The kiwi continued downwards, as the fuel from a possible QE3 in the US ran out. REINZ House Price Index is the major event this week. Here’s an outlook for the events in New Zealand, and an updated technical analysis for NZD/USD.

Last week New Zealand’s central bank maintained its super low cash rate at 2.50% stating it will continue to do so throughout most of 2012, since a strong kiwi hurts growth. Governor Alan Bollard projects, CPI will rise 1.4% by the end of 2012, which is the slowest increase in more than 12 years. Will CPI rise above Bollard’s predictions?

Updates: NZD/USD continues to fall, trading at 0.8169. REINZ HPI was up sharply, recording a 0.8% increase. FPI jumped by 0.6%, a seven-month high. NZD/USD rebounded and climbed above 0.82, trading at 0.8222. NZD/USD dropped, falling below the 0.82 level, trading at 0.8133. The markets are awating the Business NZ Manufacturing Index.

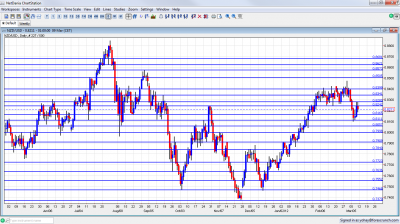

NZD/USD daily chart with support and resistance lines on it. Click to enlarge:

- FPI : Monday, 21:45. Food price index did not change in January after a 0.2% increase in the previous two months. On an annual basis, food prices are 1% higher than a year ago.

- REINZ HPI : Mon.-Fri. Private home prices dropped 1.4% in January amid a 25.2% yearly increase in house sales. Prices in December declined by 0.1%. However the overall house price remains stable.

- Business NZ Manufacturing Index: Wednesday, 21:30. New Zealand manufacturing sector softened in January dropping to 50.5 from 51.6 in December although remaining above the 50 point line indicating expansion.

* All times are GMT.

NZD/USD Technical Analysis

Kiwi/dollar continued deteriorating when the week began and bottomed out just around the 0.8110 line (mentioned last week).

Technical lines, from top to bottom:

0.8680 which was support on high ground is a minor line of resistance in the distance. 0.8620 follows closely and also was support on high ground during the summer.

0.8573 was a stubborn line of resistance during August 2011 and remains of high importance. 0.8505 was a peak on the way up during July. A move higher in February 2012 fell short of this line.

The 0.84 line separated ranges in August 2011, and earlier served as support when the kiwi traded higher. While this line was hurt recently, it still serves as a serious cap. 0.8340 was a peak in September and now returns to support. It was a tough line of struggle in February 2012.

0.8280 is a new line, that capped the pair in a stubborn manner during March 2012. 0.8240 was a peak in October and also back in May 2011. It proved its strength in January 2012 and will be tested again quite soon if the pair falls.

Moving lower, we find 0.8165. It provided support for the pair at several occasions, last seen in October. After being crossed passed a few times, its strength is diminishing.

0.8110 switched positions from support in August to resistance later on and is a minor line, now on the way down. 0.8070 was resistance in October and support beforehand.. It was also tested in January and in March.

The round number of 0.80 managed to cap the pair in November and remains of high importance, especially due to its psychological importance. Another round number, 0.79, is now stronger resistance after capping a rise at the beginning of 2012.

0.7840 worked as cap for a range and earlier stopped the pair in October. It then became much stronger in December, holding the range. The pair approached in the last days of 2011, but couldn’t really challenge it. 0.7773 was the bottom border of a range at the beginning of 2012, and also in December.

0.77 provided support in December and is now minor support. 0.7637 was a swing low in September and provided its strength in December as a swing low. It is a still strong, after capping a recovery attempt in December.

0.7550 now has a stronger role after working as a very distinct line separating ranges. It had a similar role back in January.

I remain bearish on NZD/USD

Even if the situation in Europe continues stabilizing, the troubles in China and the lack of QE3 (due to strong US jobs) will continue weighing on the kiwi.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast

- For the Swiss Franc, see the USD/CHF forecast.