Australia’s Consumer Price Index rose by 1.4% in Q3, significantly stronger than a rise of 0.9% that was expected, almost three times the 0.5% rise in Q2. Australia releases official inflation data only once per quarter, making it more important. In addition, the first release of the HSBC Manufacturing PMI for China improved significantly from 47.9 in August to 49.1 points in September, showing that the slowdown in Australia’s main trade partner is not so strong.

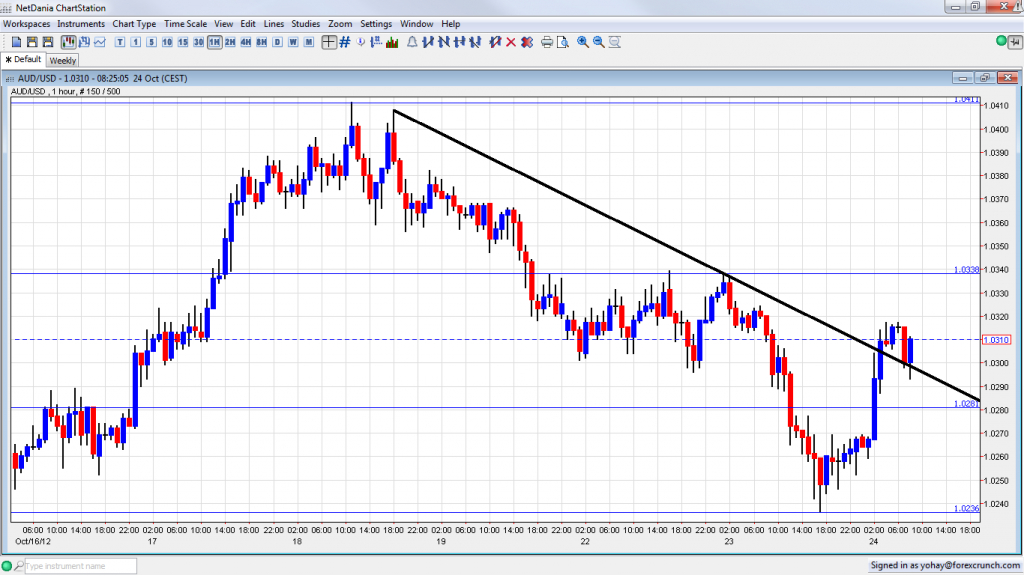

AUD/USD recovered earlier losses on the news, and is now better positioned in the wide trading range. Note the break above downtrend resistance.

The strong rise in CPI lowers the chances of a rate cut by the RBA in its next meeting, scheduled for November 6th. The Reserve Bank of Australia already cut the rates to 3.25% and further cuts were predicted by analysts.

Also the Trimmed Mean CPI (Core CPI in other countries) exceeded expectations with a rise of 0.7%, better than 0.6% that was expected. Annual inflation is at around 2.5%, certainly not too low.

According to the HSBC figure, the all-important Chinese manufacturing sector is still contracting, but at a slower rate. 49.1 points is already quite close to the 50 mark that separates contraction from growth. One worrying note in the report is that employment is contracting at a faster rate. China recently reported an annual growth rate of 7.4% in Q3.

AUD/USD is now trading above 1.03 once aain, after having plunged lower, as low as 1.0236 beforehand. The pair trades in a very wide range of 1.02 to 1.06.

For more events and technical lines, see the AUD/USD forecast.