The New Zealand dollar seems unstoppable and continued pushing higher.for a fifth week in a row. RBNZ Rate Statement is the major event this week. Here’s an outlook for the events in New Zealand, and an updated technical analysis for NZD/USD

Last week New Zealand business confidence plunged from 25 to 0 in the 4th quarter. The private sector survey revealed that companies are pessimistic regarding future business conditions believing things will be worse in the near future. NZ has slowed down disregarding the EU debt crisis with declines in the retail sector. The EU crisis may further worsen NZ economic condition. Will this slowdown continue?

Updates: The strong kiwi continued higher but topped out at 0.8140 for now. The optimism from Europe is one of the reasons for this push. 0.8110 proved to be tough resistance, and as a disorderly default seems closer for Greece, the pair lost ground and dropped to around 0.8050. Alan Bollard left the interest rate unchanged at 2.5% as expected. The big change came in the US: Ben Bernanke extended the pledge for low rates until late 2014 and sent the dollar sinking. NZD/USD tops 0.82.

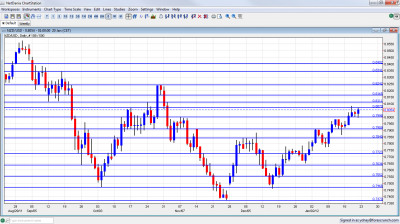

NZD/USD daily chart with support and resistance lines on it. Click to enlarge:

- Credit Card Spending: Wednesday, 2:00. New Zealand credit card spending increased by 3.2% in November, following 7.8% rise in the preceding month. This relatively low increase comes after nice gains during the rugby world cup event.

- WEF Annual Meetings: Wed-Sat. World Economic Forum meetings is held in Davos, Switzerland summoning central political and financial figures from over 90 countries to discuss global economic issues. The main goal is to find ways to balance and deleverage countries in order to avoid recession and financial bubbles, forming an integrated global management.

- Rate decision: Wednesday, 20:00. The Reserve Bank ofNew Zealand maintained the official cash rate at 2.50% in the face of global economic uncertainty. RBNZ Gov. Alan Bollard said he will maintain rates in the next months and may even increase rates from the middle of2012 in case the EU debt crisis will continue.

- Trade Balance: Thursday, 21:45. New Zealand’s trade deficit widened in November as imports outweighed exports. Deficit reached $308 million after $208 million in October. The main contributors to the rise in imports were Crude oil and fertilizers. Deficit is expected to narrow to $47 million.

* All times are GMT.

NZD/USD Technical Analysis

Kiwi/dollar kicked off the week by settling on the 0.79 line (mentioned last week). It then moved forward and settled above 0.80 before closing at 0.8054.

Technical lines, from top to bottom:

We start from even higher ground this time: the 0.84 line separated ranges in August 2011, and earlier served as support when the kiwi traded higher. 0.8340 was a peak in September and is minor resistance.

0.8240 was a peak in October and also back in May 2011. It is followed by 0.8165 provided support for the pair at several occasions, last seen in October.

0.8110 switched positions from support in August to resistance later on and is a minor line on the way up. 0.8070 was resistance in October and support beforehand.. It was also tested in January. The round number of 0.80 managed to cap the pair in November and remains of high importance, especially due to its psychological importance.

Another round number, 0.79, is now stronger resistance after capping a rise at the beginning of 2012. 0.7840 worked as cap for a range and earlier stopped the pair in October. It then became much stronger in December, holding the range. The pair approached in the last days of 2011, but couldn’t really challenge it.

0.7773 was the bottom border of a range at the beginning of 2012, and also in December. 0.77 provided support in December and is now minor support. 0.7637 was a swing low in September and provided its strength in December as a swing low. It is a still strong, after capping a recovery attempt in December.

0.7550 now has a stronger role after working as a very distinct line separating ranges. It had a similar role back in January. 0.7470 was the trough in October and worked as perfect support in December.

I am bearish on NZD/USD

Without QE in the US, the current rally of the New Zealand dollar will likely reverse, or at least correct before moving higher. A lot depends on the moves of the RBNZ as well.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For USD/CAD (loonie), check out the Canadian dollar

- For the Swiss Franc, see the USD/CHF forecast.