AUD/USD was unchanged last week, closing at 0.7439. This week’s key events are Private Capital Expenditures and Retail Sales. Here is an outlook on the major market-movers and an updated technical analysis for AUD/USD.

There were no major events out of Australia last week. Over in the US, the Fed rate statement was more dovish than expected, which weighed on the US dollar. The US economy is performing well, and the revised GDP report posted a respectable gain of 1.2%, beating the estimate.

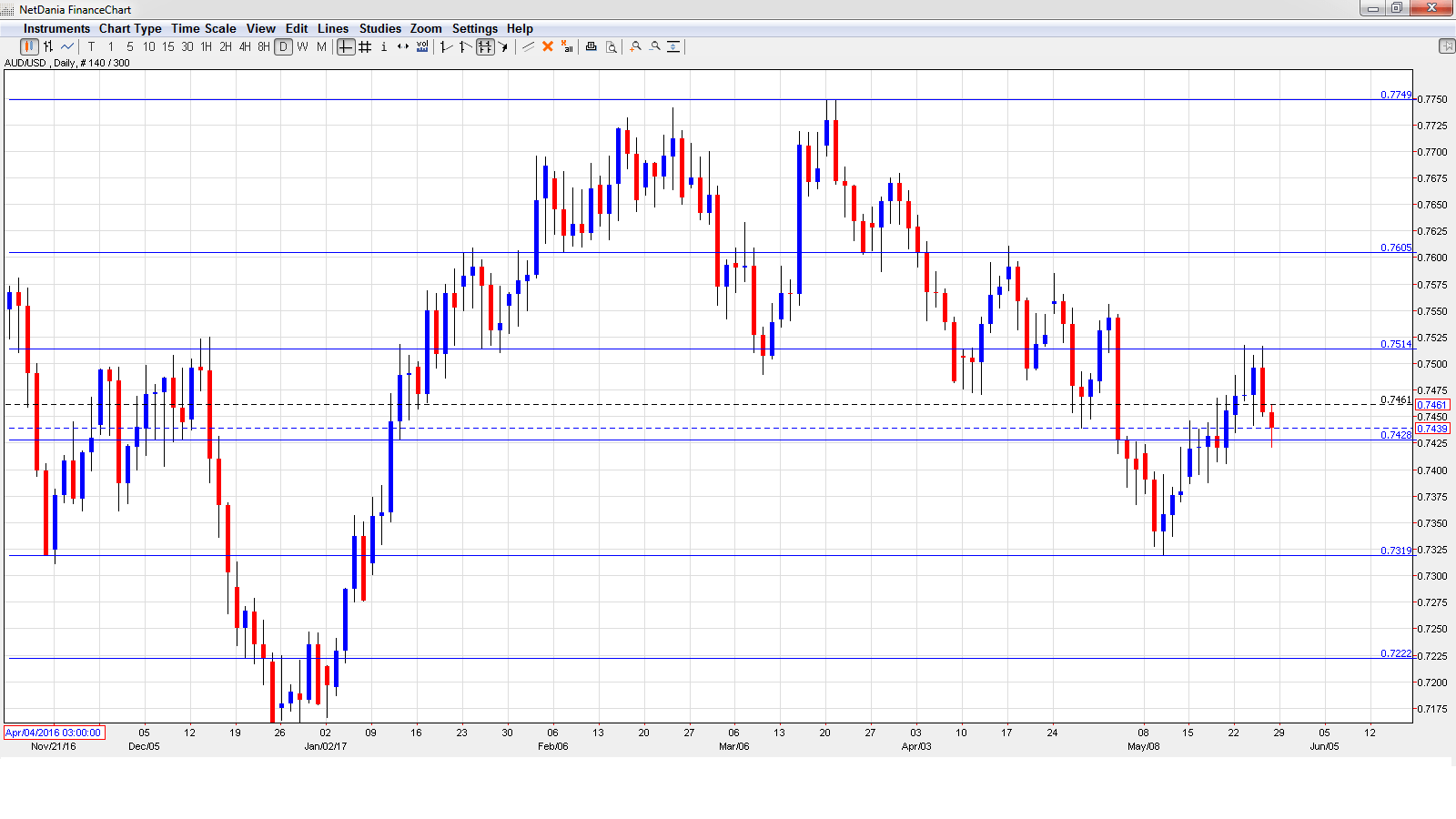

[do action=”autoupdate” tag=”AUDUSDUpdate”/]AUD/USD daily graph with support and resistance lines on it. Click to enlarge:

- Building Approvals: Tuesday, 1:30. This indicator tends to fluctuate considerably, making accurate predictions a tricky task. In March, the indicator plunged 13.4%, a much sharper decline than the estimate of -3.9%. The markets are expecting a strong rebound in the April report, with a forecast of +3.2%.

- Private Sector Credit: Wednesday, 1:30. Borrowing levels are closely followed, since they are linked to spending. The indicator has posted two straight gains of 0.3%, both times missing the estimate of 0.5%. The estimate for the upcoming release is 0.4%.

- AIG Manufacturing Index: Wednesday, 23:30. The Australian manufacturing sector continues to point to strong expansion, and improved to 59.2 in March.

- Private Capital Expenditure: Thursday, 1:30. The indicator has posted four straight quarters of declines, missing the estimate on each occasion. The indicator is expected to improve in Q1, with an estimate of 0.3%.

- Retail Sales: Thursday, 1:30. Retail Sales is the primary gauge of consumer spending, and should be treated as a market-mover. The indicator has struggled, posting three declines in four estimates. The markets are expecting better news in the March report, with a gain of 0.3%.

- Commodity Sales: Thursday, 6:30. Global demand is up, and this means more demand for Australian commodities. In March, the indicator dipped to 38.6%.

- HIA New Home Sales: Friday, 1:00. This indicator provides a snapshot of the strength of the housing market. The indicator has not posted a gain above 0.2% this year. Will we see an improvement in the April report?

AUD/USD Technical Analysis

AUD/USD opened the week at 0.7451 and climbed to a high of 0.7517, testing resistance at 0.7513 (discussed last week). The pair then reversed directions and dropped to a low of 0.7421.The pair closed the week at 0.7439.

Technical lines from top to bottom

0.7835 was the high point in April 2016.

0.7749 was a cap in March.

0.7605 is next.

0.7513 was tested last week as AUD/USD moved higher before retracting.

0.7429 is an immediate support line.

0.7319 remains the low point in May.

0.7223 is the next support line.

0.7105 has held since March 2016.

0.6998 is the final support level for now.

I am neutral on AUD/USD

There is a strong likelihood of a June rate hike, but it is by no means a done deal, unlike the March move. The Fed’s cautious stance has taken some wind out the sails of the US dollar, and the Aussie could continue to hold its own against the greenback.

Our latest podcast is titled Poking holes in the FOMC and OPEC

Follow us on Sticher or iTunes

Safe trading!

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Canadian dollar (loonie), check out the Canadian dollar forecast.

- For the kiwi, see the NZD/USD forecast.