AUD/USD had a quiet week, closing almost unchanged at 0.7118. The upcoming week is busy, with 14 events on the schedule. Here is an outlook on the major market-movers and an updated technical analysis for AUD/USD.

The US had a mixed week, as employment and housing reports missed expectations, but there was positive news from the manufacturing sector, as durable goods sparkled. In Australia, Private Capital Expenditure broke a nasty streak of declines, posting a gain of 0.8%.

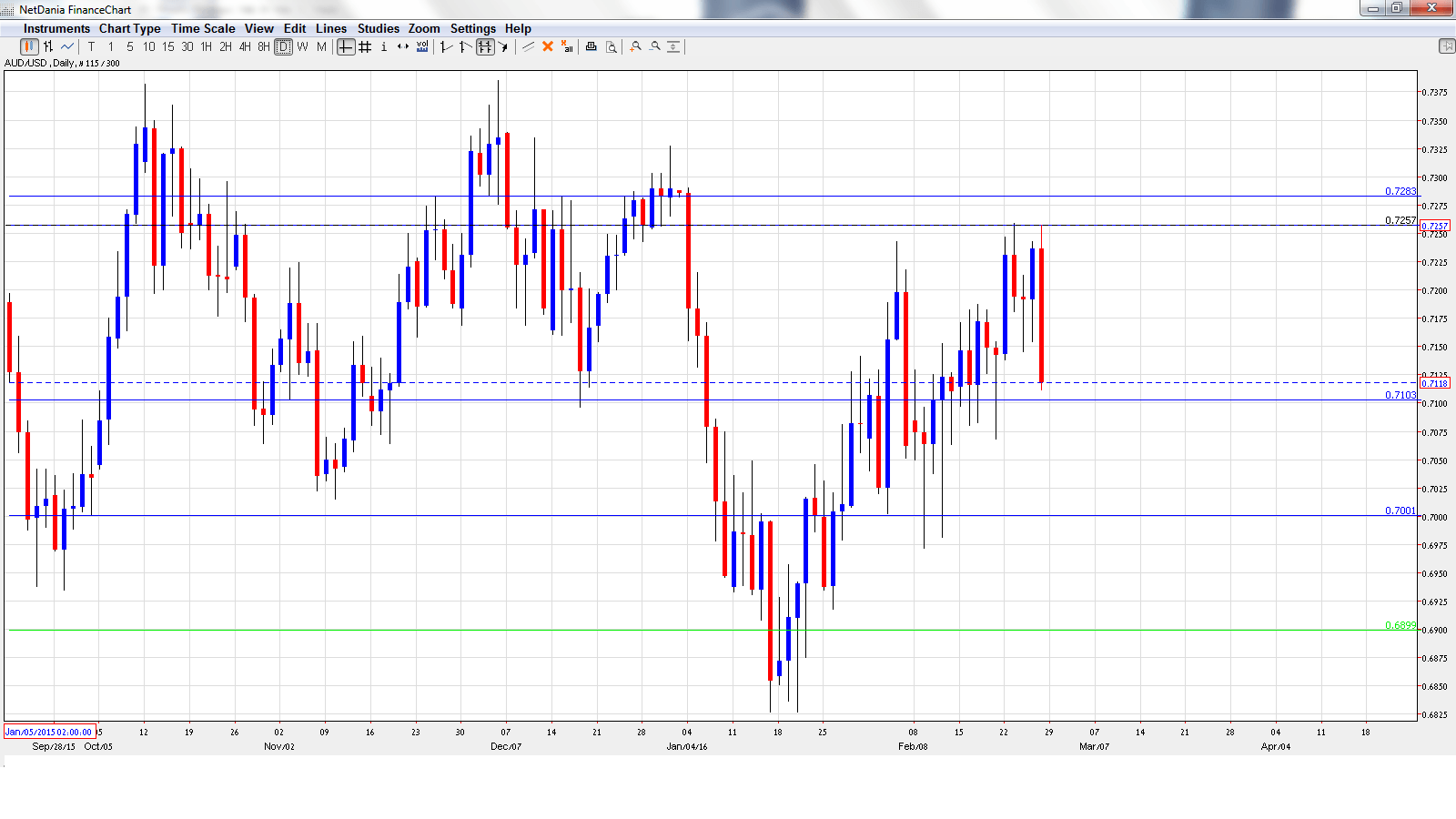

[do action=”autoupdate” tag=”AUDUSDUpdate”/]AUD/USD graph with support and resistance lines on it. Click to enlarge:

- MI Inflation Gauge: Monday, 00:00. This indicator helps analysts track CPI, which is released on a quarterly basis. The indicator improved to 0.4% in January, its strongest gain in 10 months.

- Company Operating Profits: Monday, 00:30. This event is an important gauge of the strength of the business sector. The indicator bounced back in Q3 with a gain of 1.3%, within expectations. The markets are bracing for a sharp drop in the fourth quarter, with an estimate of -1.7%

- AIG Manufacturing Index: Monday, 22:30. The index continues to churn out readings slightly above the 50-point level, which is indicative of slight expansion in the manufacturing sector. The January release came in at 51.5 points.

- Building Approvals: Tuesday, 00:30. Building Approvals is the first key event of the week. The indicator tends to show strong movement from week to week, and rebounded in December with an excellent gain of 9.2%, well above the forecast of 4.8%. The markets are bracing for a downturn in the January release, with an estimate of -2.9%.

- Current Account: Tuesday, 00:30. The current account deficit narrowed in Q3 to A$18.1 billion, but this was well above the estimate of A$16.6 billion. A larger deficit is expected in Q4, with the estimate standing at $A19.8 billion.

- Chinese Manufacturing PMI: Tuesday, 1:00. Key Chinese indicators can have a strong impact on the Aussie, as the Asian giant is China’s number one trading partner. The PMI continues to hover just below the 50-point level, indicative of slight contraction. No change is expected in the February reading, with an estimate of 49.4 points.

- Chinese Caixin Manufacturing PMI: Tuesday, 1:45. This indicator is also pointing to contraction in the manufacturing sector. The index came in at 48.4 points in January, and an identical reading is forecast for the February report.

- Cash Rate: Tuesday, 3:30. Despite weak inflation levels and an easing bias by the RBA, no change is expected in the upcoming rate statement. Currently, the benchmark rate stands at an even 2.00%.

- Commodity Prices: Tuesday, 5:30. The indicator continues to slide, a result of weak global demand for Australian exports. The January reading was dismal, with a reading of -25.8%.

- HIA New Home Sales: Wednesday, 00:00. This indicator provides a snapshot of the health of the housing industry as well as the strength of consumer spending. The indicator rebounded nicely in January, posting a gain of 6.0%.

- GDP: Wednesday, 00:30. GDP posted a respectable gain of 0.9% in Q3, beating the forecast of 0.7%. The markets are anticipating a softer fourth quarter, with an estimate of 0.5%.

- AIG Services Index: Wednesday, 22:30. The index has posted four straight readings below the 50-point level, pointing to ongoing contraction in the services sector. Will we see a stronger reading in the February report?

- Trade Balance: Thursday, 00:30. Australia’s trade deficit widened in December to A$3.54 billion, worse than the estimate of A$2.45 billion. A larger deficit is expected in the January release, with an estimate of A$3.22 billion.

- Retail Sales: Friday, 00:30. The week wraps up with Retail Sales, the primary gauge of consumer spending. In December, the indicator dropped to 0.0%, short of the estimate of 0.5%. The markets are expecting a stronger January, with a forecast of 0.4%.

* All times are GMT

AUD/USD Technical Analysis

AUD/USD opened the week at 0.7143 and climbed to a high of 0.7259. The pair posted sharp losses late in the week, dropping to a low of 0.7112, as support held firm at 0.7100 (discussed last week). AUD/USD closed the week at 0.7118.

Live chart of AUD/USD: [do action=”tradingviews” pair=”AUDUSD” interval=”60″/]

Technical lines from top to bottom:

We begin with resistance at 0.7533.

0.7440 capped the pair in August.

0.7284 is next.

0.7100 remains a weak resistance line. It could see further action early in the week.

The round number of 0.70 worked as a cushion in August.

0.6899 has provided support since September.

0.6775 is the next support level.

0.6686 was an important cap back in January 2000. It is the final support level for now.

I am bearish on AUD/USD

The global slowdown continues to affect the Australian economy, which is heavily dependent on international trade, particularly with China. The RBA has hinted that it is ready to lower rates if needed, so monetary divergence favors the US dollar. In the US, recent figures have shown improvement, so the economy may be back on track after a lukewarm start to 2016.

Our latest podcast is titled Time for Regrets? Referendum and Rates version

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Canadian dollar (loonie), check out the Canadian dollar forecast.

- For the kiwi, see the NZD/USD forecast