- EUR: The push to form a government in Italy continues and this will catch the attention of the euro, together with the moves to open banks in Cyprus tomorrow. Business and consumer confidence data will be of secondary interest against this backdrop.

- CAD: Inflation data of interest at 12:30 GMT. Market expects rise from 0.5% to 0.8% on YoY rate, with core rate seen steady at 1%. USDCAD pushed a 1-month low yesterday at 1.0160. Firmer inflation could give some support to this trend.

- USD: Pending home sales data of minor interest. Markets expect -0.3% MoM (4.5% previously). See how to trade this event with USD/JPY.

Idea of the Day

Yesterday was turnaround Tuesday in terms of ‘official speak’ at least, with ECB members and others turning back on the comments from Dijsselbloem with regards to Cyprus being a template for other future bank restructurings.

As well as the confusion caused, the issue is that banks are now going to find it that much harder to attract and retain large depositers in many Eurozone countries. This could also make lending costs for households and businesses higher, further undermining the ECB’s job and making a further cut in rates (or other policy action) from the ECB that bit more likely.

The ripples from Cyprus are spreading far and wide. Also notable was the fact that despite the back-tracking from officials, the single currency remained weighed down by events.

Latest FX News

- EUR: The euro managed a more stable day on Tuesday, but the underling tensions were there and putting downward pressure on the single currency through most of the day. The start of European trading is seeing a softer tone emerge.

- GBP: The downside continues to look less attractive than was the case a couple of weeks ago, but the generally better tone to the dollar means that further gains on cable are looking a stretch at this point in time. Focus on final GDP data today.

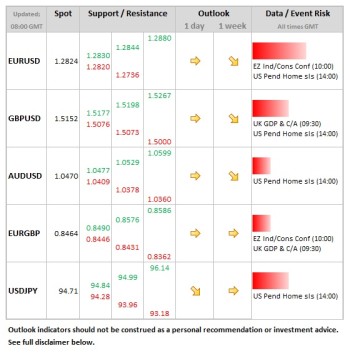

- JPY: The yen continues to want to push lower, but it pushing the limits of what can be achieved on talk alone, so the upmoves on USDJPY are more strained, but note that it remains in larger bull channel, lower bound of which is currently at 94.28.

- AUD: Continues to find underlying support from the view that rates are not likely to move lower from the current 3.00%.