AUD/USD reversed directions last week and posted slight losses. The pair closed at 0.7559. There are just three events this week. Here is an outlook on the major market-movers and an updated technical analysis for AUD/USD.

In the US, some policymakers reiterated the hawkish bend of the recent rate decision, although other members expressed concern about low inflation levels. Down under, the RBA sounded upbeat about the economy but said that it had no plans to alter interest rate policy.

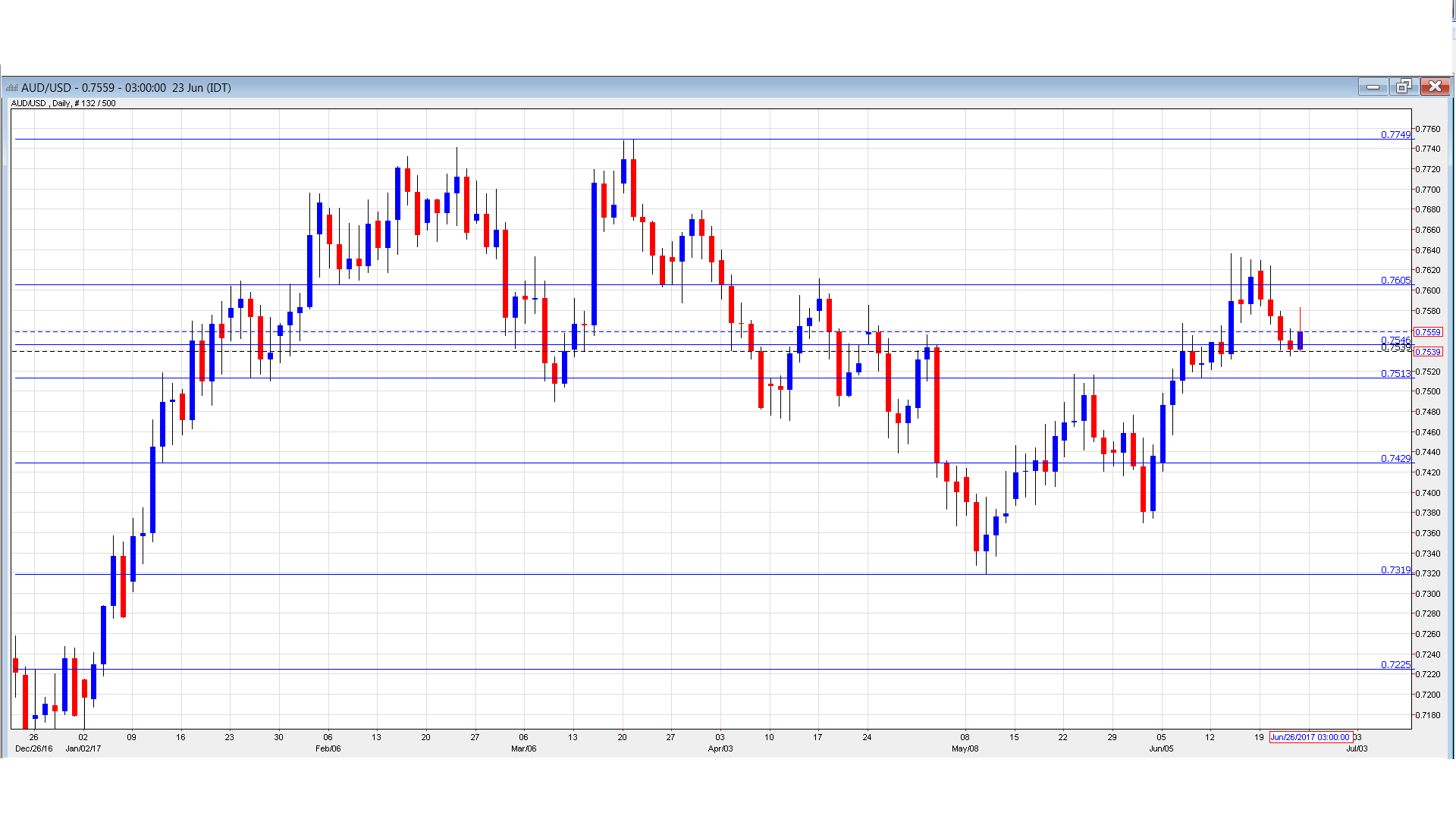

[do action=”autoupdate” tag=”AUDUSDUpdate”/]AUD/USD daily graph with support and resistance lines on it. Click to enlarge:

- RBA Assistant Governor Guy Debelle Speaks: Tuesday, 8:30. Debelle will speak at an event in Singapore. A speech that is more hawkish than expected is bullish for the Australian dollar.

- HIA New Home Sales: Thursday, 1:00. This indicator provides a snapshot of the level of activity in the housing sector. The indicator rebounded in April with a gain of 0.8%. Will we see another gain in the May report?

- Private Sector Credit: Friday, 1:30. Borrowing levels are carefully monitored, as higher borrowing usually translates into stronger spending. The indicator improved to 0.4%, matching the forecast. The estimate for the upcoming remains at 0.4%.

AUD/USD Technical Analysis

AUD/USD opened the week at 0.7619 and touched a high of 0.7629. The pair then reversed directions and dropped to a low of 0.7535 late in the week, breaking resistance at 0.7513 (discussed last week). The pair closed the week at 0.7559.

Technical lines from top to bottom:

We begin with resistance at 0.8075.

0.7938 is the next line of resistance.

0.7835 was the high point in April 2016.

0.7749 was a cap in March.

0.7605 is the next resistance line.

0.7513 has switched to resistance line following gains by AUD/USD last week.

0.7429 is the next support line. It switched from resistance when AUD/USD rallied in the first week of June.

0.7319 was the low point in May.

0.7223 has held since January. It is the final support line for now.

I am bullish on AUD/USD

The hawkishness of the Fed has been a bit of a surprise, but this sentiment is already priced in. A stronger global economy has boosted Australia’s export sector, which could boost the Australian dollar.

Our latest podcast is titled Fed faking it until they make it? + a Brexit brawl

Follow us on Sticher or iTunes

Safe trading!

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Canadian dollar (loonie), check out the Canadian dollar forecast.

- For the kiwi, see the NZD/USD forecast.