AUD/USD posted losses for a third straight week, losing about 100 points last week. The pair closed at 0.7267. There are five events on the schedule this week. Here is an outlook on the major market-movers and an updated technical analysis for AUD/USD.

In the US, key numbers were mostly positive last week. Retail Sales beat expectations and consumer confidence numbers surged higher. There were no major Australian releases last week, but Chinese Industrial Production missed expectations.

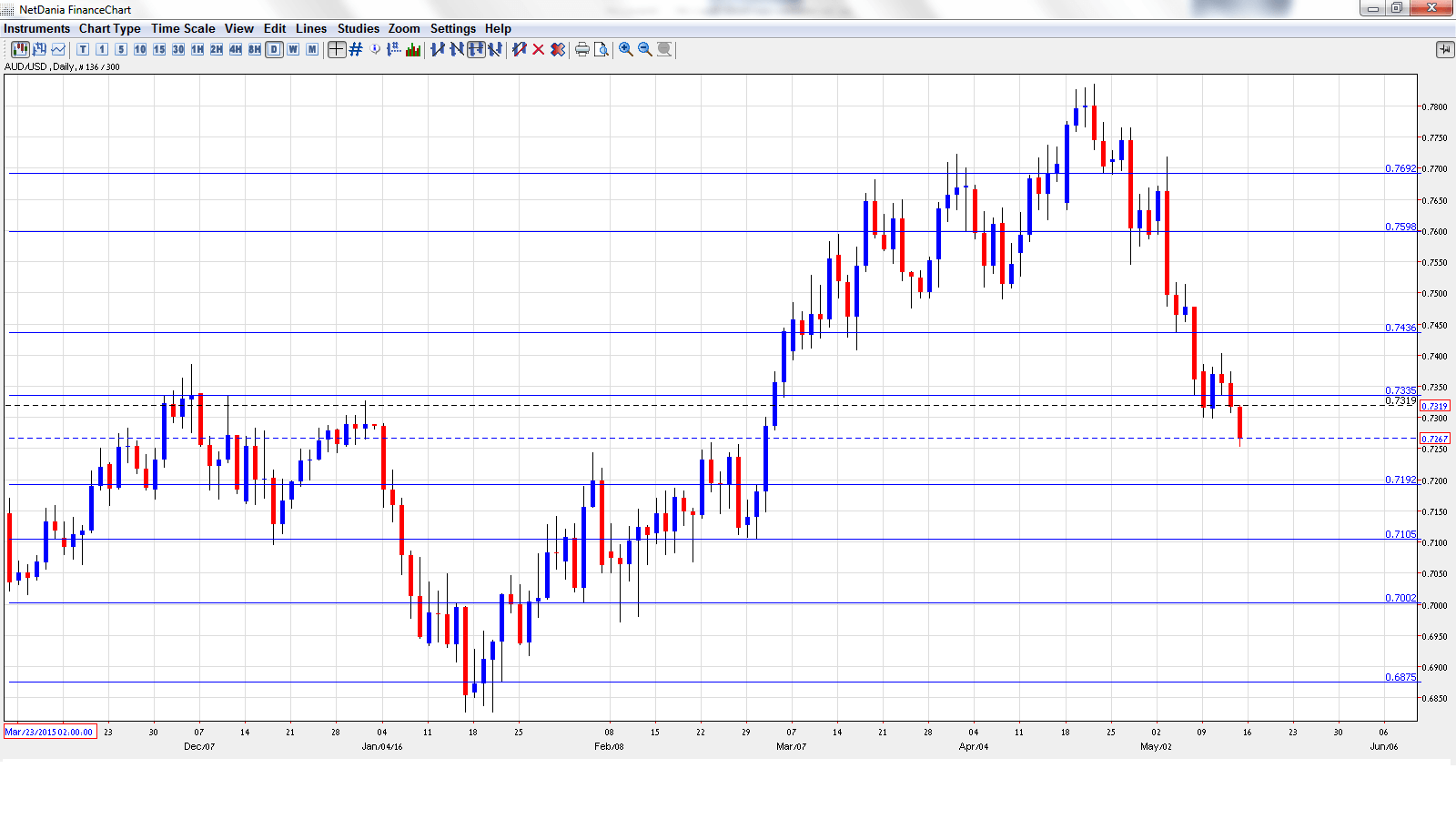

[do action=”autoupdate” tag=”AUDUSDUpdate”/]AUD/USD graph with support and resistance lines on it. Click to enlarge:

- RBA Monetary Policy Meeting Minutes: Tuesday, 1:30. The markets will be combing through the minutes, following the RBA’s surprise cut of a quarter point, lowering rates from 2.00% to1.75%. Dovish minutes could send the Aussie to lower levels.

- MI Leading Index: Wednesday, 00:30. The index hasn’t posted a gain in 2016, pointing to weakness in the Australian economy. Will we see an upturn in the April return?

- RBA Assistant Governor Guy Debelle Speaks: Wednesday, 1:00. Debelle will speak at a conference in Beijing, China. A speech which is more hawkish than expected is bullish for the Australian dollar.

- Wage Price Index: Wednesday, 1:30. Wage growth has been steady and came in at 0.5% Q1, within expectations. The estimate for Q2 stands at 0.5%.

- Employment Change: Thursday, 1:30. Employment Change is the most important employment indicator, and an unexpected reading can have a sharp impact on the movement of AUD/USD. The indicator posted a sharp gain of 26.1 thousand in March, beating the estimate of 18.6 thousand. The estimate for the April report stands at 12.3 thousand. The unemployment rate is expected to edge higher, from the current 5.7% to 5.8%.

* All times are GMT

AUD/USD Technical Analysis

AUD/USD opened the week at 0.7373. The pair touched a high of 0.7402, as resistance held at 0.7438 (discussed last week). AUD/USD then changed directions and dropped to a low of 0.7254. AUD/USD closed the week at 0.7267.

Live chart of AUD/USD: [do action=”tradingviews” pair=”AUDUSD” interval=”60″/]

Technical lines from top to bottom:

0.7692 has held firm has resistance since early May, when AUD/USD began a sharp downward trend.

0.7597 is the next line of resistance.

0.7438 held firm as AUD/USD moved higher before retracting.

0.7334 was a cap December 2015. It is an immediate support line.

0.7192 is the next support level.

0.7105 has been a cushion since the end of February.

0.7002 is providing support just above the psychologically important level of 0.7000.

0.6875 is the final support level for now.

I am bearish on AUD/USD

The RBA lowered rates earlier in May and could make another cut in August, after the Australian election. With the Federal Reserve contemplating a rate hike in June, the recent Aussie slide could continue.

In our latest podcast we examine the upbeat US consumer and oil prices

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Canadian dollar (loonie), check out the Canadian dollar forecast.

- For the kiwi, see the NZD/USD forecast