AUD/USD posted strong gains for a second straight week. The pair closed at 0.7616, its highest weekly close since March. This week’s key event is the RBA minutes. Here is an outlook on the major market-movers and an updated technical analysis for AUD/USD.

The Aussie received a boost as the Employment Change was much stronger than expected. In the US, the Fed raised rates and the rate statement was more hawkish than expected, disregarding lower inflation.

[do action=”autoupdate” tag=”AUDUSDUpdate”/]AUD/USD daily graph with support and resistance lines on it. Click to enlarge:

- RBA Governor Philip Lowe Speaks: Sunday, 23:30. Debelle will speak at an event in Canberra. A speech that is more hawkish than expected is bullish for the Australian dollar.

- New Motor Vehicle Sales: Monday, 1:30. This consumer spending indicator posted a weak gain of 0.3% in April. Will we see an improvement in the May report?

- CB Leading Index: Monday, 14:30. The index has been steady, and edged up to 0.5% in April. This marked a 4-month gain.

- RBA Monetary Policy Meeting Minutes: Tuesday, 1:30. This is the key event of the week. The minutes provide details of the RBA meeting earlier in June, at which the bank held rates at 1.50%.

- HPI: Tuesday, 1:30. This quarterly index provides a snapshot of the level of activity in the housing sector. In Q4, the indicator jumped 4.1%, well above the estimate of 2.4%. The forecast for Q1 stands at 2.2%.

- MI Leading Index: Wednesday, 00:30. This indicator continues to hover close to the zero level. In May, the index declined 0.1%. Will the index move into positive territory in June?

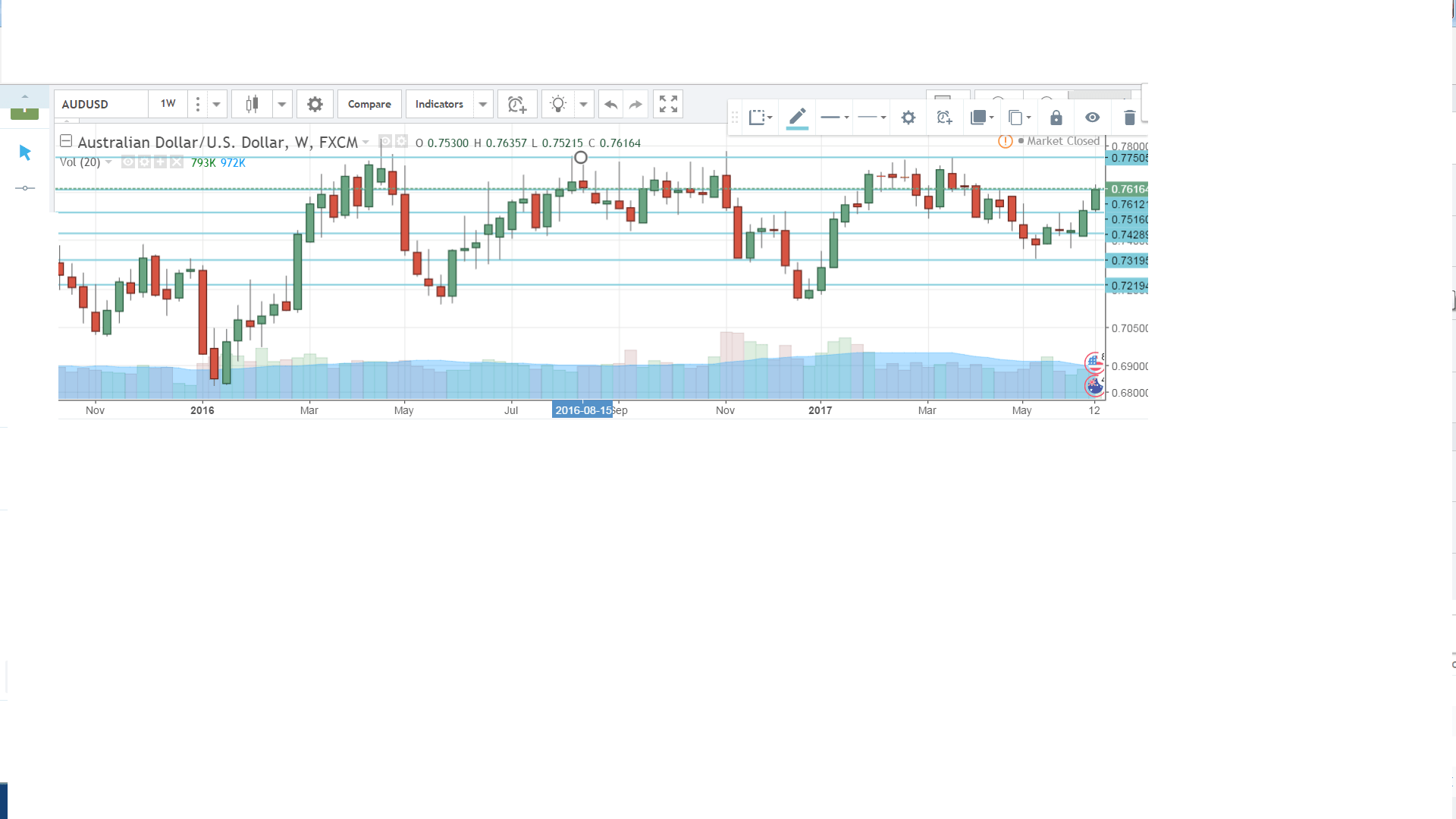

AUD/USD Technical Analysis

AUD/USD opened the week at 0.7530 and dropped to a low of 0.7521. The pair then reversed directions and climbed to a high of 0.7636, breaking above resistance at 0.7605 (discussed last week). The pair closed the week at 0.7616.

Technical lines from top to bottom:

We start with resistance at 0.8075.

0.7938 is the next line of resistance.

0.7835 was the high point in April 2016.

0.7749 was a cap in March.

0.7605 is a weak support line.

0.7513 is the next support line.

0.7429 is the next support line. It switched from resistance when AUD/USD rallied in the first week of June.

0.7319 was the low point in May.

0.7223 has held since January. It is the final support line for now.

I am neutral on AUD/USD

The Fed is more hawkish than expected and the markets are looking at another rate hike in the second half of 2017, but probably not until December. The Australian economy is showing strength, boosted by improved global demand.

Our latest podcast is titled Fed faking it until they make it? + a Brexit brawl

Follow us on Sticher or iTunes

Safe trading!

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Canadian dollar (loonie), check out the Canadian dollar forecast.

- For the kiwi, see the NZD/USD forecast.