The Australian dollar had an interesting week, getting a boost from the jobs report. Can it attack 0.80? The upcoming week is quite light in terms of indicators. Here are the highlights of the week and an updated technical analysis for AUD/USD.

Australia enjoyed an impressive gain of over 27,00 jobs in July, and the report was accompanied by an upwards revision to June. That certainly helped the Aussie. China, Australia’s No. 1 trading partner, released some disappointing figures. Industrial output advanced by only 6.4% y/y against 7.1% expected. Fixed investment and retail sales also fell short of expectations. In the US, the dollar suffered from the somewhat dovish Fed minutes, mixed economic data and the mess in the White House. However, not all is bad in America: the retail sales report was excellent.

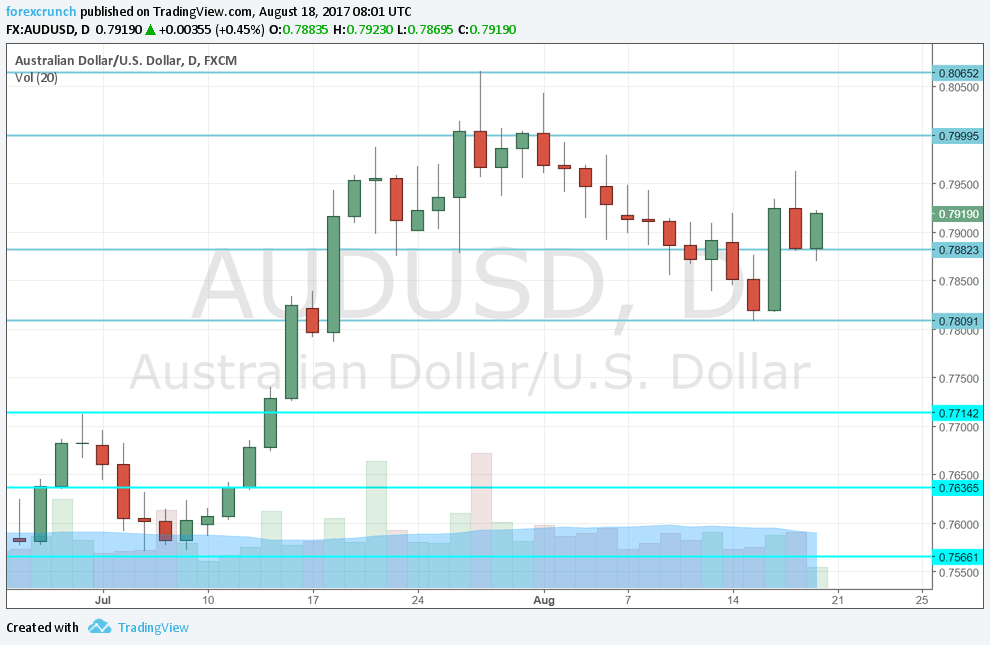

[do action=”autoupdate” tag=”AUDUSDUpdate”/]AUD/USD daily graph with support and resistance lines on it. Click to enlarge:

- CB Leading Index: Monday, 14:30. The Conference Board compiles this compound index using 7 pre-released economic indicators. It is expected to show another advance in the Australian economy after 0.1% last time.

- Chinese CB Leading Index: Tuesday, 13:00. Australia’s No. 1 trading partner also gets its composite index from The Conference Board. A rise of 1.6% was seen last time, slightly slower than 1.7% previously.

AUD/USD Technical Analysis

The Australian dollar initially held its ground above the 0.7835 level (mentioned last week).

Technical lines from top to bottom:

0.83 was a swing high seen in early 2015 and is our top line. 0.8165 was another swing high, back in May 2015.

0.8065 is the most recent high seen in 2017. It is followed by the psychological round level of 0.80.

0.7920 was the low point the pair reached after the pair moved to the highs. The round number of 0.7810 provided support in August and replaces the veteran 0.7835 level.

Below, we find 0.7740, that was a high point in June 2017 and also beforehand. 0.7635 was a stepping stone on the way up, also in June.

Even lower, we find 0.7565 was a low point before the pair shot higher in July. The last line, for now, is 0.7515.

I remain bullish on AUD/USD

The Australian economy looks good and the Aussie has room to rise. On the other side of the Pacific, the US dollar remains on the back foot due to a deterioration of the political scene.

Follow us on Sticher or iTunes

Safe trading!