Euro/dollar had a fantastic week, rising on fresh hope for Greece and from a weaker dollar, courtesy of Ben Bernanke. The upcoming week starts with an important summit and is packed with economic indicators. Here is an outlook for the week’s events, and an updated technical analysis for EUR/USD.

Bernanke’s pledge to keep interest rates at near-zero levels until late 2014 and the openness towards QE3 hurt the dollar across the board and the euro certainly enjoyed it. And Europe isn’t only Greece: fresh figures provide hope that Europe could avoid an outright recession. Also the downgrade many euro-zone countries by Fitch couldn’t stop the move. of Will this rally continue?

Updates: Germany reportedly wanted a bigger influence on Greece’s budget decisions, and Greece rejected it. Together with the still-stuck PSI talks, the euro faces pressure at the beginning of the week. EUR/USD indeed slid within the rising channel as the EU Economic Summit begins. Italy’s bond auction was OK, but still worrying. Another rally was capped and ended in a downfall, below channel support. The situation in Greece and Portugal is becoming worse. The euro is ignoring the German cornering of Greece and prefers to see the global growth. EUR/USD managed to recapture the channel it lost and it now trades under 1.32.

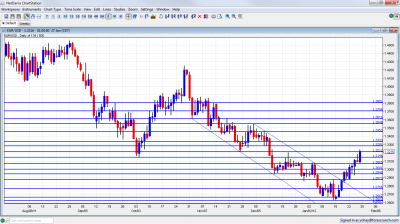

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- EU Economic Summit: Monday. The series of meetings, conferences and summits continue. Talk about keeping Greece off the agenda were likely premature. The role of the ECB in the debt crisis, safeguarding other countries and avoiding recession are probably going to be high on the agenda. It will be interesting to see how France’s role, after it lost its AAA rating.

- German CPI: Monday. The German states publish their initial CPI estimates at various hours during the day. After a few months of little changes, prices jumped by 0.7% last month. Another month of rises is likely now, but the scale will likely be lower.

- German Retail Sales: Tuesday, 7:00. Europe’s No. 1 economy has shown positive economic signs of late. After two months of drops in the volume of retail sales, a rise is expected now.

- French Consumer Spending: Tuesday, 7:45. Europe’s second largest economy has seen subtle changes in the level of consumer spending in the past few months. A rise will probably follow last month’s minor slide of 0.1%.

- German Unemployment Change: Tuesday, 8:55. Germany continues to enjoy a drop in the number of unemployed people and a drop in its unemployment rate, which attracts migrants from all over the continent. After losing 22K unemployed people last month, a smaller drop is expected now.

- Unemployment Rate: Tuesday, 10:00. Contrary to Germany, most other euro-zone countries are suffering higher unemployment. The harmonized figure is 10.3%, and will likely remain unchanged. A similar figure is expected now.

- Final Manufacturing PMI: Wednesday, 9:00. The initial purchasing managers’ index for the manufacturing sector exceeded expectations, rising to 48.7 points. This is still in contraction zone (under 50 points). The figure will likely be confirmed.

- CPI Flash Estimate: Wednesday, 10:00. Headline inflation remains above the 2% target, but this plays a smaller role in the ECB’s policy making process. A small drop from last month’s 2.8% rate is expected now.

- PPI: Thursday, 10:00. Producer prices have been on the rise for the past 3 months, but the pace has been quite moderate: 0.1% to 0.3%. A similar rise to last month’s 0.2% rise is predicted now.

- Final Services PMI: Friday, 9:00. The services sector returned to growth in January, according to the initial publication. These good news will likely be confirmed in the final version and will be positive for the single currency.

- Retail Sales: Friday, 10:00. The total volume of sales in the euro-zone has flipped between small rises and bigger drops. After a drop of 0.8% last month, a rise is likely now, and perhaps it will be higher than 0.1% seen two months ago.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar gaped lower at the wake of the new week, but quickly recovered. After overcoming the 1.2945 line (mentioned last week) the pair traded in range and then rallied higher, to levels unseen in quite some time.

Technical lines from top to bottom:

We begin from much higher ground this time. The round number of 1.38 capped the pair in September and also later on. It is weak and distant resistance. 1.37 had a similar role at the same time and also worked as support afterwards. It is stronger resistance.

1.3615 switched from support in October to support in November and is now resistance. 1.3550 capped the pair in November and December and marked the beginning of the plunge.

1.3450 was support in November and then switched to minor resistance. It used to be a stronger line, but is only minor now. 1.3330 provided some support for the pair during December 2011 and is minor now.

1.3280 had a similar role at the same time, and is stronger. 1.3212 held the pair from falling and switched to resistance later on.

The 1.3145 line, which was the lowest point recorded in October 2011, was only broken for a short time from the other side and remains very important. 1.3085 was the top border of a very narrow range that characterized the pair towards the end of 2011. It also provided support back in December 2010 and had a pivotal role.

The round number of 1.30 is psychologically important but is much weaker now. It was a pivotal line before Bernanke’s rally. The 1.2945 line is stronger once again and still provides support.

1.2873 is the previous 2011 low set in January, and it returns to support once again. This is a very strong line separating ranges. 1.2760 is a pivotal line in the middle of a recent range. It provided support early in the year.

1.2660 was a double bottom during January and the move below this line is not confirmed yet. 1.2623 is the current 2012 low, but only has a minor role now.

A more important line is 1.2587, the trough of August 2010. This line will be closely watched on any move downwards. A break below this line will send the pair to levels last seen 18 months ago.

Uptrend Support Formed

EUR/USD is riding on a neat yet steep uptrend support line that began from January’s trough. Downtrend resistance was clearly broken.

I am neutral on EUR/USD

Bernanke’s new rate pledge and talk about QE3 in the housing sector definitely weakens the dollar. Also the positive economic signs from the old continent certainly help single currency. Nevertheless, the Greek saga is far from being over, and could heavily weigh on the euro.

If you have interest in a different way of trading currencies, check out the weekly binary options setups, including EUR/USD, GBP/JPY and more.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealand dollar (kiwi), read the NZD forecast.

- For the Swiss Franc, see the USD/CHF forecast.

- USD/CAD (loonie), check out the Canadian dollar.