AUD/USD ended last week almost unchanged, closing at 0.7366. This week’s highlight is Unemployment Change. Here is an outlook on the major market-movers and an updated technical analysis for AUD/USD.

The Aussie gained ground after the RBA rate statement, as the RBA held rates but sounded less concerned about low inflation levels. In the US, Janet Yellen gave a cautious speech and didn’t mention a timetable regarding a rate hike. US employment numbers bounced back after the awful NFP report, as JOLT Job Openings and Unemployment Claims beat expectations.

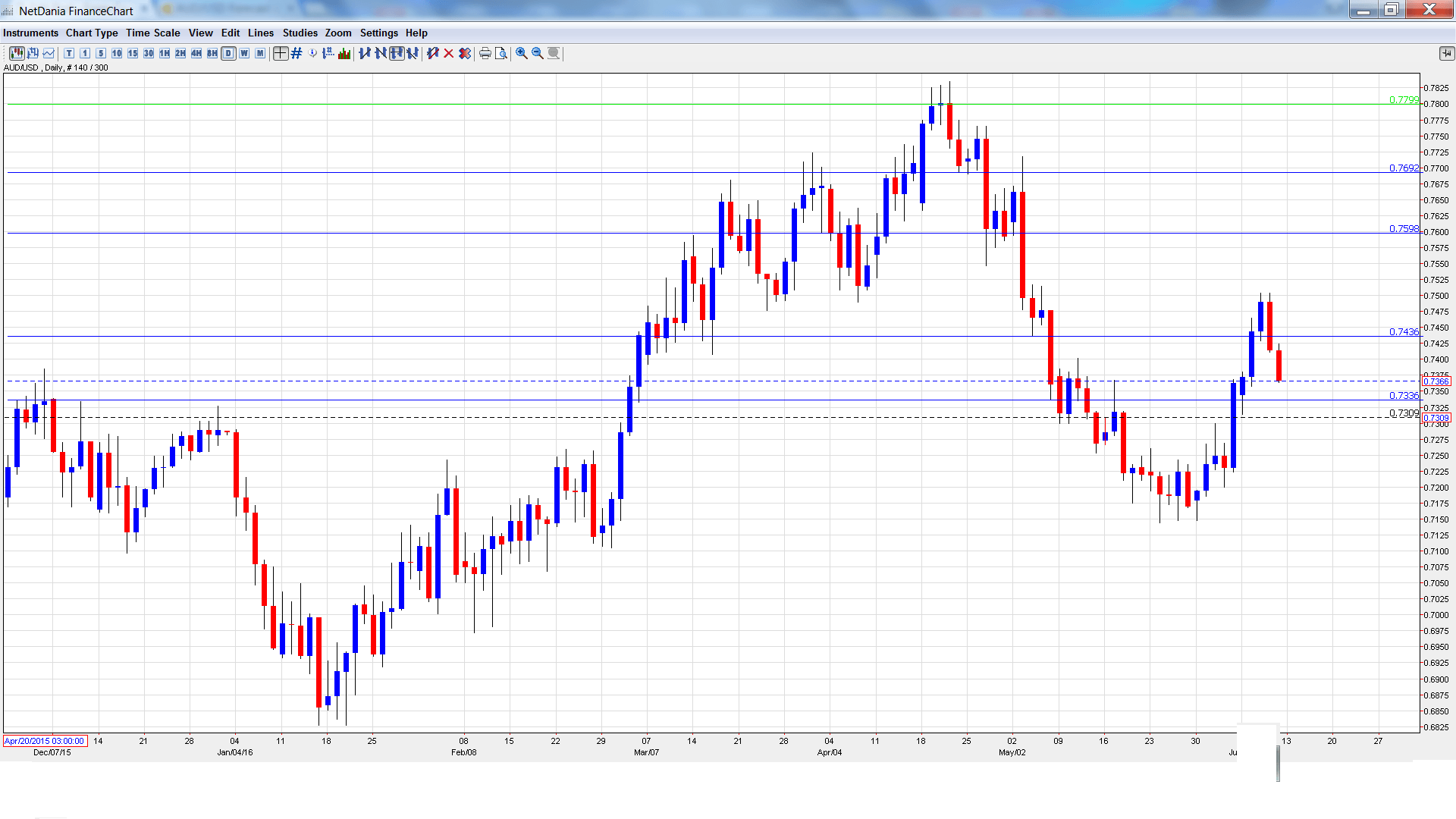

[do action=”autoupdate” tag=”AUDUSDUpdate”/]AUD/USD graph with support and resistance lines on it. Click to enlarge:

- Chinese Industrial Production: Sunday, 5:30. The Aussie is sensitive to key Chinese numbers, as the Asian giant is Australia’s number one trading partner. The indicator dropped to 6.0% in April, well short of the forecast of 6.5%. Little change is expected in the May report.

- MI Inflation Expectations: Tuesday, 1:00. This indicator is useful in tracking actual inflation trends. The indicator dropped to 3.2% in April, compared to 3.6% in the previous release.

- NAB Business Confidence: Tuesday, 1:30. Strong business confidence usually is critical for the economy, as it usually leads to increased hiring and spending. The indicator edged lower to 5 points in April, down from 6 points in the March release.

- Westpac Consumer Sentiment: Wednesday, 00:30. This minor report measures consumer confidence, an important component of consumer spending. The indicator rebounded in May, posting a strong gain of 8.5%.

- Employment Change: Thursday, 1:30. This is one of the most important economic indicators, and an unexpected reading can have a sharp impact on the movement of AUD/USD. The indicator posted a respectable gain of 10.8 thousand in April, but this fell short of the forecast of 12.1 thousand. The markets are expecting a stronger May report, with an estimate of 15.1 thousand. The unemployment rate is expected to remain steady at 5.7%.

* All times are GMT

AUD/USD Technical Analysis

AUD/USD opened the week at 0.7343 and touched a low of 0.7314, testing support at 0.7334 (discussed last week). AUD/USD then changed directions and climbed to a high of 0.7504, breaking past resistance at 0.7334. AUD/USD then retracted, closing the week at 0.7363.

Live chart of AUD/USD: [do action=”tradingviews” pair=”AUDUSD” interval=”60″/]

Technical lines from top to bottom:

0.7798 was an important resistance line for much of June 2015.

0.7692 is protecting the 0.77 line.

0.7597 is the next line of resistance.

0.7438 was tested as AUD/USD posted strong gains before retracting.

0.7334 was a cap in December 2015.

0.7192 is providing strong support.

0.7105 has been a cushion since the end of February.

0.7002 is providing support just above the psychologically important level of 0.7000. It is the final support line for now.

I am neutral on AUD/USD

The Aussie has impressed with strong gains in June. Is it time for a downward correction? The Fed will keep the markets guessing about a rate hike, although a June move would be a huge surprise. US job numbers appear to have stabilized after a dismal NFP, and market sentiment towards the US economy remains positive.

Our latest podcast is titled Oil, Brexit and the Big Fed Preview

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Canadian dollar (loonie), check out the Canadian dollar forecast.

- For the kiwi, see the NZD/USD forecast.