The Reserve Bank of Australia doesn’t always talk down the Aussie. The team led by Glenn Stevens and co. left the interest rate unchanged as widely expected but was relatively upbeat. The usual complaints about the exchange rate remained in the same level of rhetoric despite the rise in the A$.

They talked about housing prices as rising once again.Apart from that, the statement wasn’t that hawkish: they see inflation as low for some time and did warn about the exchange rate.

Part of the rise is in the dollar side, where Yellen didn’t commit to anything new. This kept the US dollar under pressure. Maybe we are witnessing another reaction to Yellen’s speech, now that the RBA is out of the way.

Here is the paragraph which includes the mention of dwellings, which is wrapped with cautious words:

Indications are that the effects of supervisory measures have strengthened lending standards in the housing market. Separately, a number of lenders are also taking a more cautious attitude to lending in certain segments. Dwelling prices have begun to rise again recently. But considerable supply of apartments is scheduled to come on stream over the next couple of years, particularly in the eastern capital cities.

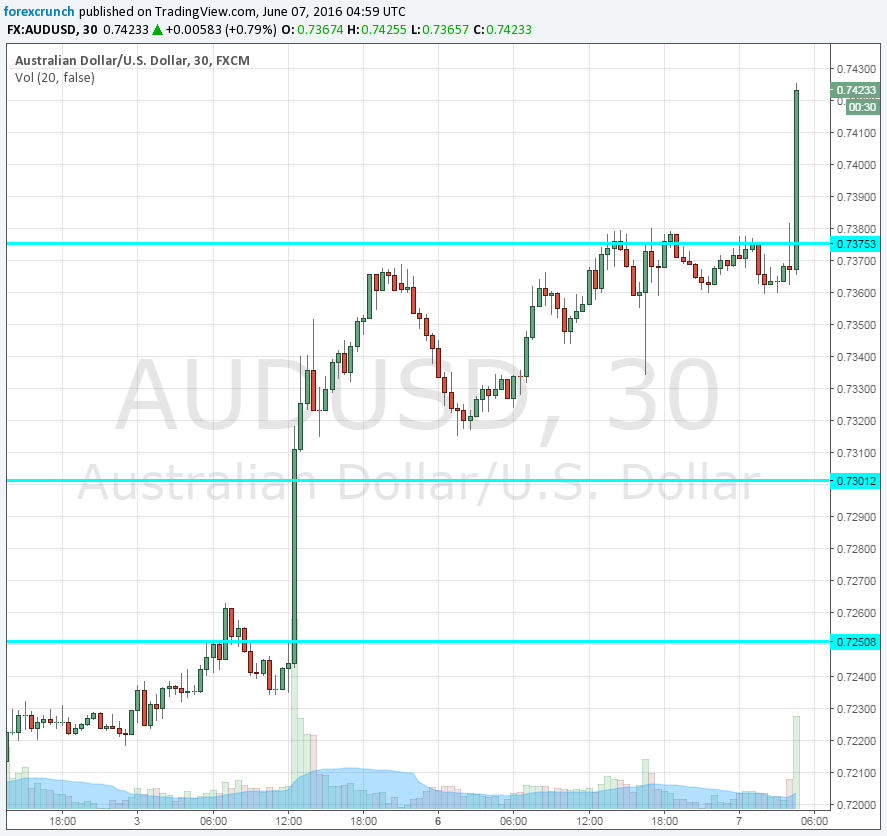

AUD/USD is now trading at 0.7423 after breaking above resistance at 0.7375 which now turns into support. The next cap for the pair is 0.7440 followed by 0.75.

This is how it looks on the chart: