AUD/USD reversed directions last week, losing 120 points. The pair closed the week just below the 0.76 line. The upcoming week is busy, with 15 events. Here is an outlook on the major market-movers and an updated technical analysis for AUD/USD.

As expected, the Federal Reserve remained on the sidelines and did not raise interest rates. US Advance GDP came in at 0.5%, short of the estimate. Australian CPI was unexpectedly soft, posting a decline of 0.2%.

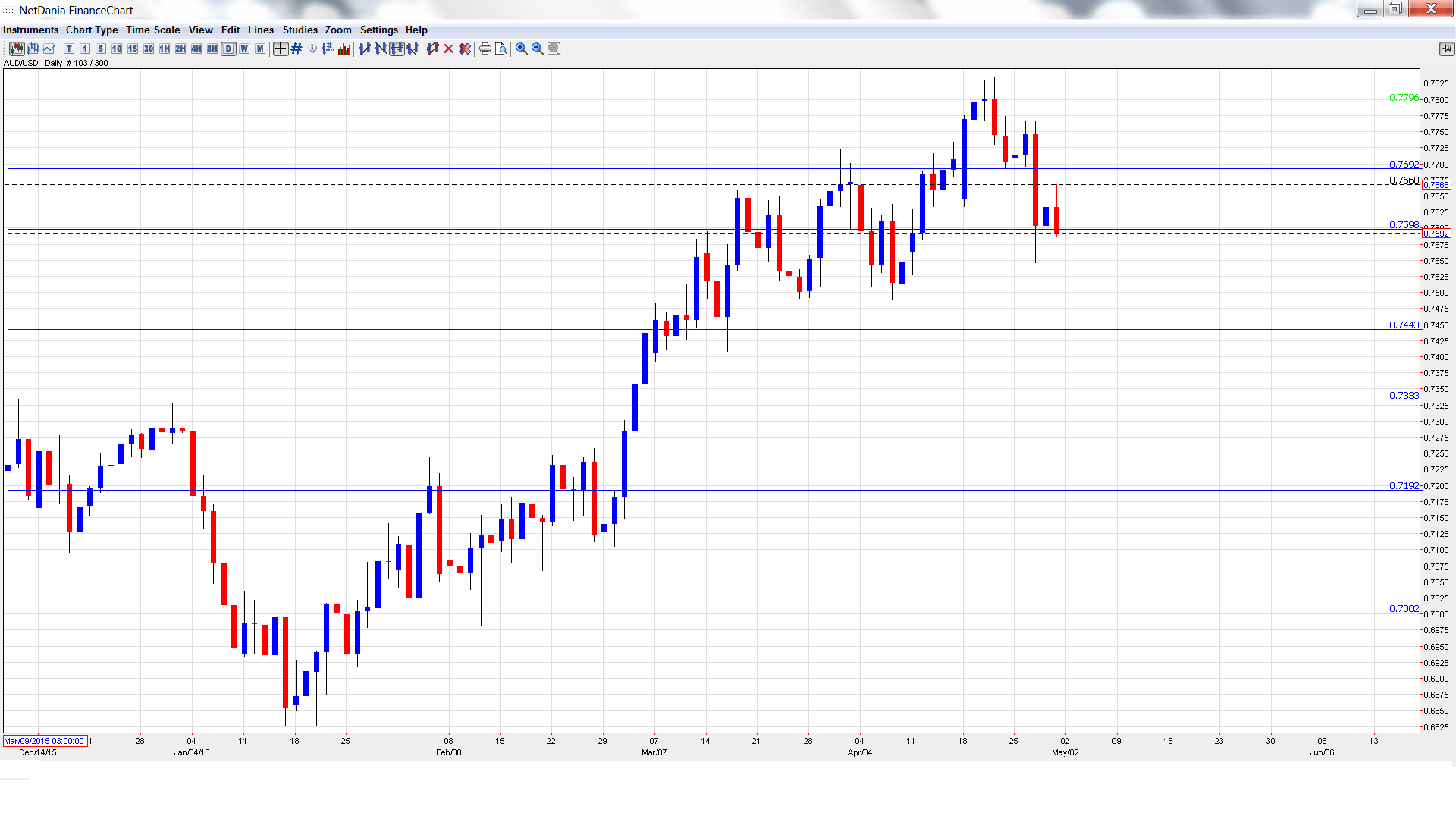

[do action=”autoupdate” tag=”AUDUSDUpdate”/]AUD/USD graph with support and resistance lines on it. Click to enlarge:

- Chinese Manufacturing PMI: Sunday, 1:00. Chinese key indicators can have a strong impact on the Australian dollar, as China is Australia’s largest trade market. The index came in at 50.1 in April, very close to the 50-line which separates contraction from expansion.

- AIG Manufacturing Index: Sunday, 23:30. The index climbed to 58.1 points in March, pointing to strong growth. Will the upswing continue in April?

- MI Inflation Gauge: Monday, 1:00. This monthly indicator helps analysts track CPI, which is released every quarter. The indicator improved to 0.0%, indicative of weak inflation levels in Australia.

- NAB Business Confidence: Monday, 1:30. Business Confidence improved to 6 points in March, marking a 9-month high. This points to improving conditions in the business sector.

- Commodity Prices: Monday, 6:30. Commodity prices continue to struggle, as weak global conditions have meant less demand for Australian exports. A decline of 15.4% was recorded in March, and the downward trend is expected to continue.

- Building Approvals: Tuesday, 1:30. Building Approvals continues to alternate between gains and losses. In February, the indicator bounced back with a gain of 3.1%, beating the forecast of 2.1%. The markets are expecting a reading of -1.8% for the March report.

- Chinese Caixin Manufacturing PMI: Tuesday, 1:45. The index has not posted a reading above 50 in over a year, pointing to ongoing contraction in the Chinese manufacturing sector. The indicator improved to 49.7 points in March, and little change is expected in the April release.

- Cash Rate: Tuesday, 4:30. The RBA has maintained the benchmark rate at 2.00% since April 2015, but a weak CPI release for Q1 means that a 0.25% cut is a possibility. Such a move would likely weaken the Aussie.

- Annual Budget Release: Tuesday, 9:30. The budget will detail the government’s projected spending and revenues, as well as borrowing levels. The budget should be treated as a market-mover, as any unexpected announcements could have a strong impact on USD/CAD.

- AIG Services Index: Tuesday, 23:30. The index has posted only one reading above 50 this year, indicative of contraction in the services sector. The March reading dipped to 49.5 points.

- HIA New Home Sales: Thursday, 1:00. This indicator provides a snapshot of the strength of the housing industry. In February, the indicator posted a sharp decline of 5.3%.

- Retail Sales: Thursday, 1:30. Retail Sales is the primary gauge of consumer spending, a key engine of economic growth. The indicator dipped to a flat 0.0% in February, shy of the forecast of 0.4%. The markets are expecting an improvement in March, with the estimate standing at 0.3%.

- Trade Balance: Thursday, 1:30. Australia’s trade deficit widened to A$3.41 billion in February, much higher than the estimate of A$2.55 billion. The deficit is expected to narrow to $A2.95 billion in March.

- AIG Construction Index: Thursday, 1:30. The indicator continues to lose ground and remains in contraction territory. In March, the index dipped to 45.2 points.

- RBA Monetary Policy Statement: Friday, 1:30. This quarterly statement details the RBA’s view of economic conditions and inflation, and analysts will be combing through the release, looking for hints as to the RBA’s future monetary policy.

* All times are GMT

AUD/USD Technical Analysis

AUD/USD opened the week at 0.7709. The pair touched a high of 0.7765, as support held firm at 0.7798 (discussed last week). The pair then reversed directions and dropped to 0.7546. AUD/USD closed the week at 0.7592.

Live chart of AUD/USD: [do action=”tradingviews” pair=”AUDUSD” interval=”60″/]

Technical lines from top to bottom:

0.8025 has held firm in resistance since May 2015.

0.7886 is next.

0.7798 was an important resistance line for much of June 2015.

0.7692 remains busy and has switched to a resistance role following strong losses by AUD/USD.

0.7597 is a weak resistance line and could see further action early in the week.

0.7438 is providing support.

0.7334 was a cap December 2015.

0.7192 is the next support line.

0.7002 is the final support level for now.

I am bearish on AUD/USD

With the Fed statement out of the way, the markets can focus on US fundamentals, which have been solid for the most part. The weak Australian CPI has increased speculation about a rate cut by the RBA, which would push the Aussie to lower ground.

In our latest podcast we ask: is China out of the woods?

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Canadian dollar (loonie), check out the Canadian dollar forecast.

- For the kiwi, see the NZD/USD forecast