Euro dollar is falling in range after the relief from Berlusconi’s tentative departure faded away. Market pressure continues, with LCH Clearnet SA raising margins. Will the ECB enhance its bond buying program to stabilize Italy? Bernanke will speak later on today, but the focus is still on Rome.

Here’s a quick update on technicals, fundamentals and what’s going on in the markets.

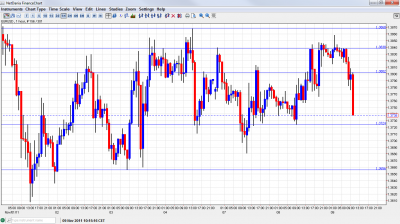

EUR/USD Technicals

- Further levels in both directions: Below 1.3725, 1.3650, 1.36, 1.3550, 1.35, 1.3450, 1.3360, 1.3250.

- Above: 1.38, 1.3838, 1.39, 1.3950, 1.4050, 1.4130, 1.42, 1.4250, 1.4282.

- 1.3650 is the clear bottom of the current range

- Strong resistance remains at 1.3838, which has a strong role, although 1.3868 should be noted/

Euro/Dollar in tight range – click on the graph to enlarge.

EUR/USD Fundamentals

- 14:30 US Federal Reserve Chairman Ben Bernanke speaks.

- 15:00 US Wholesale Inventories. Exp. +0.5%.

- 17:15 US FOMC member Daniel Tarullo speaks.

* All times are GMT.

For more events later in the week, see the Euro to dollar forecast

EUR/USD Sentiment

- Berlusconi’s tentative departure: Silvio Berlusconi announced he would step down after his main coalition partner showed him the door. But, this will happen only after new reforms are passed. Even if Berlusconi goes right now, it is unclear who will replace him and how this will help Italy. With current growth levels, Italy is deep in the mud.

- Higher margins for Italy: LCH Clearnet SA (separate from LCH Clearnet Ltd.) raised deposit requirement on Italian bonds for all maturities. This adds to the pressure. Short term yields are rising and sometimes surpassing long term yields. The benchmark 10 year yield is at around 6.90%. Italy will find it very hard to fund itself, very soon. It seems that only the ECB can save the day. Up to now, bond buying by the central bank has been limited.

- Still awaiting a new Greek government: Also here, the Prime Minster was forced to announce he would quit, but there’s no certainty about a new government and a new premier.

- Geopolitical tension: The IAEA report about Iran triggered more tension, as expected. The talks in Israel about striking Iran and the Iranian threats to retaliate have stepped up. This also helps the dollar and yen against all the rest. Nevertheless, looking deeper into the situation shows that there is little chance of a real escalation. Here are 5 reasons why Israel will not attack Iran.

- Recession coming to Europe: German industrial production and euro-zone retail sales are the latest worrying signs about the state of the European economies. Draghi, the new president of the ECB acknowledged the weak economic situation, said that forecasts will probably be downgraded and spoke about a mild recession. With rising Italian yields, we might see real QE in the euro-zone soon.

- US avoiding recession?: The fresh Non-Farm Payrolls report, with its revisions and the drop in unemployment join other figures and point to no recession in the US.