Technical Bias: Bearish

Key Takeaways

“¢ Australian dollar bulls fight to hold ground against the New Zealand dollar.

“¢ Critical breakout suggests bears are here to stay.

“¢ AUDNZD support seen at 1.0790 and resistance ahead at 1.0860.

The RBNZ ignited a rally in the New Zealand dollar against most of its counterparts including the Australian dollar, as rate hike expectation continues to lead the New Zealand dollar higher.

Technical Analysis

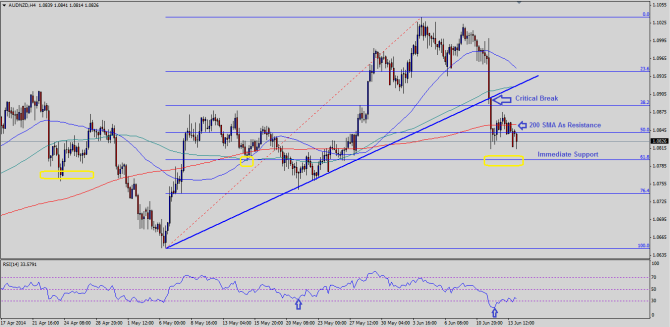

The AUDNZD pair recently broke an important bullish trend line preceding from the 1.0650 lows to trade lower. This break can be seen as critical, as the pair is trading below all major simple moving averages (200, 100 and 50) on the 4 hour timeframe. Currently, the pair is flirting around the 50% Fibonacci retracement level of the last leg higher from the 1.0650 low to the 1.1034 high. If the pair moves lower, then immediate support can be seen around the 61.8% fib level at 1.0790. The mentioned support level is crucial, as it also represents the previous swing area for the pair. So, the chance of buyers appearing around the mentioned support level is quite high. If buyers fail to defend the support area, then a move towards the previous low is possible in the short term.

RSI Divergence

There is a RSI divergence noted on the 4 hour timeframe between the last two swing lows. This suggests that the pair might correct higher from the current levels, but could face the 200 SMA (4H) as a resistance. Any further strength could take the pair towards the broken trend line, which also coincides with the 100 SMA (4H). It would be tough for the Australian dollar buyers to take the AUDNZD pair higher above the 100 SMA (4H), as the market sentiment still favors the New Zealand dollar.

Overall, as long as the broken trend line continues to act as a resistance the chance of a move lower is possible moving ahead.