Australia reported another excellent jobs report: no less than 42K jobs were gained in May, far better than 9.7K predicted. In addition, the figure for April was revised up from 37.4K originally reported to 46.1K.

Australia’s unemployment rate dropped from 5.7% to 5.5% beating expectations to remain unchanged. The drop in the jobless rate comes against the background of a rise in the participation rate from 64.8% to 64.9%, making it look even better.

The internal data is also positive: 52.1K full-time jobs were gained while 10.1K were lost. All in all, the data looks good no matter how you look at it.

AUD/USD recovers from the FED

The Australian dollar was trading under 0.76 ahead of the publication, hit by the decision of the Federal Reserve. Yellen and co. raised rates, dismissed lower inflation and sounded optimistic on growth.

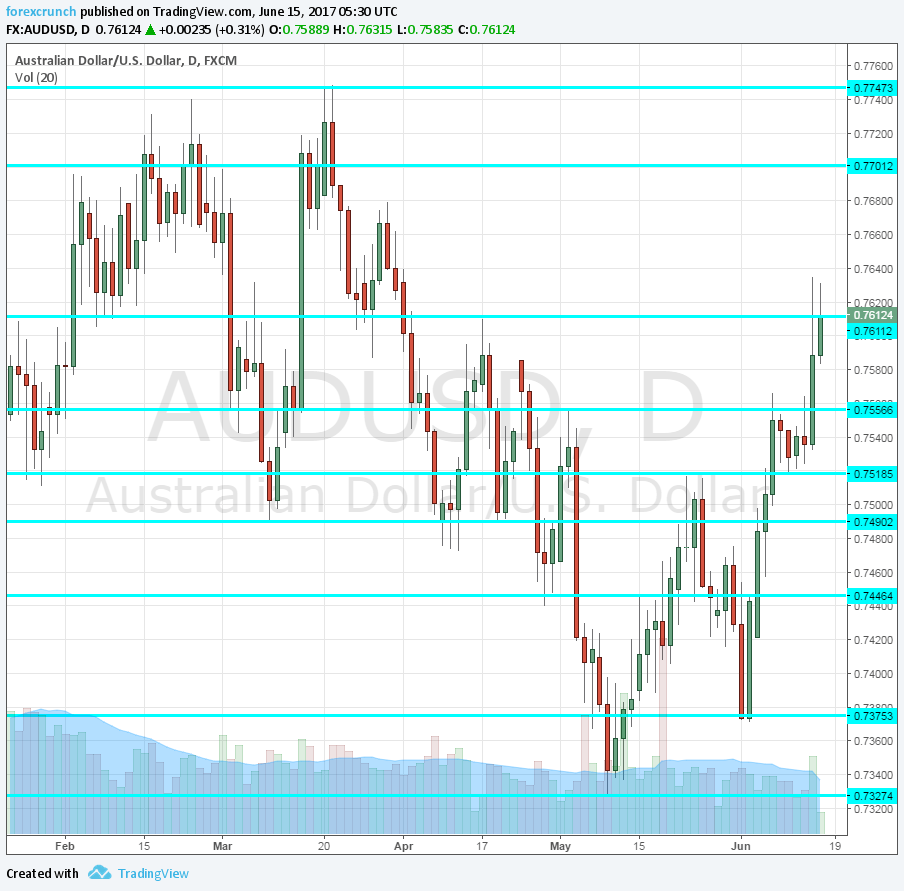

However, the Australian jobs report sent the pair above 0.76 once again, hitting a high of 0.7630.

Resistance is at the 0.7610 level which worked both as a cap and as support to the pair in 2017. A confirmation of the break is still needed.

Further resistance awaits at 0.77, followed by 0.7740 and 0.7840. Support is at 0.7560 and 0.7515.

Here is how it looks on the daily AUD/USD chart: