- Bitcoin’s impressive rally stalls above $8,700 on the SEC’s rejection of a BTC ETF.

- Bitcoin is strongly supported while a move above $8,600 is likely to give way for gains towards $9,000.

Bitcoin is trading above $8,500 on Thursday after retreating from highs above $8,700. The bullish action from $8,100 support ground to a halt around $8,712. As discussed in the technical analysis published earlier today, the price is consolidating within flag pattern whose breakout is expected to catapult BTC/USD above $9,000.

FXStreet reported that a Bitcoin-exchange traded fund (ETF) proposal by Bitwise exchange has been rejected by the United States Securities and Exchange Commission (SEC). The retreat in Bitcoin price was largely caused by the negative news coupled with the oversold conditions.

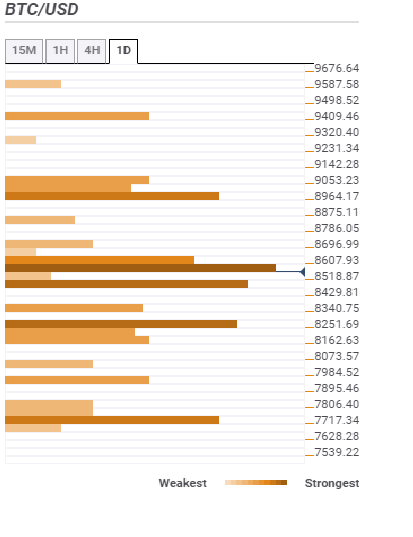

Bitcoin confluence levels

Bitcoin is currently trading above key barriers that have since turned into vital support zones. The initial resistance is at $8,607 and happens to be the most prominent sellers’ congestion zone. A bullish action above this zone could allow movement towards $9,000. However, the buyers will have to clear the hurdle at $8,964 highlighted by38.2% Fibonacci one-month and the pivot point one-week resistance two.

As mentioned, former barriers have turned into vital support areas. The first support is placed at $8,518. Corrections towards $8,000 are likely to be stopped by $8,251. However, in the case of extended declines under $8,000, $7,717 will come in handy.