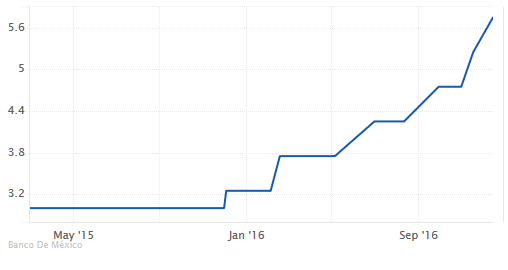

Mexico’s central bank hiked interest rates for the fifth time this year, hiking interest rates by another 50 basis points in another attempt to shore up the peso which has posted strong declines against the U.S. dollar since the November U.S. presidential elections. The rate hike by the Bank of Mexico is being dubbed as being aggressive with some even going as far as calling it as an unofficial battle to support the currency.

After being punched to historic lows, the Mexican peso was seen taking a pause last week on Thursday, rising over 1% after the Bank of Mexico announced a rate hike. Thursday’s decision comes as the nation’s benchmark lending rate now stands at 5.75%. However, by Friday the effects wore off as the Mexican peso resumed its declines in what seemed like a knee-jerk reaction. Economists were expecting to see a 25 bps rate hike. Mexico’s interest rate stands at the highest rate since 2009.

Bank of Mexico Interest Rates – 2016

Since last year, Bank of Mexico has hiked interest rates by 275 basis points, but the real effective exchange rate remains the weakest in over two decades. The steep increase in interest rates amid the Fed’s tightening cycle has also sparked concerns of outflows from the high-yield nations. The Fed for its part has signaled at least three rate hikes in 2017.

Mexico’s central bank governor, Agustin Carstens had previously maintained that he would follow the Fed’s rate hike plans, however, many expect that it would be impossible for emerging economics to withstand higher interest rates amid the Fed’s tighter policies. Thursday’s rate hike was seen by many as a clear signal to the markets.

In the monetary policy statement released by the central bank, the statement said that the expected changes in the fiscal policy and monetary policies in the United States would lead to a stronger appreciation of the U.S. dollar against virtually all currencies including those in the advanced economies. The central bank acknowledged the improvement in the Mexican labor market but noted that wage growth was still low compared to inflation. Most importantly, the central bank said that the current environment facing the national economy was characterized by uncertainty and underlining that various risks remain in the global economy.

Experts remain divided on whether the central bank acted too fast or too late. However, the rate hikes did get support from the fact that November’s inflation figures showed the highest level in two-years registering a 3.3% increase alongside signs of an increase in producer prices. The central bank is targeting 3% inflation with a plus or minus 1 point in 2017. By Friday, the USDMXN closed at 20.446.

Neil Shearing from Capital Economics said that there is more to come and expects to see no slowdown in the pace of the central bank tightening, going by the monetary policy statement that was released by the central bank.

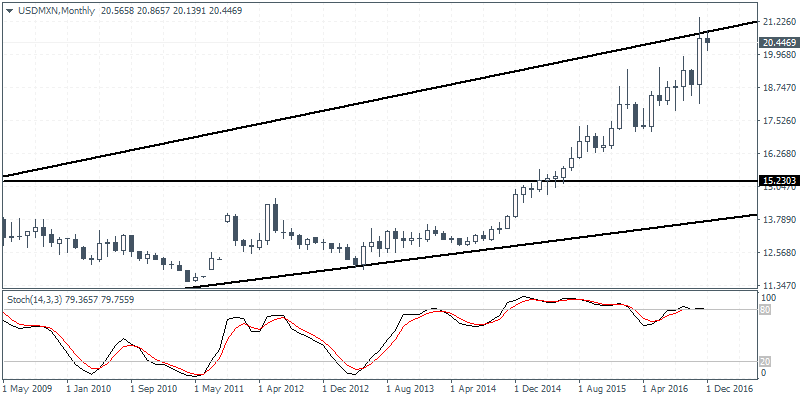

USDMXN – Forecast

The strong gains in the U.S. dollar might have pushed the Mexican peso to historic lows, but the monthly chart shows a potential correction over the coming months. Overall, the price has been trading within a broadening wedge pattern which signals a medium term correction towards 15.230 at the very least. Traders should pay attention to the monthly close in USDMXN which could potentially close out with a doji pattern after November’s strong gains. As long as the previous highs above 21.40 region is not breached, USDMXN could be seen pushing lower which is also validated by the bearish divergence on the monthly chart.

USDMXN Monthly Chart, broadening wedge pattern