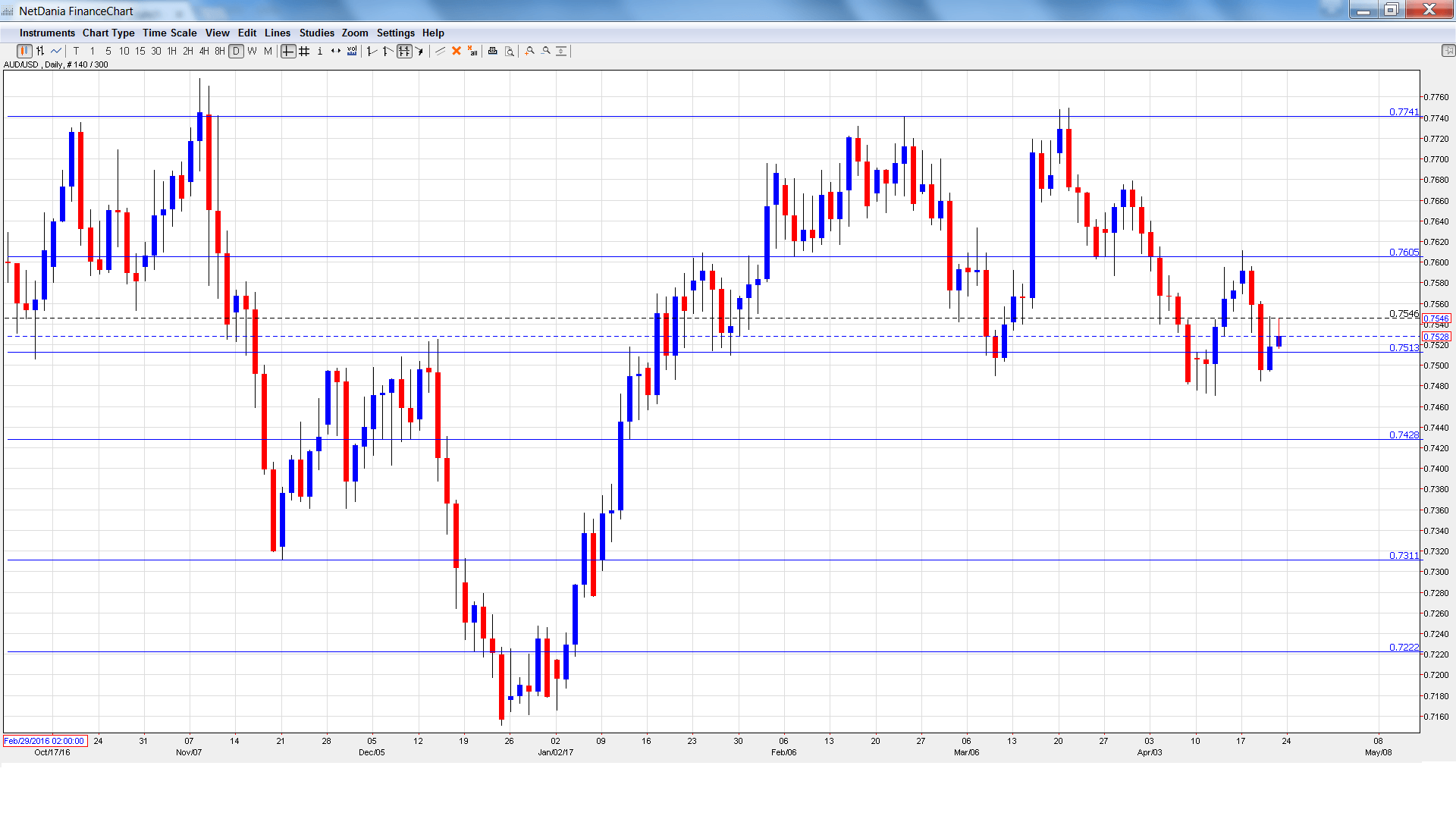

[do action=”autoupdate” tag=”AUDUSDUpdate”/]AUD/USD daily graph with support and resistance lines on it. Click to enlarge:

- CPI: Wednesday, 1:30. CPI is released each quarter, magnifying the impact of each release. The index dipped to 0.5% in Q4, short of the forecast of 0.7%. The estimate for Q1 stands at 0.6%.

- Trimmed Mean CPI: Wednesday, 1:30. This indicator excludes the most volatile items which make up CPI. The indicator remained unchanged in Q4 at 0.4%, shy of the forecast of 0.5%. The forecast for Q1 stands at 0.5%.

- RBA Governor Philip Lowe Speech: Thursday, Tentative. Lowe will speak at an event in Sydney. The markets will be looking for clues regarding future monetary moves by the RBA.

- Import Prices: Thursday, 1:30. The indicator posted a small gain of 0.2% in Q4, ending a nasty streak of four straight declines. The markets are braced for a decline of 0.4% in Q1.

- Private Sector Credit: Friday, 1:30. The indicator rebounded in January with a gain of 0.4%. Will the indicator post another gain in February?

AUD/USD Technical Analysis

AUD/USD opened the week at 0.7579 and quickly climbed to a high of 0.7611. The pair then reversed directions and dropped to a low of 0.7485, testing support at 0.7513 (discussed last week). The pair closed the week at 0.7528.

We begin with resistance at 0.7938. This line has held since May 2015.

0.7835 was the high point in April 2016.

0.7741 was a cap in February.

0.7605 has strengthened in resistance as AUD/USD lost ground last week.

0.7513 was tested in support and is a weak line.

0.7429 is the next support line.

0.7311 marked a low point in November.

0.7223 is the next support line.

0.7105 has held since March 2016. It is the final support level for now.

I am neutral on AUD/USD

The US economy is doing well, but the markets are not impressed with Trump’s first 100 days in office. Stronger global demand has boosted demand for Australian products, but US protectionism remains a serious risk.

Our latest podcast is titled French fate and British snaps

Follow us on Sticher or iTunes

Safe trading!

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Canadian dollar (loonie), check out the Canadian dollar forecast.

- For the kiwi, see the NZD/USD forecast.