Euro dollar starts the new month on lower ground, after breaking below uptrend support. Greek PSI talks are still awaiting an agreement “soon”. How soon is it now? There are doubts if Germany really wants a deal. Important figures are released in the US, which serve as important hints towards the all-important Non-Farm Payrolls on Friday.

Here’s an update on technicals, fundamentals and what’s going on in the markets.

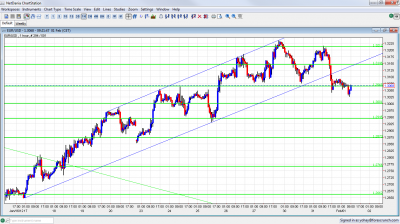

EUR/USD Technicals

- Asian session: The pair managed to hold above support at 1.3060 after losing the uptrend channel.

- Current range: 1.30 to 1.3060.

- Further levels in both directions: Below 1.30, 1.2945, 1.2873, 1.2760, 1.2660 and 1.2623

- Above: 1.3060, 1.3145, 1.3212, 1.3280 and 1.3333.

- Note the broken uptrend channel on the hourly chart. The break was clear

- Serious support is only at 1.2945. The round number of 1.30 isn’t strong.

- 1.3212 proved to be a strong cap.

Euro/Dollar below channel- click on the graph to enlarge.

EUR/USD Fundamentals

- 9:00 Euro-zone Final Manufacturing PMI. Exp. 48.7 points. Actual 48.8 points.

- 10:00 Euro-zone CPI Flash Estimate. Exp. 2.7%. Actual 2.7%.

- 10:30 Portuguese short term bond auction results.

- 13:15 US ADP Non-Farm Payrolls. Exp. 189K.

- 15:00 US ISM Manufacturing PMI. Exp. 54.6 points.

- 15:00 US Construction Spending. Exp. +0.7%.

For more events later in the week, see the Euro to dollar forecast

EUR/USD Sentiment

- Greece still stuck – troika demands more: The Greek PSI talks always seem close to conclusion, but this isn’t in sight yet elusive. The sticking point isn’t the size of the coupon anymore. Negotiations are stuck between Greece and the troika. The idea to take over Greece’s sovereign budget powers is off the table, but demands for cutting the minimum wage and other demands are putting a lot of pressure on the Greek government. Also the demand for a commitment to move forward with austerity regardless to election results is extreme. It seems that the demands are meant to be rejected and talks are meant to collapse and blame Greece. It’s important to note that German Chancellor Angela Merkel has doubts if Greece can avoid a default.

- Portugal deteriorates: Portuguese yields continue rising together with CDS, and point to a high chance of default. The chances of a default there are rising, especially if a PSI deal is signed in Greece and especially if also the ECB takes a hit.

- ECB Pressured to take a haircut: More and more speakers call for the ECB to take a hit on Greek bonds, despite the “no bailout” clause in the EU Treaty. The pressure comes from the banks (naturally) and also from the IMF. Note that ECB president Draghi didn’t categorically reject this. If Greece defaults, the ECB will have a 100% involuntary haircut.

- China still strong: Official Manufacturing PMI in the world’s No. 2 economy suggest that this important sector is growing for a second month in a row. This provides optimism also for the euro, but there are serious doubts about the accuracy of the Chinese data. Other figures point to weakness.

- Weaker signs from the US: Chicago PMI and consumer confidence disappointed. The first estimate for Q4 disappointed with a lower-than-expected headline figure, 2.8% and weak underlying components. This fuels expectations for QE3. Today we have much more important data – PMI and ADP.

- Italy still lags behind Spain: Italy was lagging behind Spain in bond auction and yields. Spain raised more money than expected while Italy continued paying high prices. Italy is now catching up, but still remains behind. The LTRO of the ECB certainly plays a big role. In the meantime, Spain reported economic contraction in Q4 2012.

- Fed Extends Zero Rate Policy: The FOMC Statement contained one significant change: the low rates are now likely to remain until late 2014, instead of mid 2013 stated earlier. Together with a hint by Bernanke that QE3 is still open, the dollar fell and the pressure on the greenback will remain in weeks to come.