Dollar/yen changed direction and dropped this time, but well within range.Tertiary Industry Activity and the Tankan surveys are the main market-movers this week. Here’s an outlook for the Japanese events and an updated technical analysis for USD/JPY.

Last week Japan’s core machinery orders dropped more than expected slipping 6.9% in October amid growing concern over the euro zone debt crisis and the strong yen. This bad reading adds to the recent declines in corporate spending indicating a general slowdown. Will Japan succeed to distance itself from the European debt crisis?

Updates: The dollar is gaining ground across the board. For a change, the yen weakens as well, but this is limited, and the pair’s run is small. The pair crossed the 78 line but retreated. The FOMC meeting is awaited and no changes are expected. Any additional easing can weaken USD/JPY. The pair reacted in a calm manner to the Fed decision, which didn’t provide more monetary easing. See how to trade the release of Japan’s Tankan Manufacturing Index. Japanese industrial output was revised to the downside, 2.2%, but the pair remains stable, also in light of the bad Italian auction. A drop in US jobless claims and a good Philly Fed Index pushed the pair a bit higher.

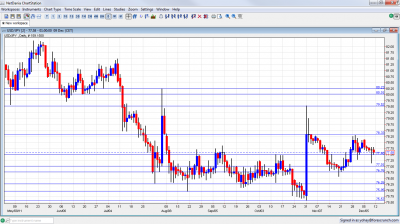

USD/JPY daily chart with support and resistance lines on it. Click to enlarge:

- CGPI : Sunday, 23:50. Japan’s corporate goods price index continued to increase in October for the 13th consecutive month rising 1.7% on a yearly base from +2.5% in September amid global slowdown in demand and the strong yen. An increase of 1.5% is expected.

- Household Confidence: Monday, 5:00.Japan’s consumer confidence remained flat in October at 38.6 amid the strong yen and a global slowdown affecting sentiment. The reading was lower than the 39.3 figure predicted indicating a moderate increase. A small decrease to 38.5 is forecasted.

- Prelim Machine Tool Orders: Monday, 6:00. Total machine tool orders increased by 25.9% in October following 20.1% in the previous month indicating continuing strong growth in the manufacturing sector.

- Tertiary Industry Activity: Monday, 23:50.Japan’s service sector index dropped 0.7% in September more than the 0.4% decline predicted and following a flat reading in the previous month. Industries causing this decline included retail trade, communications, personal services and finance. An increase if 0.5% is expected.

- BOJ Monthly Report: Tuesday, 5:00. The last BOJ report forecasted a moderation in exports and production with a highly uncertain outlook amid slowing global growth and the strong yen. The severe flooding in Thailand could also worsenJapan’s exports. Nevertheless the BOJ is backing its forecast that Japan will resume a moderate recovery but this will be reliant on the export to Asia and a halt of further deterioration of the European debt crisis.

- Revised Industrial Production: Wednesday, 4:30.Japan’s industrial production dropped 3.3% in September after a 4.0% decline in the previous month. The fall was less than the 3.8% predicted. A rise of 2.4% is expected.

- Tankan Manufacturing Index: Wednesday, 23:50. Tankan quarterly survey revealed optimism among large manufacturers reaching2 in the third quarter of 2011, after-9 in the second quarter. The reading was in line with predictions. The non-manufacturers scored below expectations with 1 compared to forecasts for a 2 but this reading is much better than the-5 in the second quarter. The manufacturing index is expected to drop 2 pts., while the non manufacturing index is expected to remain 1 pts.

* All times are GMT

USD/JPY Technical Analysis

Apart from one drop lower, the pair traded in a narrow range, holding above the 77.50 line.

Technical lines from top to bottom

80.25 was a swing low in June and a peak in July. The round figure of 80, which provided strong support, is the next line, and it is of high importance.

79.50, is the next line of resistance. This is the line that was reached after the recent intervention. 78.30 capped a second recovery attempt in November, after the intervention and had an important role earlier as well, working as support.

77.50 is now weaker once again, although it is still of importance after capping fresh attempts to move higher once again during October. It turned into support after the intervention and assumes this role once again. The round number of 77, remains a significant cap for the range trading that characterizes the pair and proved to be stronger now.

76.75 follows closely after providing strong support of late. Further below we have the swing record low of 76.25 which is still of importance after working well as resistance.

A previous low of 75.95 is minor support. The last record low of 75.57 where the BOJ intervened is the final frontier in charted territory for now.

Below, the round number of 75 is the next potential cushion and an area where the Japanese authorities will be keen to intervene.

I am neutral on USD/JPY.

While the US continues showing positive signs, the pair seems to have fallen asleep. In the long run, USD/JPY has room for rises, as Japan saw a trade deficit and and also could see more intervention from the central bank, but for now, even the news in Europe don’t move the pair – these news move other currencies.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealanddollar (kiwi), read the NZD forecast.

- For USD/CAD (loonie), check out the Canadian dollar

- For the Swiss Franc, see the USD/CHF forecast.