AUD/USD lost ground for a fourth straight week, posting modest losses. The pair closed at 0.7219. This week’s highlight is Private Capital Expenditure. Here is an outlook on the major market-movers and an updated technical analysis for AUD/USD.

The Fed meeting minutes were surprisingly hawkish, putting a June rate hike firmly on the table. US unemployment numbers were within expectations and housing numbers beat the estimate. In Australia, the RBA minutes hinted at another rate cut, and employment numbers fell short of expectations.

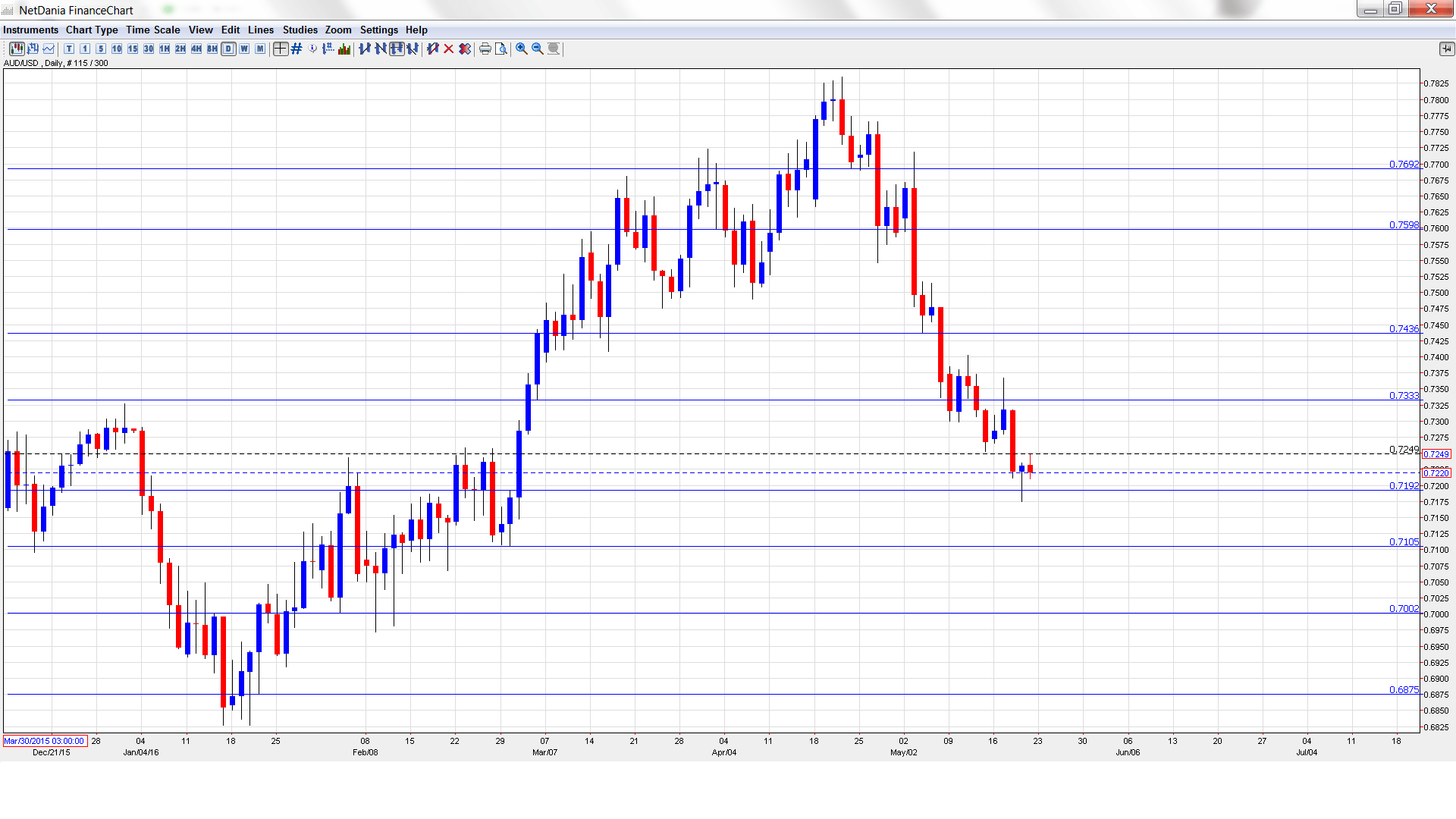

[do action=”autoupdate” tag=”AUDUSDUpdate”/]AUD/USD graph with support and resistance lines on it. Click to enlarge:

- CB Leading Index: Monday, 14:30. This minor indicator continues to struggle, having failed to post a gain since last August. The indicator posted a weak reading of -0.3% in February.

- RBA Governor Glenn Stevens Speaks: Tuesday, 3:05. Stevens will deliver remarks at an event in Sydney. Any clues regarding the timing of a rate cut could lead to volatility from AUD/USD.

- Construction Work Done: Wednesday, 1:30. The indicator is pointing to weakness in the construction sector, posting sharp declines of 3.6% in the past two quarters. This was well below the estimate on both occasions. Another decline is expected in the Q1 report, with an estimate of -1.4%.

- Private Capital Expenditure: Thursday, 1:30. This is the key event of the week. The indicator posted a gain of 0.8% in the fourth quarter, breaking a nasty streak of four straight declines. The downward trend is expected to continue in Q1, with a forecast of -3.2%.

- RBA Assistant Governor Guy Debelle Speaks: Thursday, 13:00. Debelle will speak at the Foreign Exchange Market in New York. A speech that is more hawkish than expected is bullish for the Australian dollar.

- RBA Assistant Governor Glenn Guy Debelle: Thursday, 22:30. Debelle will participate on a panel at the Financial Markets Association in New York. The markets will be listening closely for hints regarding the RBA’s future monetary policy.

* All times are GMT

AUD/USD Technical Analysis

AUD/USD opened the week at 0.7272. The pair touched a high of 0.7367, testing resistance at 0.7334 (discussed last week). AUD/USD then changed directions and dropped to a low of 0.7175. AUD/USD closed the week at 0.7219.

Live chart of AUD/USD: [do action=”tradingviews” pair=”AUDUSD” interval=”60″/]

Technical lines from top to bottom:

0.7692 has held firm in resistance since early May, when AUD/USD began a sharp downward trend.

0.7597 is the next line of resistance.

0.7438 has held firm since early May.

0.7334 was a cap in December 2015. It has switched to a resistance role.

0.7192 is a weak support level.

0.7105 has been a cushion since the end of February.

0.7002 is providing support just above the psychologically important level of 0.7000.

0.6875 is the final support level for now.

I am bearish on AUD/USD

The RBA has put the markets on notice that a rate cut is on the table, perhaps as early as August. With the Fed contemplating a June hike, monetary divergence will continue to weigh on the Australian dollar.

In our latest podcast we examine the road to a June hike (or not)

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Canadian dollar (loonie), check out the Canadian dollar forecast.

- For the kiwi, see the NZD/USD forecast