The Aussie was down sharply against the US dollar, and is well below parity, testing the 0.97 level. The upcoming week is quite busy in terms of events, with the release of seven indicators. Here is an outlook for the Australian events, and an updated technical analysis for AUD/USD.

Economists are predicting that Australia’s economy will grow by a healthy 3.3 per cent in 2012. This would represent a significant improvement from an estimate of only 1.4% growth for 2011. At the same time, however, commodity currencies such as the Aussie have been among the worst performers against the US dollar in 2011.

Updates: AUD/USD enjoyed hopes for an Italian rescue by the IMF and a general correction rally. The pair opened with a gap higher and got close to parity. The improvement in the mood helped the Aussie rise above parity and approach 1.01 before the struggle around party resumed. AUD/USD enjoyed a strong rally that stopped only around the 1.0314 line before the pair fell back down. The trigger was the decision to cut the dollar swap rate, in order to help banks. In Australia, retail sales were OK but building approvals disappointed with a sharp drop. The Aussie is climbing once again as hopes are high for a positive outcome in the US Non-Farm Payrolls. 1.0314 remains the barrier.

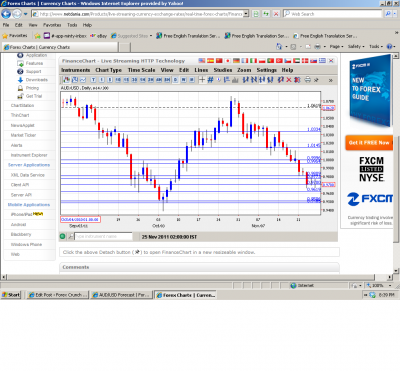

AUD/USD daily graph with support and resistance lines on it. Click to enlarge:

- Private Capital Expenditure: Wednesday, 00:30. This indicator has been on a steady upward swing since February. September’s reading came in at 4.9%, beating the market forecast of 4.1%.

- Private Sector Credit: Wednesday, 00:30. This indicator, which measures consumer borrowing of credit, has been on the rise since dipping into negative teritory in July. October’s reading was 0.5%, easily surpassing the market prediction of 0.2%.

- AIG Manufacturing Index: Wednesday, 22:30. The previous release of the index was 47.4, which was higher than the forecast of 42.3. On the down side, the index has been below 50 since June, which indicates economic contraction.

- Building Approvals: Thursday, 00:30. This construction sector index has been extremely volatile and has analysts and investors scratching their heads as to what to expect next. After an outstanding reading in October of 11.4%, the index crashed to -13.6% in November, well below the prediction of -4.5%.

- Retail Sales: Thursday, 00:30. This indicator has been in positive territory since September, hovering around 0.5%. November’s reading came in at 0.4%, just off the forecast of 0.5%.

- Chinese Manufacturing PMI: Thursday, 1:00. Last month’s Manufacturing PMI in China, Australia’s Number 1 trading partner, remained above 50, although just by a whisker, at 50.4. This was below the forecast of 51.9. A reading above 50 indicates economic expansion, and below 50 is a sign of economic contraction.

- Commodity Prices: Friday, 5:30. This index, an important indicator of Australia’s export sector, measures the change in commodity prices. The index has been steadily dropping in each the last 9 months, from a high in February of 48.7%. November’s reading was only 19.4%.

- Retail Sales: Friday, 8:15. The last three readings of the indicator, have been well below the market forecasts, and the Oct. 31 reading was a weak -0.9%.

*All times are GMT.

AUD/USD Technical Analysis

Aussie/Dollar began the week just shy of parity, at 0.9994. It dropped as low as .9665, before closing the week at the round number of .9700 (discussed last week).

Technical levels from top to bottom:

1.04 was a swing low in June and also the peak of a failed recovery attempt in September. It was also a cap in October, and its position is stronger once again. 1.0335 is a line of strong resistance. 1.0145 served as a strong support in October and November but with the Aussie’s sharp drop, it is now a line of resistance.

The very round number of parity strengthened in September after capping a recovery attempt. It also proved its importance in October. Below parity, 0.9953 is a line of weak resistance.

0.9850, provided support when the Aussie was falling in October and is minor now. Below, .9773 provides further resistance. The round number of 0.97 provided some support for the pair in September, before falling even lower.

0.9622 was a swing low and served as a springing board for a jump higher. 0.9505 is a line of minor support, and .9487 serves as the final line of support for now.

I am bearish on AUD/USD

The weakness in China, Australia’s main trade partner, and the ongoing debt crisis in Europe continue weighing on the Australian dollar.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealand dollar (kiwi), read the NZD forecast.

- For USD/CAD (loonie), check out the Canadian dollar.